Rose's share price issues nearly over, says CEO

27th June 2014 12:19

by Harriet Mann from interactive investor

Share on

share price has been suffering from an overhang of stock following the conversion of a loan note into 80 million shares, its chief executive told Interactive Investor.

Nearly £10 million has been lost from the company's market capitalisation, but Matt Idiens was confident that the stock would no longer be "held back" as the converted shares have nearly all been sold by Geiger Counter Limited and City Natural Resources High Yield Trust.

"We have had a pretty good run ... obviously we had our very untimely convert of a convertible loan note, which as common sense will tell you; there is only one reason why you are going to convert it and that is to sell it.

"I think that overhang, which has held us back from going even higher, is now nearly at an end, and then once that has gone, our stock will not be held back any more and we will be up and running," he added.

The cash will fund a 3D seismic survey for the Paradox Basin and testing a vertical shut-in well in the same area. The placing will also finance the drilling and completion of a horizontal Mancos well, be used to help pursue strategic acquisitions and will go towards general working capital purposes.

However, Rose has a commitment to spend around £10.6 million on the two assets in the region.

"The plan is to commence operations and create some value on that basis. We didn't want to raise all of it at this level because clearly it is very dilutive for our existing shareholders when we can spend a little bit of money and create a lot more value and either come back and raise more at a much higher price or we find an industry partner, of which many have approached us, so there may be no further equity dilution," Idiens said.

No need to reinvent the wheel

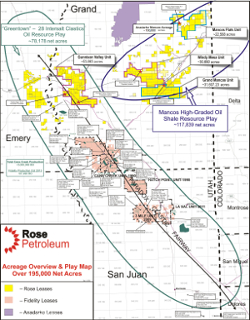

In the Utah acreage, the Paradox Basin lies to the east and the Mancos to the west. Rose has joined Fidelity Exploration & Production in the region, which has an acreage to the south of the Paradox Basin and is already producing. Learning from Fidelity's experience, Idiens believes 3D seismic is the "key".

"Rather than invent the wheel, we will replicate what Fidelity have done very successfully, they have produced a million barrels from the basin last year...and they are ramping up to two rigs this year. We will replicate what they have done with regards to how they have targeted their targets and the processes they have used to get production going."

When asked who will complete the drilling in Utah and whether they have experience in the area by an Interactive Investor discussion board user, Idiens said: "We know that Fidelity have clearly unlocked the code on the Paradox basin and our intention is to use the consultants that have been used by them. We know who they are and we are in contact with them. There is no point in us using some completely different who has never done it before."

Rose is happy to proceed drilling in the Mancos Basin with 2D analysis as there are 400 wells in the area, which were all considered in the reserves report from Ryder Scott. While the company will use fracking to obtain the oil and gas from the Mancos Basin, the method will not work in the Paradox Basin as it is "highly over-pressured and highly natural fractured".

"The Paradox Basin is deeper, it is about 9,500 feet, and it a multi-layer basin separated by salt, which is non-porous. So you have the classic situation where the shales [source rock for hydrocarbons] in a normal environment would seep out, go somewhere else into a conventional reservoir where it is stored. In this basin it has nowhere to go, so the shale has generated the oils and the gas then it is stored in the sandstone/siltstone and dolomite within these layers so it became very over-pressured because it couldn't go anywhere."

Idiens is confident of the resource potential in the Paradox Basin as Fidelity has identified a further 10 layers to be developed this year, on-top of the Cane Creek unit which is where all its production has come from so far.

On "conservative" numbers for a 30-year life-span of the project, the net present value with a 10% discount for both Basins totalled $2.4 billion (£1.4 billion), which is versus a £20 million market capitalisation.

"Obviously we need to drill and prove that what we think is there is there, but the Ryder Scott is an independent report. In the Mancos we have prospective recoverable resource P50 of 486 million barrels of oil and 2.9 trillion cubic feet of gas. In the Paradox Basin ... 966 million barrels of oil as a best case and 3.9 trillion cubic feet of gas."

Don't drop the ball

While Rose is concentrating on getting what it has in its portfolio up and running, it is not closed to other possible ventures.

"What Europe doesn't understand ... is there are an awful lot of opportunities still out there in the US. Everyone assumes just because a UK company's got it, it can't be very good. Well there are lots of very, very good projects available it is just having a technical team who is capable of assessing them and knows what they are doing."

Idiens says this is what Rose prioritised when it converted into an oil and gas company, which has helped Rose grow into something "really quite big".

Included in Rose's portfolio are its uranium assets, which it plans to sell when the market is healthier and its copper porphyry joint venture with Lowell Copper, who has a 75% earn-in interest deal.

Idiens believes Rose has been successful in making sure it keeps its shareholders educated and informed while it changed focus from mining to oil and gas.

"We are doing it slowly and that is an intentional thing we are not just dropping the mining asset and switching over. We are going to do both, which may not be popular in the City. Fund managers like you to be a single commodity company, but to be frank, they are not always right."

In trading on Friday, Rose Petroleum's share price was down by over 8% at 2.175p with a 0.05p spread.