Trust Awards 2014: Europe

10th July 2014 09:43

by Fiona Hamilton from interactive investor

Share on

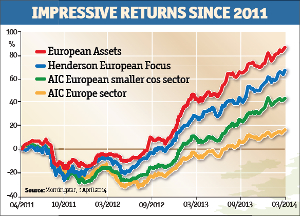

Winner: European Assets

F&C Asset Management's Netherlands-based has one of the tightest discounts to net asset value (NAV) in the two Europe sectors, partly because it has much the best three-year NAV returns, and partly because it offers the highest yield.

Each year's dividends are set at 6% of the opening NAV per share, and they have increased by 14.9% annually over the past five years.

However, investors should note that they are funded mainly out of capital. That means dividends will fall if NAV per share falls, and they are also vulnerable to a deterioration in the euro/sterling exchange rate.

He believes this is "the best way to achieve good capital growth over the long term, but also to preserve capital during more difficult times". Gearing tends to be modest, which also limits the downside risks.

Buying quality businesses whose share prices plummeted in 2011/12 because they were in out-of-favour countries or sectors worked particularly well.

But his wariness of investing in cyclical businesses meant returns were only just ahead of the trust's benchmark index in 2013. He warns that the trust is likely to lag when lower-quality stocks are in the ascendant.

Cosh says there has been no clear pattern of leadership in Europe so far in 2014. In his view neither financials nor peripheral markets look obvious bargains any longer. However, he notes that a growing preference for companies focused on European rather than global sales is favourable to smaller companies.

| Managed by Sam Cosh since October 2011 | ||

| Sector | European smaller companies | |

| Three-year NAV total return | 62.6% | |

| Three-year share price total return | 85.3% | |

| Discount | 0.1% | |

| 12-month range | +7% to -1% | |

| Average for sector | -9.0% | |

| Ongoing charges | 1.71% | |

| Notes: Figures to 1 April 2014. | ||

| Website: europeanassets.eu | ||

"Following their spectacular recovery, European smaller company shares are no longer as cheap as they were two years ago," he warns. "We need to see companies delivering a lot of earnings growth for the market to go forward from here."

He thinks this is achievable, however, since European company earnings are generally still well below previous peak levels, whereas in the US they have broken through to new highs.

He expects smaller companies to continue to outperform over the long term mainly because they have better growth prospects, and also because they are more likely to be subject to takeovers. As for Europe, he says: "It still looks good value in comparison to other parts of the world."

Highly commended: Henderson European Focus

Investors in the former Gartmore European Trust have been well served since John Bennett took charge in December 2010 and persuaded the board to let him manage it along similar lines to his open-ended fund.

Renamed , it has pulled well ahead of the other mainstream trusts over the past three years and its share price returns have been further enhanced by the virtual elimination of the discount to NAV.

Bennett boasted 17 years as a successful fund manager at GAM prior to joining Gartmore and then moving to Henderson. He likes a high-conviction approach, so his open-ended fund has only 40 holdings.

The trust's board felt this would be too risky for a core European fund, so Bennett agreed to target around 60. This allows him to include some companies which would be too small and illiquid for the open-ended fund.

As a value-oriented investor, Bennett believes in taking big long-term positions in unloved sectors. For the past three years he has had more than 30% of the portfolio in pharmaceuticals, which has worked out well, and he expects the theme to remain rewarding for some years.

His second main focus has been financials, in particular domestic banks in weaker parts of the region.

A third theme is "smart cars" by which he means companies such as Valeo, and Continental, which draw a significant portion of earnings from supplying parts to help make cars more fuel-efficient and safer. When the market wakes up to this potential, the trust will benefit.