Six alternative investments to bonds

19th August 2013 12:55

by Heather Connon from interactive investor

Share on

QE or not QE? That is the question. The markets have already decided that a negative answer to that question could lead to a tragedy of Shakespearian proportions.

In June a mere hint from Ben Bernanke, chairman of the US Federal Reserve, that the country's four-year quantitative easing (QE) programme could end in the next year was enough to send bond investors scurrying for the exit. Bond prices fell, pushing yields - the flipside to prices - sharply higher. In the US and Germany yields rose to their highest level since 2011. There was a knock-on effect on equities, with stockmarkets falling across the world.

The reaction was understandable. Tim Cockerill, head of collectives research at Rowan Dartington, says: "For the past five years markets have been held up and pushed higher by the support of central banks." The US alone has spent more than $2.3 trillion (£1.5 trillion) buying back assets to inject demand into the economy.

The markets for PIBS and PREFS are in a sorry state. To find out what alternative options bond experts believe are out there, read:PIBS and preference shares hit hard by Co-op trouble.

"When this support is removed it's quite possible that all asset classes will fall in value, as we have seen recently," adds Cockerill. "The removal of QE should only be done if the economy can support itself, and this is questionable right now. But it will be removed at some stage, and the Fed has simply flagged this up."

Bernanke has not actually said when QE will end, and the Fed has recently explicitly stated that "a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase programme ends and the economic recovery strengthens". However, Bernanke has reminded investors that QE must eventually be phased out and, given that no one has any real idea what impact that will have, traders will be likely to sell off anything perceived to be at risk.

Thomas Beckett, chief investment officer at Psigma, thinks the panic has been premature. He says: "The Fed must know the economy can take the strain of a reduction in QE (and eventual end to the programme), which is tantamount to a monetary tightening. Bernanke must have as good an idea as anyone as to the US's prospects for growth and is unlikely to rock the boat unnecessarily."

An end to QE elsewhere is some way off: the UK recovery is still anaemic, large swathes of the eurozone have yet to display any growth at all, and Japan is embarking on its own version, Abenomics, set in train earlier this year by new Prime Minister Shinzo Abe. However, the US is still the world's biggest and most influential economy, so actions there will have a disproportionate impact.

There is little doubt that QE has had a big effect on the bond market. Fed buying has kept demand high, pushing yields on government gilts to abnormally low levels. It has also had a knock-on effect on stockmarkets, gold, emerging market shares and bonds, and prime residential property: all have been buoyed to some degree by the massive asset-buying programmes. A return to normality was inevitable - and the prices of bonds and other assets could fall further as markets place bets on when QE will end.

Private investors, who have traditionally relied on bonds for a steady income and relative capital security, now have to think carefully about what to do with their bond holdings. Niamh Wylie, portfolio manager at Coutts, thinks bonds have already lost their role as a way of diversifying risk. She says high-quality bonds have traditionally been negatively correlated with equities, but that has ceased to be the case more recently. She adds: "I am still very cautious about yields at this level, and any hint of a pick-up in inflation expectations could make it worse."

Further capital losses are likely as the market reverts to more normal conditions. Robert Burdett, who runs F&C's multi-manager business, says there could be more bad news to come. Calculations he made last year suggest that if gilts and blue-chip bonds revert to the rate they were at five years ago, investors will face a 40% loss. While that will mean higher yields, these may not be high enough to compensate for inflation, never mind absorb the capital losses.

Investors who want to stick with bonds should look for those that will be relatively resilient to the market correction. David Roberts, head of fixed income at Kames Capital and manager of its Strategic Bond fund, has been positioning himself for just such a sell-out for 18 months but accepts that, as a long-only manager, he cannot completely avoid losses. He says it has taken the markets just weeks to achieve the kind of correction that previously took months.

"Bonds are now better value than they were a month ago, and investors should forget the noise and think about where the value is. They should not expect the 10%-plus returns [of past years] this year, next year or maybe even the year after. But relative to inflation expectations, most bond funds now offer a healthy return," he comments.

But if you're keen to avoid the further falls in bond capital values, where else could you look? We offer some alternatives to consider.

Niche bonds

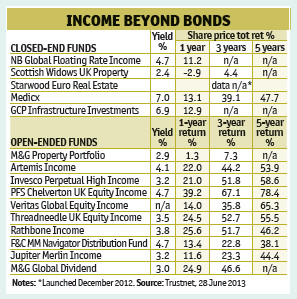

Burdett favours niche areas of the bond market such as floating-rate bonds (where the coupon moves in line with interest rates), via the closed-end fund , although he cautions that investors should be aware of the level of discount or premium on the fund before deciding to buy. Cockerill recommends switching to a short-duration fund such as . "This fund is yielding around 4% and will protect capital against a sell-off in fixed interest to a potentially greater degree than a conventional bond fund," he says.

Property

Wylie points out that commercial property is one of the few assets to have held its value in the recent turmoil. "[It] has an attractive yield, but we need to see economic growth coming through for capital values to increase," she says. Her holdings include M&G Property Portfolio and .

Burdett likes , another closed-end fund. He says it is run by one of the most experienced property fund managers in the business and contains fresh loans written since the financial crisis, all with low levels of loan-to-value. Another of his "very selective" property holdings is , which owns GP surgeries and is tapping into a "hinterland of demand" for modern facilities among GPs.

Infrastructure

Burdett is also enthusiastic about , again a closed-end fund. It buys loans backed by government cash flows - for example on schools, hospitals and other public buildings, - and also 3i Infrastructure, which he says has been a steady performer in all market conditions.

He thinks closed-end funds are attractive in this climate, as the manager has a fixed pool of assets to run and is not distracted by inflows and outflows, as they are with open-ended unit trusts or similar vehicles.

Equities

Equities have also suffered from the talk of QE ending. Markets across the world have fallen sharply from recent highs, and shares are likely to remain volatile while speculation about the ending of QE lasts.

However, Wylie thinks "quality equities offering yields of between 4 and 5%" are still attractive. She says: "It is interesting that the dividend yield on equities has remained resilient throughout the economic cycle" - growing by an average of 7% annualised over the past 40 years. Her favoured funds include and .

Burdett observes that small companies have continued to do well as markets have fallen, although he warns that they may be behaving like cartoon characters who belatedly realise they are about to fall to earth some time after they have stepped off a cliff. He likes , which focuses on small companies. He also likes overseas income funds such as , run by Stuart Newton - who founded and then sold the fund management group Newton - and .

Patrick Connolly, certified financial planner at Chase de Vere, also likes UK and global income funds as an alternative to bonds. His picks include and .

Investors could also consider balanced funds, such as the , run by Burdett and his team, or , both of which offer reasonable yields and good long-term performance.

Gold

The gold price has been falling since the autumn and the decline steepened as Bernanke made his QE comments. It no longer has "safe haven" status and the lack of income on gold means it is not an attractive investment.

Cash

Cash may sound like the safest place to keep your money. However, with interest rates low and inflation rising, anyone holding cash will incur a real loss in value. According to Moneyfacts, just one account was paying an interest rate higher than inflation at the end of June: the 5-year fixed-rate ISA from Virgin, which offered 2.75%; the consumer prices index was 2.7% in May.