Long-term value emerges in BRIC markets

30th April 2014 15:24

by Jim Levi from interactive investor

Share on

Mark Mobius, Franklin Templeton's globetrotting doyen of emerging markets fund managers, likes to relate the story of how he once found himself stranded in Indonesia in the middle of a coup d'etat.

With the bullets flying round his hotel room in Jakarta, he got on the phone to the local stockbrokers and aggressively bought Indonesian equities. Of course, it eventually paid off handsomely.

To find out how the panellists rate the outlook for US equities, read:US equities split asset allocation panel.

Russia

A modest echo of that nerveless approach to investing comes from one of the panellists - Chris Wyllie of Iveagh Private Investment House. On the day Russian troops began their annexation of Crimea at the beginning of March, Wyllie was donning his buying boots in Moscow as the Russian market fell by 12%.

"It was about the only move we made of any consequence during the first three months of 2014," he says. Uniquely, Wyllie has left all his scores unchanged compared with three months ago. He describes it as "a period of masterly inactivity".

"The more I think about emerging markets as an asset class, the less I like it," he says. "It is too diverse. I am happy to be at least neutral in Asian emerging markets, but I am wary of Latin America, Eastern Europe and oil producing countries."

Wade deserves a pat on the back for his caution in February. However, even he has now raised his score from four to five, admitting that if he is right in thinking the US economy is going to continue to grow and the eurozone continue to recover, "it should feed through some benefits for emerging countries".

Thames River's Rob Burdett is also less than gung-ho about the sector. But he notes the ability of frontier markets to outperform in the emerging markets mix. He points investors in the direction of Baring Frontier Markets fund - a small Irish-authorised Ucit with a spread of 60 or more investments across such countries.

Most emerging markets took a beating during the early weeks of this year, on the back of fears about China's growth story coming unstuck and worries about the effects, on the dollar and interest rates, of the US's decision to wind down quantitative easing.

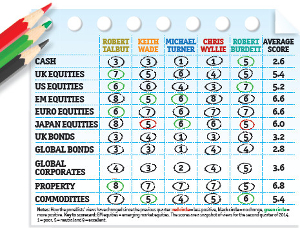

The five panellists

Chris Wyllie is chief investment officer at Iveagh Private Investment House. He is also the head of portfolio management at Iveagh Wealth Fund, with £250 million under management.

Rob Burdett is co-head of multi-manager funds at Thames River Capital, with £1.5 billion under management. It is a largely autonomous business within the F&C group, managing funds of more than £100 billion.

Michael Turner is head of global strategy and asset allocation at Aberdeen Asset Management, with £177 billion under management.

Robert Talbut is chief investment officer at Royal London Asset Management, with more than £40 billion of assets.

Keith Wade is chief economist and strategist at Schroders, which has £203 billion of assets under management.

That market weakness has only whetted the appetite of other panel members. Iveagh's Wyllie has kept his score for emerging markets at eight since last November. "We have kept our faith. The valuation case is very strong and sentiment very negative," he says. "We have had four years of underperformance in these markets and it is far too late to become bearish."

Long-term value

Robert Talbut at Royal London raised his score here from seven to eight back in February. "I am not going to change that score now," he says. "There is more and more long-term value to be had here."

Aberdeen Asset Management's Michael Turner acknowledges his company's important emerging markets exposure, while pointing out that valuations - particularly in the Asia Pacific region - are nearing levels at which historically it has been good to buy.

"After a recent shake-out, some of the currencies now seem to be stabilising," he says, "Outflows of funds have slowed and key countries such as Brazil and India are seeing a change in the political landscape, with more market-friendly parties possibly winning power."

Turner sees clear signs of the emerging markets worm finally turning. Remarkably, he reveals that the Brazilian stock market, in sterling terms, outperformed the UK's FTSE 100 index in the first quarter of 2014. "That is thanks to a rally in the local currency and recovery in shares in the final days of March," he says.

Comparing the strength of developed markets over the past couple of years with the underperformance in emerging markets, he sees a yawning 40% discount on offer. "Average price/earnings ratios of 15 or 16 in the US and Europe compare with averages of 10 in emerging country stocks. We think a discount of that size is a good cushion against all the risks."

Looking at the broad spread of financial markets in the opening months of 2014, the performance of the different asset classes has not played out quite as expected. Leading equity markets had a setback over Ukraine, but the investor mood in favour of buying on dips meant that by the end of March Europe and the UK showed little overall change. US markets touched new peaks in early April, but Japan lost 7%.

In contrast, there was a slight rally in bond markets, while gold appeared to bounce off a $1,200 (£864) floor to a six-month high of $1,392. The crisis in Ukraine encouraged a renewed search for safe havens, and gold is an obvious one.