Bonds rumble but fail to tumble

4th February 2014 17:17

It has not been an exciting year for fixed-interest investors, and in some cases it has been a disappointing one. Nevertheless, the bond-watcher's Armageddon scenario in which economic activity takes off, interest rates soar and bond prices collapse has failed to arrive.

Instead, we have seen an orderly fixed-interest slowdown since US Federal Reserve chairman Ben Bernanke announced a possible, but not immediate, end to quantitative easing. For 2014, the big question will be whether this discipline can be sustained.

From that pivotal moment in May when Bernanke hinted that quantitative easing would have to come to an end, certain parts of the bond markets have been in decline. There has been repeated talk of a "great rotation" that would see investors exit bonds in their droves and reinvest in the stockmarket, but this has failed to materialise.

To find out how market commentators and industry experts reacted to the US Fed's decision to taper, read: Market reaction to US Fed's taper decision.

At the time of writing, Bernanke has yet to taper and there has yet to be any great rotation, but some bond prices have moved lower. The bursting of the great bond bubble has so far produced little more than a gentle hiss.

Bryn Jones, manager of the , says: "There is still demand in the asset class - the great rotation is not yet in evidence and there has been no mass exodus from the bond market. New investors have come in to support the market as prices have dropped."

Gary Potter: Routes to market for fixed income

This fund, run by experienced manager Peter Harvey, focuses purely on credit analysis. It has allocations to investment grade and non-investment grade bonds. The fund is currently keeping duration quite short in the face of potential for bond yields to rise.

This is a passive route to market for investors striving to keep costs down.

This is a highly flexible bond fund run by a specialist fixed-income boutique able to take advantage of the prevailing market.

Gilts hit

That said, government bonds have been hit. The average fund in the IMA gilt sector dropped 3.8% in 2013 (total return to end November). This may not have been a disaster, but it was probably not what investors were expecting from their "safe" assets.

The global bond sector has also seen weakness, with the average fund dipping 1.8%. In this sector, the weak funds were almost exclusively emerging market corporate bond funds.

Nevertheless, there were still some strong areas in 2013. High yield had another good year, with the average fund rising 6.2%.

Strategic bond funds also generally rewarded investors, with the average fund rising 2.7%.It was a relatively weak year for investment-grade corporate bonds, with the average fund rising just 1.5% to the end of November.

At the end of 2013, it still looks as though there is only one direction for interest rates in the US, the UK and - since the rate cut in early November - Europe.

However, any rate rises still appear to be some way out. The consensus in the UK is still that rates will not rise for another two years and will still be below 3% in 10 years' time.

Quantitative easing, for the time being at least, is still supporting the markets in Europe, Japan and the UK, though perhaps not for much longer in the US.

Gilts market remain steady

The government bond market is likely to remain reasonably steady, according to Eric Holt, manager of the .

He says: "We are in the position we expected to be in at the end of this year. We are more comfortable with where government yields are now and we expect yields to continue to edge higher in 2014.

"The background is one of a slow recovery, not just in the UK but across the developed world - a lacklustre recovery from the depths of recession. So this is a long-haul process to get countries onto a stable footing. The government bond markets have moved to fair value and we are not expecting a significant shift in gilt prices from here."

"Inflation appears to be under control - there is a lot of unemployment, with people working longer hours for less money, so inflationary pressures seem unlikely to emerge."

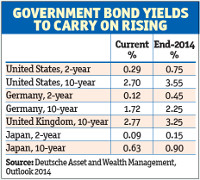

On the other hand, he doesn't see a lot of value either and believes government bond prices may still move lower, albeit in an orderly fashion. He is currently forecasting a move in 10-year treasury (US government) bonds from their current yield level of 2.7% to around 3.5% in 2014, and a smaller but similar move in UK 10-year government bonds. With bonds, as yields rise, prices drop - so existing investors would see a capital loss.

Potter believes the biggest risk for the government bond market is a sudden resurgence in growth. "This would change the quantitative easing and interest rate outlook, and could create a sudden rise in yield and drop in price, but this is not our central case," he says.

Many investment-grade corporate bond forecasts are for a steady but unexciting year. Holt believes the current level of income available on corporate bonds is likely to support prices. The yield on funds in the sterling corporate bond sector currently varies from about 3% to 5.5%.

Investors well-compensated

Jones still finds investment-grade bonds attractive, and believes that, with most individual bonds, investors are well-compensated for the risk of default. He points out that the investment-grade bond markets are forecasting that around 7-8% of European bonds will default.

The average has been 1% and in the worst year it was 4%, so this still looks relatively high. In other words, investment-grade bonds are not expensive on most conventional measures. Holt agrees, suggesting it will be a year of mid to high single-digit returns.

Investors need to be dynamic by using managers with the flexibility to go short or find parts of the bond market that have value."Garry Potter

So far, so uneventful. What of the higher-octane world of high-yield corporate bonds?

This area has had a strong run recently, leaving it with relatively little scope for further big gains. But equally, it is difficult to see what might prompt a significant sell-off, short of a major growth shock or rise in bankruptcies.

Claire McGuckin, manager of the , says: "High yield still has a solid place from an income perspective and investors could reasonably expect a mid single-digit income plus a couple of per cent extra from a good manager.

"Equally, the fundamentals still look relatively strong: defaults are running at below 2% and an increase looks unlikely; companies are comfortably financed and economies appear to be recovering, although Europe is significantly behind the US.

"To warrant a 2009/10-type correction, there would need to be a significant systemic issue coming up - the European crisis resurfacing or the Syrian conflict escalating, for example. An economic recovery would be nice, but it is not necessary - many companies have grown used to a sluggish economy.'

Cause for caution

However, some multi-managers are nervous about higher-risk bonds. Psigma Investment Management's chief investment officer, Tom Becket, says he has become "incredibly selective" on high-yield bonds and that the asset class has been "red hot" for five years and could be '"an accident waiting to happen", particularly since it is illiquid, which can exacerbate falls.

Bill McQuaker, head of multi-manager investments at Henderson, says he is avoiding emerging market debt for similar reasons: it has become an over-crowded trade and it could be painful if flows reverse.

Jones too is contemplating taking less risk across his portfolios, rather than more. "We have 6-7% in cash, which is the highest weighting for a long time. In the past, we would be picking up riskier assets as economic growth improves, but the prices are not attractive, so we have not been putting a lot of money to work."

For Potter and his fellow multi-managers, flexibility is still the watchword. He says: "Investors need to be dynamic. This means using managers with the flexibility to go short or find parts of the bond market that have value."

He continues to favour the strategic bond sector, with funds such as the Cazenove Strategic Bond fund.

Parts of the fixed-interest market look better than they did a year ago. The income available on government bonds is higher and no imminent rise in interest rates appears to be on the cards.

Investors can expect unexciting income and flat or slightly falling capital returns from government bonds and investment-grade corporate bonds. The danger lies at the higher-risk end of the bond market, which has seen significant inflows and could be derailed by a shock.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks