Fund Awards 2014: UK Bonds

18th June 2014 15:19

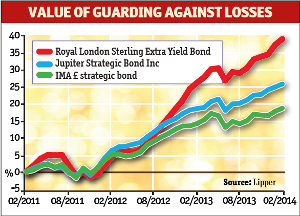

Larger fund winner: Royal London Sterling Extra Yield

The winner of this year's large UK bond fund award is managed by Eric Holt, who has also carried off the trophy for the best ethical bond fund. Although he adopts a common approach to selecting bonds, he says the two funds are very different.

In both cases, however, he stresses the need to guard against losses. He says: "With bonds it is important to remember that all the risk is on the downside because the upside is limited anyway, so it is important not to have all your eggs in one basket.

"For this reason I also look for protection, which may be conveyed through credit ratings, though the structure and security behind the bonds is also important."

However, with the fund Holt adopts a somewhat less cautious approach than for its ethical cousin. The fund has over 180 holdings, but currently around 20% of the fund is invested in its top ten holdings.

His emphasis with this fund is on income duration. The fund also has a larger exposure to sub-investment grade and unrated bonds. Indeed, only 20% of the fund is currently in investment grade bonds.

"We think this is pretty robust," says Holt. Similarly, he points out that the unrated bond sector is not homogenous. "These bonds range from very high to very low quality."

He believes that bonds are still an attractive source of income for investors, and he doesn't expect a rapid improvement in the economy that will change this situation any time soon.

"There are still economic challenges. The global background is not great. The government still needs to get its finances in order," he says. "Interest rates will have to rise but I think it will be slow progress. In the meantime, investors are still being paid relatively well for taking credit risk."

The fund returned 39.3% in the three years to 1 March, against an average of 20.5% for the sterling strategic bond sector. In the past year its ongoing charges figure was 1.4%.

Highly commended larger fund: Jupiter Strategic Bond

Strategic bond funds have become increasingly popular in the past two years, as value has become more difficult to find in the fixed-income market. They can seek out the best opportunities across the bond spectrum, including high-yield bonds, investment-grade bonds, government bonds, preference shares and convertible bonds; they may also, as in the case of our highly commended fund, be able to use derivatives for investment purposes.

However, having greater scope to invest can also leave greater scope for making mistakes. This does not seem to be a problem for Ariel Bezalel, the manager of the fund, who has achieved highly commended status for the second consecutive year thanks to the consistency of his performance.

Bezalel, who has run the fund since its inception in 2008, has made some astute market timing decisions. Having the power to invest in derivatives, which was added at the end of last year, will also allow him to mitigate the risk of falling bond prices.

The fund currently holds a variety of bonds, of which around a quarter are investment grade, with less than 10% in unrated bonds. It also has a broad geographical remit. Although its highest exposure currently is to the UK, it also has holdings in Europe and beyond. Three of its top holdings are Australian government bonds.

Bezalel attributes this consistency to time spent meeting and researching the companies he invests in. He looks for companies with robust business models and competent management teams, and then holds for the medium to long term.

Where possible, he prefers bonds at the highest possible end of a company's capital structure. In considering the positioning of the portfolio, he also takes into account world events and general economic factors such as inflation and the outlook for interest rates.

The fund returned 26.1% in the three years to 1 March, against an average of 20.5% for the sterling strategic bond sector. In the past year its ongoing charges figure was 1.5%.

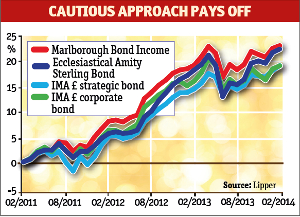

Smaller fund winner: Marlborough Bond Income

The managers of our award-winning smaller UK bond fund are no strangers to the podium. This year they are also receiving the trophy for the best smaller global bond fund for the third consecutive year.

However, this is the first time the has come to the fore. It has been run by Geoff Hitchin and his co-manager Nicholas Cooling since its inception in 1998.

Their approach to both funds is similar. They take a cautious approach, focusing on capturing gains in positive markets while limiting the effects when they fall. When deciding which bonds to buy, they look for those where they believe there is a disconnect between price and value. The general economic situation can also play a role.

Over the past three years, Hitchin feels they have managed to strike the right balance between their search for yield and the care they have taken in selecting individual bonds that have enabled them to manage volatility and achieve consistent performance.

In particular, he says, "we have been well served by our holdings in the subordinated debt of insurance companies, including , and Clerical Medical".

He sees one of their key challenges now as making the right call about when, and by how much, UK interest rates will rise.

"With the year-on-year inflation rate down to 1.6% in March compared with 2.8% a year ago, and a similar pattern elsewhere in the developed world, we believe the evidence is that monetary stimulus since the 2008 crisis has had only limited success in stimulating growth," he says.

"The UK's GDP has shown some signs of improvement but remains below 2008 levels. Our view is that interest rates will remain at today's ultra-low levels for quite some time."

The fund returned 22.8% in the three years to 1 March, against an average of 20.7% for the sterling corporate bond sector. In the past year its ongoing charges figure was 1.6%.

Highly commended smaller fund: Ecclesiastical Amity Sterling Bond

Like many successful bond funds of late, has benefited from being significantly underweight in UK gilts, which currently account for less than 3% of the fund. This has proved a boon to the fund over the past three years, as inflation has outpaced gilt yields, and also more recently as gilt yields have risen and corporate bond spreads have tightened, says manager Chris Hiorns.

Explaining his process, Hiorns says he focuses on both corporate bonds and more niche areas of the market, including preference shares and building society permanent interest-bearing shares (Pibs), which he says help him to maintain a "well diversified portfolio" of up to 100 holdings.

"We seek to adjust the duration of the portfolio and the split between index linked bonds and conventional bonds, gilts and corporate bonds, and different business sectors. However, we will only do this on a gradual basis and we will not overly expose the fund to any one area of the fixed interest market," he says.

For Hiorns, holdings must have "strong balance sheets, good cash flows, sustainable business models and long track records". This is why, he says, the fund's top 10 investments are largely household names, including , Nationwide Building Society and the .

However, with over 20% of the fund currently invested in unrated bonds, Hiorns is not averse to taking a little risk, although he insists that his holdings in this area represent "good quality credits" and that Ecclesiastical conducts its own research into the companies.

Preference shares that have served the fund particularly well in recent years include those issued by blue-chip financial companies like , and , as well as those from utility companies including Bristol Water and Northern Electric. Hiorns' building society Pibs have also performed well, a fact reflected in Nottingham Building Society's top spot in the fund.

The fund returned 22% in the three years to 1 March, against an average of 20.5% for the sterling strategic bond sector. In the past year its ongoing charges figure was 1.4%.

Editor's Picks