Glowing returns of up to 192% from our 2013 specialist trust tips

22nd January 2014 17:00

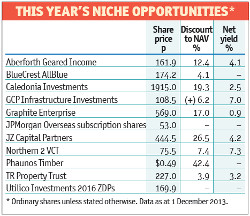

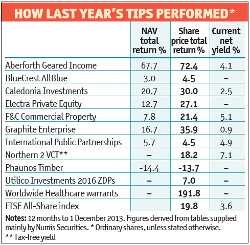

Our niche opportunity investment trust and closed ended fund selections have had a rewarding year, especially those that are structured to do well when markets are rising.

Despite a diminishing selection of warrants and subscription shares in the market, the warrants attached to have shown how rewarding this sort of holding can be when the underlying trust is doing well.

They have gained 192% in the 12 months to 1 December 2013, compared to a 52.7% total return on the ordinary shares of WWH. Highly geared ordinary shares should also flourish in rising markets, and the ordinary shares of Aberforth Geared Income Trust duly delivered.

Their 72.4% share price total return can be compared with a 55.6% total return for the ordinary shares of the less highly geared Aberforth Smaller Companies Trust.

Both trusts have similar investment portfolios. Targeting a tightening in a trust's share price discount to net asset value (NAV) is another feature of closed-ended funds for investors to exploit. This contributed to welcome gains on a number of our selections in 2013, including Northern 2 VCT, Caledonia Investments, and the two private equity trusts.

Private equity is an asset class which cannot be accessed through open-ended funds and it has historically been very rewarding. In part this has been due to high gearing levels, but also to the capacity for portfolio managers to overhaul unquoted companies much more dramatically than they could quoted ones.

Rising markets

Rising markets have helped some private equity trusts to achieve good exits from their investments, but have left them with relatively immature portfolios which will take time to mature.

Electra Private Equity, which was one of last year's selections, is a case in point. It has therefore been replaced this year by another private equity option.

In particular, zero dividend preference shares that are well-provisioned are liable to be dull in a rising market, but should hold up well in a setback.

Very wealthy people also tend to put a high priority on capital preservation, so family trusts such as Caledonia, which invests on behalf of the Cayzer family, are liable to be defensively managed.

Thirdly, most hedge funds aim to make similar returns in good or bad markets. Closed ended funds are increasingly being used to allow the ordinary investor to participate in alternative assets favoured by the big institutions, such as infrastructure and property.

The attractive and partially inflation-proofed yield on infrastructure funds has made them so popular that many have been trading on high premiums to NAV. But premiums almost inevitably crumple in the end, so investors need to tread carefully.

Most of the UK-focused property funds are also on dangerously high premiums. Even the high-quality F&C Commercial Property trust looks too expensive on a 16% premium, so we have looked to a different sort of investment company for our property exposure.

To find out Fiona Hamilton's top tips for income and growth or alternative and balanced investors, read: Top alternative and balanced investing tips for 2014 and Five tips for growth and income investors.

Editor's Picks