Volatile markets fuel revamp in Income Growth Portfolio

21st May 2014 16:13

Stockmarkets have been volatile since the last review, partly due to rising tension in Ukraine and the feeling among some investors that companies need to deliver improved returns to justify the surge in share prices last year.

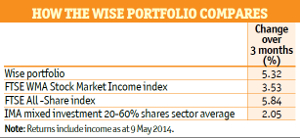

Nevertheless, by the end of the quarter, the market had recovered and the FTSE All-Share index was up 5.8%, with the income growth portfolio not far behind.

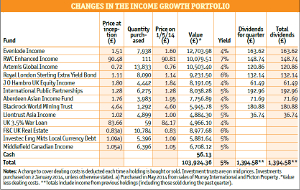

Most of the portfolio's holdings made headway during the quarter. Two did so well that Tony Yarrow, chairman of Wise Investments and manager of our hypothetical £100,000 portfolio felt it was time to take a profit.

At the time of the review, he decided to replace them with three new holdings.

To view the income growth portfolio's holdings and trading chronology, click here.

Too good to miss

Yarrow says: "Bruce Stout, the manager, is much respected and the trust usually trades at a high premium. It went to a discount because of its exposure to Asia and the emerging markets, which had fallen from favour.

"I would love to continue holding it, but I don't think we have seen the last of the emerging markets' problems. Cashing in on this premium was too good an opportunity to miss."

He also sold , another trust that had gone to a big premium. "I have nothing against the trust, but its price had risen a lot over the past year and is now well over the odds," he says. "Its yield is now down to 5%." As a replacement, he has bought another property trust, F&C UK Real Estate, which is on a smaller premium and higher yield of 6.1%.

Even though prices have risen, Yarrow believes the commercial property market still has a way to go, especially outside London, where no one has been building. "A year ago it was all doom and gloom. Only now are we starting to see some movement in prices outside London, but still in close proximity to the capital.

In any case, I think it unlikely that we have gone through a complete property cycle in just over a year, so it is still worth maintaining exposure to this sector."

The other two holdings he has acquired are and . He says: "The emerging market bond sector has been killed over the past year. People have fallen out of love with these markets because they believe tapering will weaken economies.

"As a result, the yield on this fund has risen. Some emerging markets are certainly better than others, but I think Peter Eerdmans and his team at Investec will know where to find the best value."

Exposure to canada

Middlefield Canadian Income is an investment company quoted on the London stockmarket but managed in Canada, that specialises in Canadian equity income shares.

Yarrow believes this trust will produce a good return. "Part of my bull case is that the Canadian dollar has been weak but has now bottomed out and will improve," he says. "Also, the team that runs the fund has an amazing record of beating the market."

The energy sector is the second-largest exposure in the Middlefield portfolio. Yarrow explains that the managers see considerable potential for the export, starting in 2016, of liquid natural gas to European and Asian markets where gas sells at a significant premium to North American prices.

One explanation for this is that the former is an investment trust while the latter is a fund.

"We did consider selling the Aberdeen trust because, rather like the other trust holdings we sold, we had bought it at a discount when Asia fell from favour," explains Yarrow. "It has now bounced back and is trading at a premium. But we have decided to continue to hold it for the time being."

Banking on a Chinese recovery

Yarrow has also decided to hold onto the Liontrust fund, despite its poor performance, which he puts down largely to its heavy exposure to China. He likes the fund's investment team and believes that China will recover again when people realise the economy is actually going to be okay.

Another strong performer for the portfolio over the quarter was the Wise in-house fund, , which is managed by Tony Yarrow's son Hugh, assisted by Ben Peters.

As Yarrow senior points out: "This fund invests in 'sleep at night' companies. The managers get good results because they focus on a relatively small universe of around 100 companies, so they know them very well indeed and can get the best out of them."

Apart from Liontrust, the only other holding to lose ground over the quarter was . Yarrow says mining is a cyclical business and its fortunes in recent years have been linked to China's, but he feels the infrastructure deficit in the US, the UK and Europe means that, whatever happens to China, commodities will be in demand. "We may not have timed the bottom of the cycle, but we are getting a decent yield in the meantime and will make money as the cycle picks up," he says.

Yarrow stresses that he has no idea how markets will behave over the next few months. But, he says: "It doesn't really matter, because, whatever happens to markets, we can take advantage of the situation to take profits when they go up or find buying opportunities when they go down."

Editor's Picks