Income streams from alternative sources

1st May 2014 12:17

by Cherry Reynard from interactive investor

Share on

Interest rate rises may now be in prospect, but high-income investments remain elusive.

The income available from bonds is still low and there remains the potential for capital losses. Meanwhile, equity markets have risen significantly and valuations are looking increasingly stretched.

In this climate, it makes sense to diversify your income stream and move away from reliance on conventional sources. With that in mind, there are a number of "offbeat" sources of income that investors could consider.

Talib Sheikh, manager of the , argues that some income-producing assets have become so expensive it is questionable if they can still be defined in those terms: "For example, we haven't held corporate bonds for some time, on the basis that the income does not adequately compensate us for the risk we are taking," he says.

"We believe there are cheaper sources of income out there. In all cases, it is not a case of maximising the income by simply picking the highest-paying asset, but about optimising the risk-adjusted return."

Increasingly investors have moved to the stock market for income. After all, many equity income funds are still delivering a yield of 4-5% and investors can now look beyond the UK to North American, European, Asian or emerging market income funds. Certainly, income shares look better value than the bond equivalents, but there is a danger that some "bond proxy" shares may also be dragged lower by higher interest rates.

These shares may look attractive relative to bonds, but not on their own merits. With the main sources of income relatively unappealing, canny investors are seeking out alternatives. This is generally good practice. If investors have a diversity of income sources in a portfolio, they are less vulnerable to one area going wrong. In general, the trade-off for many of these income ideas is liquidity. For example, infrastructure is a solid, income-generative asset class, but an airport or a road is not readily sold, so investors must be willing to look to the long term. They may also have to suspend a mistrust of the "unusual".

Convertibles

Convertible bonds are fixed-income securities that pay an income and are redeemed at a predetermined price after a number of years. In this way, they look like conventional bonds, except that they contain the option for investors to convert them to shares.

In effect, they act as a bond/shares hybrid and their performance will have some relationship with both types of asset. If the equity market is rising, the right to convert to equities becomes valuable, but if stock markets then start to perform badly, the convertible bond will gradually come to behave more and more like a straightforward bond.

The global convertibles market is currently around $450 billion (£272 billion) in size, with the majority of the market in US and Europe. Convertibles are relatively insensitive to interest rate rises, with the credit quality of the underlying company more important.

It is now increasingly difficult to find shares paying an income of 5%"Alex Crooke

There is now a range of dedicated convertibles funds: open-ended funds are available from M&G and Aviva Investors, and JPMorgan has a closed ended vehicle. Yields are attractive too. The JPMorgan fund, for example, currently pays more than 4% per year.

Preference shares

Preference shares look and feel like ordinary shares, but have extra rights in place. Preference shareholders are paid ahead of ordinary shareholders in the event of a company bankruptcy. They also tend to pay out a fixed rather than a discretionary dividend. This means they share some characteristics with bonds and will show performance and risk characteristics somewhere between shares and bonds. They can also pay a chunky yield.

JPM's Sheikh points out that many preference shares are now paying as much as 7%. Preference shares are far more commonly used in the US, but there are a number traded on the London Stock Exchange, including those from major companies such as pub group , aerospace group , housebuilder and .

Funds specialising in preference shares are rare, but there is the , which paid an income of more than 6% last year.

Renewables

Renewables are a sub-sector of infrastructure and therefore may not merit their own category. However, they have different drivers. Potter has been investing in areas such as wind and solar power, which can generate an income of 6-7%.

He says: "If you look at the EU's 2020 vision, power generation from renewable sources is going to be increased. There are plans to reduce the dependency on coal and, as such, there is undoubtedly growth in this area."

The asset class is still backed by Crooke, who says: "We hold funds such as Foresight Solar and . These are underpinned by government subsidies and have an attractive return relative to the bond market." These two trusts are also favoured by Potter.

Infrastructure

In many ways, infrastructure could be the perfect income investment. Many funds have long-term, government-backed income streams, supported by safe-haven assets such as schools, roads or hospitals. The problem with many infrastructure trusts is that the asset class is illiquid and has largely been discovered by investors.

The illiquidity is not a problem in itself. The majority of funds are structured as investment trusts and therefore the liquidity constraints can be managed. Long-term investors can simply gather the yield and not worry too much about the capital. However, the trusts are on significant premiums to net asset value (NAV).

, for example, trades at a 14.5% premium to NAV. Again, this is not automatically a problem - it simply implies that the market believes that NAVs may be revised higher - but it has pushed yields lower. The HICL fund now has a dividend yield of just 2.56%. It also leaves the funds vulnerable to any change in sentiment towards the sector. However, there may be opportunities outside the UK. For example, Potter invests in the Gulf Cooperation Council (GCC), which invests in Abu Dhabi infrastructure.

