UK confidence for Tactical Asset Allocator

15th January 2014 08:51

by Ceri Jones from interactive investor

Share on

As January goes, so goes the year. This old saying has proved correct for 62 of the past 85 years, and could be a warning, because it specifically relates to the first five working days of the year, when markets both here and in the US stuttered badly.

Since then, however, they have perked up, as if they are in two minds about whether the economic recovery is digging in, with real sustained growth.These swings reflect the uncertainty investors are having to contend with.

Unusually, the potential risks are almost diametrically opposed. We can all envisage a scenario where the economy will slow more than expected, but equally it would be no great surprise if stockmarkets progress into bubble territory.

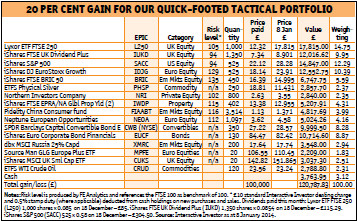

To view the Tactical Asset Allocator's holdings and trading chronology, click here.

At the end of 2013, the markets were preoccupied with the US Federal Reserve's decision to begin monetary tightening but in the event, their response was relatively sanguine. However, the taper process is unlikely to be smooth.

Tapering effects

The Fed's new chair, Janet Yellen, has a dovish reputation, but overall the composition of the Fed committee is slightly more hawkish than it has been in the past and interest rate hikes may occur sooner than anticipated.

This has led to the movement of money into short-term rather than long-term interest rates and could put pressure on fixed-income securities.

We are also hearing a lot about so-called bond vigilantes - investors concerned about inflationary pressures who might sell off their bond holdings, increasing yields, which would damage debt-laden developed markets.

Optimism that equity markets and other higher risk assets will continue to do well remains widespread, however. The challenge in stockmarkets is that price/earnings multiples are outstripping growth in earnings.

One area where there is pronounced confidence in real earnings growth is the UK.

Sterling has strengthened, encouraging capital inflows, and UK companies are often bid targets as the UK authorities are relatively relaxed about selling companies to overseas businesses. The corporate sector has disproportionate cash on its balance sheets and will be picked up in merger and acquisition activity.

Currently, the managers of leading multi-asset funds, who are able to look across the whole market for opportunities, tend to be overweight UK equities and also Japanese equity, emerging market equity and local currency debt, and Spanish and Italian bonds.

Abenomics

Our portfolio aims to be fairly well diversified, rather than making big bets on individual asset classes, so we have avoided the temptation to pile into Japan because of its long-term structural and debt issues.

However, there are signs of a new vigour in Japan's stockmarket. The capital raised in new issues last year was double that of 2012, for example.

We now wait to see whether the third "arrow" of Prime Minister Shinzo Abe's growth strategy focused on domestic tax reforms can emulate the success of the first two, which aimed to boost money supply and public works spending and had such an immediate impact on stock valuations and market volumes.

The portfolio's coffers were swelled by dividends of more than £500 from three holdings over the past month, boosting the cash balance to £3,763.95.

The largest, of £304.50, came from the , followed by £115.29 from the and £85 from .

Meanwhile, capital raised on China's equity market declined by 13% last year, and its domestic problems are significant, such as rising labour costs and water rationing.

The two nations are also at military loggerheads over two small islands in the East China Sea, a dispute that has dragged on for months and could escalate this year.

Although China is the world's largest e-commerce market, it has been surprisingly slow to apply business technology in an effective way, and is only now beginning to harness technology in the business environment to reduce headcount and transform supply chains.

Politically and socially, the governing regime is still far from transparent - something the world will be reminded of on 4 June, the 25-year anniversary of the Tiananmen Square massacre, any mention of which is still forbidden in public.

Our holding in has done well so far but we will be watching both Japan and China closely for further evidence that policymakers are forging ahead with constructive measures.

For out-and-out contrarians, bonds could be an interesting play because they may hold up better than the consensus believes. The absence of credit growth means that rates will be low for longer and any hiccup in growth or equities will send investors back to bonds because the alternative would be negligible returns on cash.

In the US the five-year forward rate is already 4.5%, and government bonds and investment grade corporate debt provide sought-after income.

The in our portfolio has been a thorn in our side since inception, tumbling over 40% during the 15-month life of the portfolio. It is tempting to just jettison the holding and if the investment was an equity holding, cutting your losses quickly after a significant fall is usually the right move.

In equities, bad news tends to materialise sequentially, as the dynamics of the underlying business lock into a vicious spiral.

However, this is silver - a notoriously volatile and sentiment-led precious metal that has always been cyclical, rising from $8.53 (£5.19) in October 2008 to almost $50.00 in April 2011, and then plummeting to under $19.00 in June and December 2013.

It will come back at some stage and very possibly for little reason, which is when we will head for the door. Meanwhile, it is still a good diversifier for the overall portfolio.