Share Sleuth's June Watchlist

4th June 2014 09:53

by Richard Beddard from interactive investor

Share on

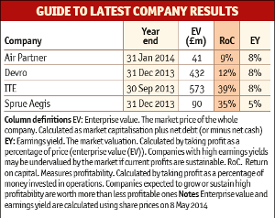

Each month Richard Beddard trawls through annual corporate results for his Watchlist and the Share Sleuth portfolio of companies that satisfy key valuation metrics such as earnings yield and return on capital - and profiles the most interesting candidates.

Air Partner

full-year results are, superficially, excellent. Revenue grew 7%, adjusted profit grew 31% and the company's net cash balance grew 12%. Its cash flows are particularly impressive.

But the results for the year ending 31 January 2014 are proforma. The statutory results are for the 18 months since July 2012, when the company last published full-year results. Air Partner has changed its year end.

Compared with 2012, turnover is marginally lower and profit is slightly higher. Compared with 2011, the company is doing poorly; compared with the recessionary years before that, it's doing well; and compared with the boom years before the credit crunch, it could do better.

The air charter firm is susceptible to economic circumstances because it ferries business people to conferences and product launches. It's affected by disasters because aid agencies need to get people and aid in, and businesses need to get people out. Governments need to do both.

Air Partner's reputation is bolstered by its 50-year record in the industry, strong finances and a business model that can change with circumstances.

The company is replacing business lost following a switch among governments to less interventionist foreign policies, by chartering planes to tour operators and oil and gas companies. But for all its flexibility, growth at Air Partner, and the air charter industry generally, will probably remain constrained while economic growth is restrained.

Other elements of Air Partner's strategy may help. The company is renewing its IT infrastructure and recently reorganised into a product-led structure. A share price of 485p values the firm at just £41 million, about 12 times adjusted 2014 earnings, which is probably good value. The earnings yield is 8%.

Devro

Sausage casing manufacturer reported an uncharacteristically flat 2013 in March. Subsequent trading for the first quarter of 2014 was below the same period in 2013. Although there are signs of improvement, revenue is likely to be flat for the year to December 2014 too. The company expects profits to fall as it accelerates plans to move production to more modern, lower-cost production lines. It recently completed a new factory in the Czech Republic.

A disappointing year, followed by a profit warning, is not the kind of performance investors expect from a company that, with a handful of competitors, has carved up the global market for collagen casings - which are more consistent and cheaper to manufacture than traditional animal gut casings.

Despite rapid inflation in the price of hides (the source of collagen) high pork prices and adverse currency movements in 2013, Devro's biggest and most profitable market is Europe - responsible for nearly half of revenue and 80% of profit.

However, China, now the world's biggest consumer of collagen casings, and the US are highly significant strategically. The company has committed to investing £90 million in a new factory in Shanghai and improving an ageing plant in South Carolina, part-funded by a new $100 million (£59 million) loan. The investment will probably wipe out free-cash flow for two years.

These investments are risky. There is no guarantee they will earn Devro the juicy returns it gets in Europe. China is a new market and Devro's largest competitor already has a presence there. The US market, meanwhile, is very competitive.

That said, as part of Johnson & Johnson, Devro invented collagen science and the manufacturing processes that enable low-cost production and customisable product. It has developed strong relationships with customers, food machinery manufacturers and ingredient suppliers.

A price of 226p values the enterprise at £432 million, 13 times adjusted 2013 earnings. The earnings yield is 8%. The shares are probably good value, if the company's qualities trump the costs of expansion and competing in potentially tougher markets.

ITE

Trade show organiser published its results for the year ending September 2013 last year, but events merit its inclusion in Share Watch.

Then, the prospect of conflict in Ukraine was not vexing UK investors and the company reported another year of record profit. But Ukraine earned ITE 6% of revenue and 7% of profit in 2013. Although the company has said it doesn't expect to cancel forthcoming events, sales are affected.

However, ITE forecasts a relatively small dent in profit of £2 million for the financial year ending in September, compared with a pre-tax profit of £60 million in 2013.

A bigger headache for investors is Russia, which is accused of stirring up separatism in Ukraine. The EU, the US and other nations have imposed sanctions on Russian politicians and businessmen that are reportedly damaging their ability to conduct business and may already have tipped the slowing Russian economy into recession.

An escalation that targeted businesses directly would harm the exhibitions that serve them - Mosbuild, for example, a construction show that is ITE's biggest and most profitable event. Russia contributes 63% of total revenue.

Under less troubled circumstances, ITE's commanding position in Russia and former Soviet states is one of its advantages. For 20 years, it has built leading brands in construction, oil and gas, food and tourism, supported by a network of local offices and international sales offices, which, the company says, would be expensive to replicate. It is using the cash from its highly profitable operations to expand in India, China and Asia Pacific.

The economic risks of recession are reduced by ITE's flexible cost structure, which allows it to keep events profitable even if demand for exhibition space falls short of expectations, effectively by employing fewer people and sharing the financial burden with venues - by only paying for the amount of exhibition space used, for example.

The risk of investing in Russia is ever-present and something of an advantage in that it deters other exhibition organisers. It stands to reason that the safest time to add shares in ITE is when that risk is palpable and reflected in a lower share price.

At 229p the share price is off its lows, and values the enterprise at £573 million, about 13 times adjusted 2013 earnings. The earnings yield is 8%. Although profit will suffer while the crisis continues, ITE is on the cusp of good value.

Sprue Aegis

In the full-year to 31 December 2013, Sprue Aegisraised turnover 30% and adjusted earnings 60%. The level of net cash fell, as the company funded increasing levels of stock and receivables to meet demand.

Sprue designs smoke and carbon monoxide detectors, outsourcing most of its manufacturing to China and logistics and warehousing to a company in Cambridge. Its strategy is to invest in technology rather than manufacturing, designing smaller, more responsive and more efficient products, and marketing them increasingly widely.

It's also the exclusive distributor of Jarden Corporation's FirstAlert, BRK and Dicon brands, an agreement renewed recently. The company says the agreement, on improved terms for Sprue, reflects the reduced contribution it expects from the three brands it distributes. That's because they face major competitors in Sprue's own brands, which are more profitable.

Growth is fastest in continental Europe, where Sprue's FireAngel ST-620, the market-leading retail smoke alarm in the UK, is doing well in Germany. Some German states are making it mandatory for private homes to have a smoke alarm.

Sprue is introducing FireAngel in the Benelux countries too. French homes must have at least one smoke alarm by May 2015, and it has launched a different brand, AngelEye, there. In the UK, Sprue is sole supplier to retailers B&Q, British Gas, Wickes and Robert Dyas. It also supplies the UK Fire & Rescue Service, Tesco and Screwfix.

Sprue's designs are protected by a growing number of patents. High levels of profitability and the company's growth since its formation in 1998 suggest it is turning technical advantage into strong brands. The 10-year lifespan of its sealed battery products means the replacement cycle has already started in the UK, a pattern about to be repeated in Germany.

A share price of 228p values the enterprise at £92 million, or 21 times adjusted 2013 earnings. The earnings yield is 5%. That's not obviously cheap, even for a company with strong finances, a record of profitable growth and the prospect of more to come.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.