Trust Awards 2014: UK Smaller Companies

10th July 2014 08:54

by Fiona Hamilton from interactive investor

Share on

Winner: Henderson Smaller Companies

Last year the companies at the smaller end of the Numis Smaller Companies index (NSCI) performed better than the larger ones, many of which are in the FTSE 250 index.

This made life tough for , as it has the highest weighting to mid-cap companies in the sector.

Hermon raised his weighting to smaller and AIM-listed companies a little during the year, to 16 and 7% respectively.

However, he did not make big changes, partly because he has more than £700 million under management in UK smaller companies and does not like to limit his liquidity by including too many smaller fry, and partly because he keeps costs down by investing for the longer term. Hence, all the trust's top 10 holdings have been in the portfolio for at least five years.

Hermon expects his low weighting to smaller companies to be less of a handicap this year, on the grounds that they are no longer exceptionally cheap. He is very committed to growth companies and believes it is worth paying up for them.

To make his point, he says the average price/earnings ratio of the trust's holdings at the end of March was 10% higher than that of the NSCI, but the average growth in earnings per share of NSCI constituents was nil in 2012 and 2013, and is forecast to be only 4% in 2014.

In contrast, the average earnings growth for the trust's holdings was 12% in 2012 and 13% in 2013, and is forecast to be 14% in 2014.

The trust's portfolio has a slightly higher overseas exposure than the NSCI, at around 50%, and Hermon considers sterling strength one of his biggest worries. "Sterling appreciation against most currencies is affecting the earnings of a lot of companies and could be a real blow to companies with overseas operations," he says.

He bolstered the trust's UK exposure a little last year by adding some retail and leisure exposure, including , and . He also invested in four new issues, all of which have performed well; but he has not been tempted by this year's initial public offerings.

| Managed by Neil Hermon since 2002 | ||

| Sector | UK smaller companies | |

| Three-year NAV total return | 83.3% | |

| Three-year share price total return | 101.8% | |

| Discount | -12.4% | |

| 12-month range | -19% to -9% | |

| Average for sector | -9.1% | |

| Ongoing charges | 1.09%* | |

| Notes: Figures to 1 April 2014. *Includes performance fee. | ||

| Website: hendersonsmallercompanies.com | ||

He is disappointed that mid-cap takeovers have been sparse recently, but hopes they will emerge later in the year. "The medium to smaller company market has had a fantastic run, and valuations are now fair rather than outstanding," he comments.

As a result, the trust is 9% geared, which is at the middle of its historic range. It is hard to see why the shares of this large and consistently successful trust have one of the highest discounts to net asset value (NAV) in its sector.

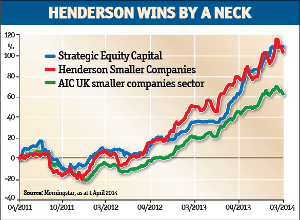

Highly commended: Strategic Equity Capital

Launched in 2005, suffered a near-50% fall in its NAV by the end of 2008 but has recovered impressively. Its NAV returns topped the UK smaller companies sector over the past three years, but it missed the cut in the second year, so it wins our highly commended award.

The trust uses a private equity-style approach to create value from a portfolio of 10 to 15 smaller LSE or AIM-quoted holdings. Companies typically have a market capitalisation of less than £150 million at the time of purchase, are doing well in a growing niche market and have a strong balance sheet.

The management group encourages them to use this to increase dividends, return capital to shareholders or make earnings-enhancing acquisitions.

The skills of the trust's management team are critical to such a proactive investment approach. However Adam Steiner, who was one of the co-managers from launch under SVG, recently departed, due to disagreements over changes at the management company, which has been taken over by a Swiss-based holding company and renamed GVO Investment Management.

The trust's board is satisfied that Steiner's departure was not connected to the day-to-day running of the portfolio and welcomes the fact that Stuart Widdowson, who worked alongside Steiner from 2006, remains in charge. Having previously spent five years at HgCapital, a highly regarded private equity manager, he has the right credentials to manage Strategic Equity Capital. His co-manager, Jeff Harris, joined GVOIM in 2012.