Income continues to beat growth: Model Portfolio July 2014 update

8th July 2014 10:56

by Helen Pridham from interactive investor

Share on

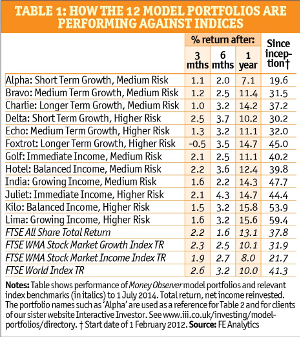

World stockmarkets rose relatively strongly over the second quarter of 2014 thanks to positive economic signals globally and the lessening tensions between Russia and the Ukraine. Beating the share prices indices over the period has therefore been something of a challenge for active investment managers and portfolio builders. All but one of our model portfolios has made positive progress but only one managed to beat the FTSE All-Share index.

Measured from their inception in January 2012 all portfolios bar one made solid progress compared with the previous review, led by the 59.4% gain from the Growing Income Higher Risk version. The Longer Term Growth Higher Risk portfolio fell by 0.5% over three months, but has generated a 45% gain since January 2012 (see Table 1 for further details).

To find out why Newton Asia Income is the best-performing income holding, read: Growth and income portfolios - Leaders, laggards and switches July 2014.

However, the WMA Income and Growth indices are not a direct comparison with our model portfolios as they do not take into account risk or timescales, which we have set out to achieve with all 12 portfolios.

Income Portfolios make hay

Looking back over the last quarter, it was our model income portfolios that once again, on average, made the best progress. One notable feature was the similarity in the outcomes achieved by the medium and higher-risk selections with returns ranging between 1.5% and 2.2%. Indeed, for two of the pairings - Immediate Income and Growing Income - the returns achieved by the medium and higher-risk versions were identical despite their different holdings.

The two Immediate Income portfolios both achieved returns of 2.1%. The medium-risk version was buoyed up by the strong performances of and . Returns on the higher-risk version were boosted by and , with the latter making good progress under its new manager Mark Barnett.

Click here to viewthe constituents and factsheets of all 12 Money Observer Model Portfolios.

Both versions of the Growing Income portfolio returned 1.6% over the quarter. The medium-risk version was held back by a fall in the share price of , partly due to its exposure to medium-sized companies. However, with its long history of increasing dividends, low charges and substantial income reserves, we still think it's a good holding for this portfolio. The main detractor from the performance of the higher-risk portfolio was , which also suffered from its bias towards medium and small companies.

Rather surprisingly, the Balanced Income, Medium Risk portfolio was our top performer in the income category this quarter with a return of 2.2%. It was a welcome development as this has been our weakest income portfolio to date measured by its return since inception. All of its holdings made positive progress, notably Threadneedle UK Equity Income and Artemis Global Income. Meanwhile the higher risk version of this portfolio did less well with a return of 1.5%, held back partly due to its holding in Unicorn UK Income.

.jpg) Growth portfolios mixed

Growth portfolios mixed

The progress of the growth portfolios once again lagged behind the income versions. It was also much more varied, ranging from a fall of 0.5% to a gain of 2.5%. Otherwise returns averaged just over one%. The six medium-risk versions showed most consistency with gains of between 1 and 1.2%.

The most striking result over the quarter came - somewhat surprisingly - from the Short Term Growth, Higher Risk portfolio, which achieved the best return of the quarter across all our portfolios, with a rise of 2.5%. This was despite one of its holdings, , slipping back by 0.5%. Even though it is the higher-risk version, we would not normally expect either of the shorter term portfolios to stand out in terms or either gains or losses. The goal of these portfolios is to make relatively steady progress since there is relatively little time to make up ground if a loss occurs.

What's more neither of the holdings that produced the best gains for the portfolio is particularly high risk. Although it is region-specific, is run on a cautious basis. It has been boosted recently by a resurgence of interest in Asian markets which are now looking better value than stockmarkets in developed economies.

was the other top performer in this portfolio. This investment trust adopts a multi-manager strategy so risk is well spread but in recent years its performance has improved markedly, thanks to a much more active approach by its chief executive, Andrew Bell.

The only portfolio to lose ground slightly over the quarter was the Longer Term Growth, Higher Risk portfolio. However, it could have been worst because four of its seven holdings suffered losses over the period, including technology trust which fell nearly 8%. Fortunately, these losses were offset by strong gains from and . However, as this portfolio is designed for the long term, such short-term fluctuations are not a great concern.