Still more returns to play for in Tactical Asset Allocator

9th July 2014 11:31

by Ceri Jones from interactive investor

Share on

The S&P 500 and Dow Jones Industrial Average indices have moved into record territory this year, and as the bull market rolls on into the summer, steady flows of money are still pushing up US stocks and mutual funds.

The big driver in the US is domestic consumption, which still accounts for 70% of the nation's GDP, and the backdrop for this has improved beyond recognition since the financial crisis. The US consumer has deleveraged, with savings rates rising substantially, and interest rates look set to stay low. Falling unemployment levels, low inflation and energy prices and renewed vigour in the housing market also support consumer confidence.

However, despite the five-year rally in US stocks, annualised total returns are still below historical norms and equity valuations remain inexpensive, so there is every chance the rally will continue to plod along steadily.

European equity highs

Similarly, some European equity benchmarks have also hit new highs, and are trading at a discount to their historical standards. The high level of cash on businesses' corporate balance sheets will enable them to invest in expansion or productivity, or boost dividends or buybacks, driving further gains.

At any rate, these markets require high selectivity, so for our tactical plays we are happy to stay invested in the and the , which follows a group of brokers' best ideas.

Both funds are invested in specific European financial stocks for example, taking advantage of the fact that although banks have deleveraged and restructured and bad historical loans have largely been written off, the sector remains unloved and current valuations do not reflect the improvements that have taken place.

It is also proving an idiosyncratic year in emerging markets, with the fortunes of different nations largely dependent on their governments' policies and initiatives.

The Fragile Five (Brazil, India, Indonesia, South Africa and Turkey) have continued to perform well as they tighten their fiscal policies and improve their current account deficits. India and Indonesia have been particularly successful in reducing their current account deficits and their currencies are bouncing off three years of lows.

China concerns

The big macro concern is China's flagging growth which, according to official data, slowed to 7.4% in the first quarter. However, even the Chinese premier Li Keqiang has said he does not believe the GDP figures, calling them "man-made" and therefore unreliable.

China's slowdown has also been reflected in a sharp dip in new building projects. Meng Yin, vice secretary general of the China Real Estate Research Association Market Committee, has said that the number of new building projects launched between January and May plunged 19% year-on-year, and in terms of floor space, they are down around 22% year-on-year. While the Chinese property market has slowed since 2005, this year's adjustment has been marked by particular supply and demand pressures, she said.

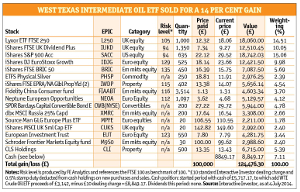

The other prime concern is increased uncertainty about energy security and prices. We bought WTI Oil at the turn of the year. Having made over 14% on the holding, we are now selling out before increased oil supply squashes prices in the longer term.

For some investors, this trend presents an opportunity. Increased supply has been hitting energy company shares and understandably so, but the oil services sector has also been sold down by association, although these services should be in strong demand owing to the increasing levels of technology and services necessary for the extraction of recently discovered oil and gas reserves.

Investors who want to buy into this space have the choice of four ETFs, all listed in the US unfortunately: Market Vectors Oil Services ETF (OIH), , and .