Should you stay loyal to your star fund manager?

10th April 2014 12:14

by Holly Black from interactive investor

Share on

On 1 May Neil Woodford will officially join Oakley Capital where, under the brand Neil Woodford Investment Management, he will launch a new UK equity income fund.

Many investors - and many millions of pounds - wait in the wings with bated breath. And while they do so, his former funds are haemorrhaging money.Invesco Perpetual, where Woodford managed a massive £33 billion, saw half a billion pounds of outflows in a single day in January, according to data from FE Analytics.

The he managed has already shrunk to £11.4 billion of assets, as investors question whether his successor, Mark Barnett, can fill the star-studded shoes that Woodford leaves behind on Invesco's front doormat.But should investors be so quick to flee? Should they loyally follow the manager who has produced impressive returns for them, or trust that the strategy of the fund and the wider team contributing to it will prevail?

Stand by your manager

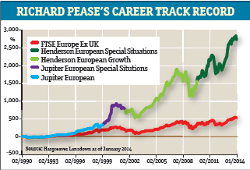

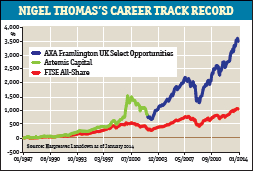

Since its 1986 inception the Artemis fund has returned 2,358%, while the Jupiter fund has achieved 2,750% since its 1987 launch.But can a manager truly take all the credit for the success of a fund? Managers are typically supported by a huge network of analysts and researchers, so there are many moving parts that need to perform for the machine to function smoothly. Yet in an industry with around 2,500 funds available to retail investors, there must be a reason why certain individuals become stars."Some of these guys have exceptional track records. They have the conviction and the knowledge, and really the only thing that will stop them is retirement," says Adrian Lowcock, senior investment manager at Hargreaves Lansdown.

But a lot of it is down to good breeding. "Most of them have come up through the ranks," he points out. "This gives them experience, ensures they have an analytical mind and that they know their market."

Why did they leave?

Gary Potter, head of multi-manager at F&C, says that while investors should not panic and follow their fund manager as a knee-jerk reaction, they should perhaps take heed and consider whether the departure is a warning signal.

Smaller companies become off-limits and quick trades are ever more difficult. While investors pile money into the successful manager's fund, its expanding size will eventually become a hindrance, points out Potter. "However good a captain is, the bigger the ship you put him on, the harder it becomes to turn around."But Alistair Thaw, director at Barclays Stockbrokers, thinks people put too much emphasis on the importance of fund managers. "Investors care about returns. If a star fund manager is delivering then maybe they will follow.

But I think quite a lot of money follows consensus; people will look at the most popular funds and sectors [rather than the managers in question]," he explains.He also thinks too much weight is put on the individual manager compared to the team as a whole, when the underlying resources and group ethic in fact account for a large part of the success of the fund."Do I actually think [star fund managers] make a difference? Probably not. They may have some good instincts, but I think it is more a team effort and the infrastructure that is involved in that and the investment process," he says.But Lowcock thinks this too is down to the manager. "We do not think it is the manager who comes up with all the ideas, but he or she is able to digest a large amount of information and use that to construct a blended portfolio. A good team is critical too, and a good manager will build that team around them," he argues.

Anthony Bolton

However, not even the best of managers is immune to a change in fortune. Anthony Bolton is the most commonly cited recent example where the tables have turned.

Having successfully managed the from 1979 to 2007, producing an annualised return of 19.5% across that time, Bolton changed not only funds but regions, turning his attention from the UK to China. There he has not fared so well."But there is a lot more learning and understanding to be done [with that sort of move] that will take a bit longer," says Lowcock.This may be the X-factor that has made Woodford's manoeuvre such an historic one. A man who has always had a penchant for smaller companies, Woodford had very limited access to these markets in his mega-funds, but still produced some great returns.

As he moves back to his favourite patch, no doubt investors are excited to see just what he can do."This new fund will be smaller to start off with; Woodford can start again with a clean sheet of paper and buy what offers the best value at the time, and be more nimble," says Jeremy Le Seuer, managing director at 4 Shire Asset Management.His advice to those who know they will follow the manager is: sell straight away. If you wait to sell, shares will be less liquid and the bid offer spread may be larger.However, he cautions, Woodford has had a significant period of "gardening leave" and if you took the decision to sell immediately, there has been a long period in which markets have been rising when you may have had no exposure. As always, there is a trade-off. Those who wait around may be lumbered with units they are unable to sell.Staying loyal is tempting, and doubtless there are a few individuals out there who can add real value time and time again. But, as the fund management industry so often warns: past performance is no guarantee of the future.

Ask why they left; is something not working at the business?"Gary Potter

Should you follow the manager?

How does the manager perform compared with the fund's peer group? While being top of the sector over every time period is not vital, if a manager is consistently mediocre they may not be worth following.Why is the manager leaving? If it's in search of a different mandate offering more investment freedom, brilliant. But if colleagues start to follow, it could be a sign of trouble at the firm.Where is he going? Is it to a new fund group, and if so are you happy to take on the additional risk that comes with that? Does the new group's house style suit the manager's strategy?What type of fund will he be running? Running a similar fund will, hopefully, mean a similar strategy and continued strong performance.How big will the fund be? A smaller fund can allow managers to be more nimble and invest in smaller companies; a bigger fund may limit their possible investment universe.Is it new or existing? If the fund already exists, look at the history of the fund, why the manager is being replaced, the team already in place and how the new manager will fit into it. If it's a new fund, consider whether it fits into the range of the fund group and whether the group has the skill and resources to do a good job.What is the fund strategy and will the manager be able to change it? If his approach is not aligned with the fund group's ethos or the fund's mandate, it could signal problems on the horizon.