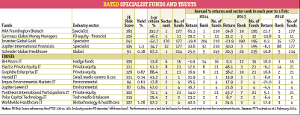

Rated Funds 2014: Specialist funds

11th April 2014 10:32

by Helen Pridham from interactive investor

Share on

One of the major advantages of investing through funds and trusts is that you can, if you are an adventurous sort, gain exposure to very specialist areas without the danger of losing your shirt.

By contrast, if you were to invest directly in, say, a business start-up or an experimental biotechnology company, there would be a high risk that you could lose your entire stake if the business went pear-shaped.By investing through a collective fund, not only will your investment be spread across a number of specialist companies, but your money will be managed by someone who has both financial knowledge and expertise in the specialist area itself.

To see the full list of Money Observer Rated Funds, click here.

Thematic focus

In our selection of rated specialist funds, we have focused on a few themes we believe are likely to deliver good investment gains over the next decade. There are four technology/biotechnology funds, although the fourth is a somewhat more generalist healthcare-oriented fund.All forms of technology permeate our lives nowadays and there is unlikely to be any let-up in innovation in the future, even though as an investment sector it can go in and out of fashion.There are two financials funds: after a difficult time since the global financial crisis, we believe this sector is on the up. There are also two environmentally oriented investment trusts, specialising in a sector which should surely gain increasing recognition as the world's climate becomes increasingly unpredictable.There are two private equity funds that provide backing for a host of entrepreneurs. However, our last specialist pick - BH Macro - is an exception within the often volatile specialist sectors, as this fund of hedge funds aims to produce smooth rather than volatile returns.

Axa Framlington Biotech

is an Editor's Selection. It is managed by Linden Thomson, and its aim is to provide long-term capital appreciation by investing in companies involved in biotechnology, genomic and medical research globally, although in practice most of its holdings are American. US companies account for nearly 90% of the portfolio, which reflects the concentration of the relevant businesses in that part of the world.The outlook for the sector is positive. Thomson points out that this is due to fundamental factors such as the ageing world population, as well as research and development focusing on innovation and demand for new and improved drugs and therapies. Merger and acquisition activity also helps to boost the sector.

BH Macro IT

The is an Editor's Selection. It is a Guernsey-based hedge fund that was launched in March 2007 and feeds into Brevan Howard's flagship Master Fund, incorporated in the Cayman Islands. Its aim is to generate consistent long-term appreciation mainly by trading on the global fixed income and foreign exchange markets.Brevan Howard has trading teams around the world, the majority of whom are based in London and Geneva. They do have a good track record of delivering positive returns and protecting capital in difficult markets, although performance during 2013 was lacklustre. However, they are expecting to be able to take advantage of more volatility in 2014.

Graphite Enterprise IT

The is an Editor's Selection. It invests both directly in private equity backed companies and also in other private equity funds, an arrangement that provides plenty of diversification but still gives the potential for above-average capital growth. It is managed by Graphite Capital, which has a long history as a direct buy-out manager.Typically 20-25% of the portfolio is in investments directly managed by Graphite Capital. Investments in other UK companies and in overseas markets are made through third-party funds. The UK accounts for nearly half its assets; the remainder are mainly in Europe. 2013 was a good year for sales.

Guinness Global Money Managers

is an Editor's Selection. It is a Dublin-based fund that was launched in 2010. It specialises in companies engaged in money management services, primarily asset management, but also wealth management, stock exchanges and others. The managers, Tim Guinness and Will Riley, believe that over the long term asset management companies can grow their earnings faster than the general equity markets.They point out that asset management is a growing global sector with assets under management rising faster than underlying equity markets. The fund consists of 30 equally weighted holdings. The managers look for good companies that are attractively valued, taking into account the assets the companies specialise in and their distribution channels.

Herald IT

The is included in one of the Money Observer model growth portfolios. It specialises in investing in smaller quoted companies in the communications and multimedia sectors. It has been managed by Katie Potts since its launch in 1994 and she has an impressive track record.Although it can invest globally, two thirds of the portfolio consists of UK companies, which is where Potts and her team tend to find most value. They also take a longterm view and are supportive of company management teams. It is well diversified, with over 260 holdings.

Impax Environmental Markets IT

is an Editor's Selection. Since it was launched in 2002, its main focus has been on companies involved in the cleaner and more efficient delivery of energy, water and waste services. Last year it broadened its mandate to include sustainable food, agricultural and forestry opportunities. Manager Bruce Jenkyn-Jones and his team are recognised experts in their area, but the general economic climate has not favoured the sector in recent years. But this could change.

Jupiter Green IT

The is an Editor's Selection. It is managed by Charlie Thomas and invests globally in companies which have a significant focus on environmental solutions, with a focus on three key areas: infrastructure, resource efficiency and demographics.This covers a broad range of green investment themes, including food, transport, health, education, water, waste, construction, planning and alternative energy. It is a small trust but it has performed well, and last year it introduced a discount control policy enabling it to buy back and issue new shares to increase the liquidity for both buyers and sellers.

Jupiter International Financials

is an Editor's Selection. It has been managed since 2011 by Robert Mumby, who has extensive experience of the financial sector, having previously worked as an investment analyst specialising in financial services companies.The fund invests in financial sector companies globally, including specialist and emerging market financials depending on market opportunities and conditions. Mumby takes general economic and structural themes into account when he is selecting stock. He generates investment ideas through his own proprietary research .

Pantheon International Participations IT

is held in one of Money Observer's model growth portfolios. It is a fund of private equity funds, so it provides plenty of diversification for investors interested in gaining exposure to the private equity sector.The manager, Andrew Lebus, is able to spread the portfolio's investments across companies of different sizes at different stages of their development, including small and large buyouts, and companies in the venture and growth phases, as well as special situations. The trust has two classes of share, one ordinary and the other redeemable at net asset value.

Polar Capital Technology IT

The is an Editor's Selection. It is managed by the very experienced Ben Rogoff, and invests in a diversified portfolio of technology companies. This includes areas as diverse as information, media, communications, environmental, healthcare and renewable energy, as well as the more obvious applications such as computing and associated industries.Companies are selected for their potential for generating capital growth, not on the basis of technology for its own sake. Among Rogoff's current core themes are internet infrastructure and broadband applications, while he retains significant exposure to mobile data.

Schroder Global Healthcare

is an Editor s Selection. It has been managed for 10 years by John Bowler. It invests in healthcare, medical services and related-product companies on a worldwide basis. This covers a wide spectrum of businesses, from relatively small start-ups to very large companies . These businesses are benefiting from the increased resources being directed towards healthcare, as the population of the developed world ages and living standards rise in the developing world.

To find out the methodology behind Money Observer's Rated Funds, read: How 2014's Rated Funds were chosen.