AIM

Alternative Investment Market (AIM) shares already carry some appealing tax benefits. Provided they are held for three years, they are free from capital gains tax (CGT). They can also be used to defer an existing CGT liability and for inheritance tax planning. Few investors see them as a natural source of income, but a number of the shares on Aim are family businesses and pay an attractive regular dividend.

Sheridan Admans, investment research manager at the Share Centre, highlights stocks such as , which currently yields 2.5% and has shown three-year dividend growth of 29%. This independent pharmaceutical company is a marketing partner for emerging biotech and R&D companies. He says: "The company continues to seek acquisition opportunities in the UK and Europe, and has an attractive portfolio of products, plus a good return on equity and dividend cover."

He also points to asset management group , which yields 3% and is seeing growth on the back of improving fund flows.

Catastrophe bonds

Catastrophe bonds are a means to bypass insurance companies. After a major catastrophic event, such as flooding, insurers will often baulk at being asked to insure the risks associated with a repeat event. Instead, catastrophe bonds can be created and sold to investors.

If a catastrophic event occurs, the money raised goes to pay for the damage. If it doesn’t, investors get their money back at the end of the term, plus interest in the interim. The US market has grown significantly over the past 10 years to almost $20 billion. Fund managers have tapped into this market with the launch of portfolios of catastrophe bonds.

For example, the Star Cat Bond fund was launched in October 2011 and has grown in popularity as investors look for diversified sources of income. Gary Potter, joint head of multi-manager at F&C investments, has recently been building up holdings in catastrophe bond funds such as Blue Capital Global Reinsurance. These produce a yield of around 6%, and neither capital nor income is linked to the performanc

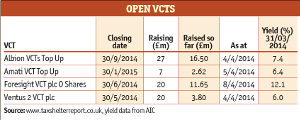

VCTS

Once seen as a pure growth investment, venture capital trusts (VCTs) are increasingly used as an income vehicle. Mike Piddock, business line manager for VCTs at Octopus Investments, says that the 30% upfront tax relief can be given as a one-off lump sum tax repayment or, if someone invests at the beginning of the tax year, they can have their PAYE tax code adjusted immediately. This means the investor takes home more money in their pay packet each month.

The latest figures from the Association of Investment Companies show that 73% of VCTs yield over 5%"Mike Piddock

He adds that while VCT investments also attract CGT exemptions, the tax free dividends will be more attractive for income-seekers. "Since their inception, VCTs have proved to be highly income-focused investment vehicles. The combination of upfront income tax relief with the potential returns generated through tax-free dividends makes them a powerful planning tool for investors. The latest figures from the Association of Investment Companies show that 73% of VCTs yield over 5%."

Aircraft leasing

Aircraft leasing is part of asset financing. Trusts such as Doric Nimrod own an aircraft and then lease it back to an airline for a set number of years, paying the income back to shareholders. The plane is bought with a combination of the capital raised and borrowings. Unless the airline defaults, investors get a regular income and then a payment back at the end. In the case of Doric Nimrod, the airline is the well-capitalised Emirates, so default is relatively unlikely.

Real estate lending funds

The credit crisis has seen banks move away from their "riskier" lending, which has left certain sectors bereft of financing. European commercial realestate has been a notable victim. Although larger groups could issue corporate bonds or turn to insurance companies, smaller companies have had to seek alternative solutions. A number of investment trusts have now emerged to fill this gap in the market.

Arguably the most successful has been the Starwood European Real Estate fund, which lends to the riskier end of the property market at higher loan-to-value ratios. These higher rates mean a higher income for investors. It has been supported by the multi-manager teams at Premier Asset Management and F&C Investments.

The Starwood fund now pays 3%, though some of the higher-risk funds, such as , pay income as high as 6%. PIBS Pibs or "permanent interest-bearing shares" are issued by building societies and listed on the London Stock Exchange. As the name implies, they do not have a maturity date, but pay a fixed rate of interest forever. Interest payments are made gross and are usually higher than the income available on bonds or shares. In theory, the building society can miss payments as it chooses, but this doesn’t tend to happen. They have proved a low-volatility alternative to the fixed income market.

Emerging market corporate bonds

Investors may want little to do with emerging markets at the moment, but after a long run of difficult performance, some opportunities are appearing.

Emerging market corporate bonds offer an alternative option to conventional equities and government bonds. Many emerging market companies can now compete with their developed-market peers and have issued bonds.

Companies issuing bonds have included Brazilian state oil firm Petrobras, Mexican firms Pemex and America Movil, Indonesian power group PT Cikarang Listrindo, Chilean miner Codelco and Kazakstan oil and gas group Nostrum. Many of these bonds pay 7-8% interest.

Groups such as Pimco and Aberdeen have launched funds in this area. Emerging market corporate bonds may also appear in flexible or strategic bond funds.

Once investors find a new and attractive source of income they may muscle in and drive yields lower, so the income sources above may not be around forever - investors need to get them while they are hot.