Fund Awards 2014: North America

24th June 2014 15:55

by Helen Pridham from interactive investor

Share on

Larger fund winner: Old Mutual North American Equity

, our winner in this category, was also the recipient of last year's smaller North America fund trophy.

Since then it has more than quadrupled in size, as it has attracted more investor attention as well as having continued to produce good performance. As a result it has moved into the larger fund category.

Active fund managers often find it difficult to outperform the US stock market because it is well-researched so finding pricing anomalies is tricky.

However, Ian Heslop and his co-managers Amadeo Alentorn and Mike Servant have developed an approach that aims to give them an edge whatever the prevailing trends may be.

They use a rigorous set of criteria for assessing companies, which takes into account stock price valuation, balance-sheet quality, growth characteristics, efficient use of capital, analyst sentiment, and supportive market trends.

They use the same process for their other funds. This year they have won three separate Money Observer fund awards using the system, which they adjust to reflect the individual characteristics of different markets. Heslop says: "We have to adjust for different accounting rules in different countries and how investors react in different markets."

One thing they don't do is to exclude any stocks as style-oriented managers will do, says Heslop. "It is our system that produces our investment choices. The only subjectivity involved is in the way we have designed the process, which has been evolving since 2004."

The system seems to have come into its own in recent years as the managers have refined it. Heslop does not believe it is because conditions have been particularly favourable.

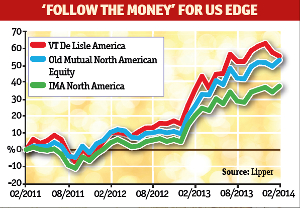

The fund returned 54.1% in the three years to 1 March, compared to an average of 37.4% for the North America sector. In the past year its ongoing charges figure was 1.7%.

Smaller fund winner: VT De Lisle America

When larger multi-faceted fund groups achieve winning performances, they often attribute their success to their considerable resources. By contrast, the winner of this year's best smaller North America fund award, a, is a small company that specialises in investing in US smaller companies. It is managed by Richard de Lisle, assisted by Sarah de Lisle.

De Lisle describes his basic investment approach as backward looking. He says: 'We don't receive any research and only care about the past. If a company has been doing what it says it will do for the past 20 or more years, then its culture is strong and will even supersede a change in chief executive.

"Thus our charts going back to 1951 are our most useful possession. In buying a stock, I like to read annual reports from 10 years ago before reading a current one. This process tends to keep us out of technology stocks, though we do have some."

When choosing stocks, he is pragmatic about what type of company he invests in, as long as it meets valuation criteria. When assessing companies, he says: "Sales per share is the most important variable. After that there are about eight more boxes we'd like to tick."

Looking back at particular success stories for the fund over the past three years, he says: "As we let profits run, there will always tend to be a monster driving things from the front. Currently, MWI Vets is 7.1% of the portfolio.

"Bought at an average of $31 (£18) five years ago, it is currently $153, and it still meets most of our valuation criteria. It helped our performance in 2012 and 2013. In 2011 it was our holding in Green Mountain Coffee Roasters which had gone up 12-fold for us."

De Lisle says the main challenge for the future is "staying in fashion". He points out: "Already small stocks are suffering a reaction after last year, and yet we're not shifting as we feel they are heading for a more major top a few years out. Other future challenges would be if there were a sector boom, say energy where we're light - we'd have to spot it and adjust."

The fund returned 56.4% in the three years to 1 March, compared to an average of 37.4% for the North America sector. In the past year its ongoing charges figure was 1.3%.