Relaunch brings solidity to Balanced portfolio

20th March 2014 17:08

by Helen Pridham from interactive investor

Share on

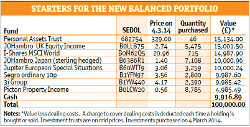

The balanced portfolio is the third of our hypothetical £100,000 portfolios to be relaunched this year. Its main aim is to provide steady real growth without the volatility of a pure equity portfolio.

When times are uncertain, a balanced portfolio can provide the best way forward. It will normally include a mixture of different investments that complement and offset each other, and so help spread risk and keep the portfolio on an even keel.

Managing partner at financial adviser Kohn Cougar Roddy Kohn points out that preservation of capital is at the core of the strategy.

Traditionally, balanced portfolios have been partly invested in fixed-interest securities. However, Kohn feels there is such a lack of value in the bond sector at the moment that it does not make sense to include direct bond holdings in the new portfolio. He has decided to hold cash for the time being and include an increased weighting to commercial property instead.

Modest holdings

The three largest holdings, which account for 15% of the portfolio each, are the , the and .

The MSCI World ETF is a low-cost tracker fund that Kohn says he is using partly to gain exposure to the US market. He adds: "The ETF currently has a 54.5% weighting to the US. It is a well-known fact that many active managers fail to outperform the US market, so we prefer to have our exposure through a tracker."

The JOHambro UK Equity Income fund accounts for the bulk of the portfolio's exposure to UK shares. Kohn says: "This fund is one of our long-term favourites. It is managed by Clive Beagles and James Lowen, who have proven themselves over a long period to be very astute stockpickers.

Value is at the core of their process and they have a strict yield discipline to keep their investment process in check - they invest only in stocks with a prospective yield above that of the FTSE All-Share index average. The fund also provides a very good level of income, currently 4.6%."

Personal Assets Trust is an international investment trust. Kohn describes it as one with a healthy corporate culture, an experienced board that is proactive on investors' behalf, and an excellent manager, Sebastian Lyons, who can choose investments from a range of asset classes. Currently it has around 42% invested in equities, mainly in the US and the UK, 39% in fixed-interest securities and 10% in gold bullion.

Solid position

Kohn believes the trust is well positioned to withstand any vicissitudes in 2014. "The highly defensive positioning of the trust's investments may mean 2014 is going to be Sebastian Lyons' year," he says. Personal Assets Trust also provides the portfolio with some exposure to bonds. Kohn says he is happy to let Lyons dictate strategy in this area.

Four holdings each account for 10% of the portfolio: investment trust , FUND:JK73:JO Hambro Japan, and .

3i Group gives the portfolio a diversified exposure to international private equity. Kohn says: "With evidence of banks' increased lending early the private equity sector is poised to benefit from such initiatives and from growing consumer confidence in the economy."

JO Hambro Japan and Jupiter European Special Situations complement the portfolio's other international equity holdings.

Regarding Japan, Kohn says: "We have faith in Scott McGlashan and Ruth Nash, who have steered JO Hambro Japan ably through bad and good times with their emphasis on quality shares, mainly in the smaller-cap arena."

The fund is hedged back into sterling, so investors need not worry about falls in the value of the yen as a result of the significant quantitative easing Japan's prime minister, Shinzo Abe, has put in place.

Kohn believes that, despite a strong rally in share prices over the past year, Japanese equities remain cheap, based on several valuation metrics. Nevertheless, he points out that the future direction of the market will depend very much on whether the Japanese government's programme of structural reform is successful.

European flavour

Another key part of Kohn's approach is his relatively large holding in Europe, through Jupiter European Special Situations. The fund, managed by Cédric de Fonclare, is more than 50% invested in Germany, France and Switzerland. Kohn says the fact that there continues to be pessimism about economic growth in Europe, where earnings have lagged other western markets, gives him reason to believe there is scope for future recovery.

Closer to home, Kohn has chosen two property holdings. The two funds invest in very different types of property.

Cash is being held at this level to act as a substitute for bonds, but it allows us to add to our positions or introduce new asset classes on market weakness."Roddy Kohn

The larger one, Segro, focuses on secondary commercial property. It owns, manages and develops modern warehousing and light industrial and data centre properties, principally in London's western corridor and in key conurbations in France, Germany and Poland.

The second holding, , is more focused on offices, but it also invests in industrial, retail, warehouse and leisure property. At the time of purchase, it was offering investors a healthy yield of 5.3%, while Segro was yielding just over 4%.

Kohn believes the trusts will also produce some capital growth to deliver a good overall return in the current economic climate. The remaining 10% of the portfolio is in cash.

"Cash is being held at this level to act as a substitute for bonds, but it also allows us to add to our positions or introduce new asset classes on market weakness," explains Kohn.

He does not believe anybody really knows where markets are heading at present. However, after the strong stockmarket growth of the past couple of years, he thinks companies must begin to produce strong profits if the markets are to make headway in 2014.

Although equity markets are likely to be volatile, he thinks they could still deliver good returns this year.