Fund Awards 2014: Higher-risk mixed asset

23rd June 2014 11:46

by Helen Pridham from interactive investor

Share on

Larger fund winner: Fidelity Moneybuilder Balanced Income

Our second set of mixed-asset awards goes to funds in two IMA sectors: mixed-investment 40-85% shares and flexible investments, where funds can have up to 100% invested in shares.

Funds are usually perceived to be more risky, the higher the proportion of shares they contain. However, our winning large fund, , is managed by two managers considered to be "safe pairs of hands".

Michael Clark runs the equity portfolio while Ian Spreadbury manages the bond component. The fund has a strategic asset allocation of 65% equities and 35% fixed income, plus or minus 5%. Both managers focus on income generation in their respective asset classes.

The second quality he looks for is the ability to generate sufficient cashflow to fund future growth and pay increasing dividends over time. He likes stable, defensive businesses that deliver low-volatility returns and steady capital growth.

One of Clark's success stories over the past three years was his purchase of , which was not favoured by investors because it is a conglomerate. This has been a particularly rewarding investment because of great returns in its grocery division, but it has been its retail company, Primark, that has excelled. Clark believes there is more great performance to come.

Spreadbury's fixed-income component is invested in UK gilts, but he can also invest in investment-grade corporate bonds. His allocation of a small part of the fixed-income portfolio to high-quality corporate bonds has contributed most to relative returns over the past three years.

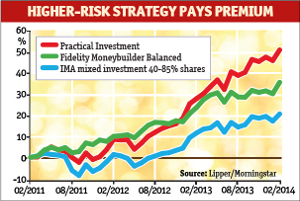

The fund returned 35.2% in the three years to 1 March, compared with an average of 21.4% for the mixed investments 40-85% shares sector. In the past year, its ongoing charges figure was 1.2%.

Smaller fund winner: Practical Investment

is one of our repeat winners. It has won our smaller-fund award in this category for the third consecutive year. It also has the distinction of being one of the UK's oldest unit trusts, having been set up in 1941. Its performance has been consistent and its management continuity second to none, having been managed by the same family since inception.

Sean Ashfield, grandson of the fund's founder and present manager, has retained an emphasis on capital preservation as much as achieving growth and income. Another consistent factor has been the use of investment trust companies as the fund's main investment universe.

At the last count, it was invested in around 35 investment companies, with the top 10 holdings accounting for around 50% of the portfolio. Its largest holding is in the t, the fund's parent company, although this holding was reduced last year as it was getting too close to the maximum 10% level.

Ashfield takes several factors into consideration when selecting investment companies. He says: "Confidence in the expertise of the management and its ability to achieve better-than-average performance over the years is essential."

If possible, he likes to buy when a trust is at a higher-than-average discount to net asset value, although that has become more difficult recently as discounts have narrowed to historically low levels. He does not rule out buying equities directly. He held between 2012 and 2013, but that was unusual.

There can be exposure to fixed-income securities in the portfolio, although as the prices of these securities have risen over the past six years, especially those of UK gilts, Ashfield has reduced exposure from a third to less than 10%.

The fund returned 50.8% in the three years to 1 March, compared with an average of 21.4% for the mixed-investments 40-85% shares sector. In the past year, its ongoing charges figure was 1.1%.