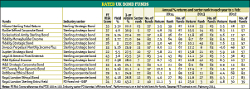

Rated Funds 2014: UK bonds funds

11th April 2014 17:28

by Helen Pridham from interactive investor

Share on

Investing in bond funds is not as popular as it has been in recent years.

Following the global financial crisis, bonds were offering very attractive yields, and investors piled into this asset class because it offered a better return than cash with considerably less risk than holding shares.

As a result bond prices were driven up; there are now concerns about possible price falls, particularly when interest rates eventually start to rise.

However, there are still good reasons for holding bond funds, and there are still out-of-favour areas of the fixed-income market where value can be found.

A balanced investment portfolio should normally include uncorrelated assets, so bond funds are a useful complement to riskier assets. Some are still paying a reasonable yield and a regular income, so they are useful for income seekers.

The first group comprises those focusing on UK sterling denominated bonds where managers can spread their holdings, and the second group covers the global bond funds that can diversify their funds geographically and also make use of currency movements.

To see the full list of Money Observer Rated Funds, click here.

Baillie Gifford Corporate Bond

The was a double winner in Interactive Investor's sister site Money Observer’s fund awards last year. Not only did it receive the accolade of best UK corporate bond smaller fund award, but it was also the winner of our unique best value for money award, thanks to its lower than average charges.

It can invest in high-yield as well as investment-grade bonds. The managers, Stephen Rodger and Torcail Stewart, argue that their fundamental research enables them to identify individual bonds that can deliver high returns. The fund pays a monthly income.

Fidelity Moneybuilder Income

This fund is included in two of Money Observer's income portfolios. The invests mainly in high-quality, investment-grade UK corporate bonds and can also hold gilts.

It aims to produce a consistent income and capital stability. Income is distributed monthly, which is attractive to those income seekers who rely on their savings to help pay regular bills. Manager Ian Spreadbury has over 25 years’ experience in fixed income.

Fidelity Strategic Bond

This fund won Money Observer's UK corporate bond smaller fund award last year. The is also managed by the highly experienced Ian Spreadbury who we believe is well qualified to run this type of portfolio with a cautious approach.

He has the flexibility to invest across all types of fixed-interest securities including high yield, emerging market and non-sterling denominated bonds, as well as government and investment-grade corporate bonds. He keeps the fund well diversified in order to reduce risk, and stresses the importance of Fidelity’s in-house researchers.

Jupiter Straegic Bond

This fund won a Money Observer highly recommended award last year. Managed by Ariel Bezalel the can invest in a variety of fixed-interest securities including high yield bonds, investment-grade bonds, government bonds and convertibles.

Bezalel takes into account economic factors such as inflation and the outlook for interest rates, and they influence the way he positions the portfolio. He prefers bonds issued by companies with robust business models, so meeting company managements and conducting cash flow analyses are both key parts of his investment process.

M&G Optimal Income

This fund is included in several of Money Observer’s model income portfolios. is fully flexible and can invest across the whole fixed-income universe, including overseas bonds. It aims to find the most attractive or optimal income streams at any point in the economic cycle.

It is managed by the highly respected Richard Woolnough, whose track record in this asset class is second to none. He considers general economic trends before deciding on the type of bonds to invest in and the sectors he wants exposure to. Decisions on individual bond purchases are made with the help of M&G’s in-house research team.

PFS Twentyfour Dynamic Bond

This fund is a Money Observer's Editor’s Selection. The group that manages it, TwentyFour Asset Management, is unusual in that it focuses purely on managing fixed-income investments.

The can invest in all types of bonds, and is managed on a collegiate basis by several of the company’s partners. It is designed to pay an attractive quarterly income. Its flexible approach enables the managers to take advantage of changing market conditions.

The portfolio contains a diversified selection of the managers’ best ideas. They still expect some good returns, and are planning to gradually increase their holdings of financial bonds at the expense of high-yield bonds this year.

Royal London Ethical Bond

Theis a member of Money Observer's Premier League and is run by Eric Holt. He ensures the fund’s portfolio does not contain bonds which contravene its ethical criteria, avoiding those issued by companies involved in activities such as gambling, alcohol and tobacco production.

Otherwise he maintains a broad portfolio which currently consists of more than 270 holdings. He does not rely purely on credit ratings. He and his team consider carefully the levels of risk and reward offered by bonds, which means that, for example, unrated bonds and smaller issue-size bonds may be included in the portfolios where valuations are attractive. He also focuses on longer-term investing.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

To find out the methodology behind Money Observer's Rated Funds, read: How 2014's Rated Funds were chosen.