Funds Premier League: July review

10th July 2014 15:44

by Rebecca Jones from interactive investor

Share on

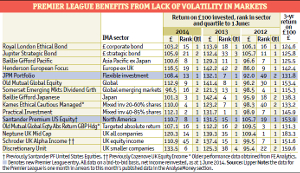

Money Observer's Premier League of top-performing funds is in fine form as we come to our quarterly review. Since our last review in May only two sectors have seen changes: flexible investment and North America.

This consistency serves to highlight the robust selection process behind our Premier League, which identifies the best funds within each of the Investment Management Association's (IMA's) 15 most-popular sectors.

To gain a place in our league, a fund must have first delivered three consecutive years of top-quartile performance. It should also be widely accessible, hold at least £10 million of assets and have had the same managers at the helm for three years.

Long-term players

Since the full review of our Premier League funds in November 2013, eight members have remained unchanged, with consistency distributed across a broad range of sectors. These include Japan and global emerging markets, both of which suffered from a negative shift in sentiment leading to sharp sell-offs between late 2013 and early 2014.

Within these sectors and , both of which are Money Observer Rated Funds, have been shining lights among their peers.

The former, managed by Sarah Whitley and Matthew Brett, is the fifth best-performing fund in the IMA Japan sector between 1 June 2013 and 1 June 2014, returning 1.31% compared to an average loss of 3.63% from the sector as a whole.

Somerset Emerging Markets Dividend Growth also held fast during the US tapering-fuelled sell-offs seen in emerging markets during June 2013 and January 2014. It lost just 3.5% compared to a loss of over 6% from its sector, IMA emerging markets, between 1 June 2013 and 1 June 2014.

According to manager Edward Lam, the recent success of the fund is largely due to a decision to switch to stronger, lower dividend-paying stocks at the end of 2012.

"Dividend yields are an important criterion, but having a high dividend is not a substitute for good long-term management," he says. Lam also received a Money Observer 2014 Fund Award in June when his fund was named best larger emerging market fund.

Fixed-income stars

Our two Premier League bond funds, and , have also retained their positions as top dogs within the IMA sterling corporate bond and IMA sterling strategic bond sectors since November, defying the uncertainty that has plagued fixed-income markets over the past year.

In the 12 months to 1 June, RLEB delivered returns of 3.2% compared to 2.3% from the IMA sterling corporate bond sector and 3% from its benchmark, the iBoxx Sterling Non-gilts All Maturities index.

The Money Observer Rated Fund is managed by Eric Holt, who picked up two Money Observer Fund Awards in June: best ethical/SRI bond fund for RLEB and best larger UK bond fund for his .

While the bond market has been tough of late, Holt says he is still finding good opportunities, such as a recently purchased 100-year bond from EDF. "I don't like paying for liquidity I don't need. This bond was a wonderful opportunity," he says.

Fellow Money Observer Rated Fund Jupiter Strategic Bond has also performed well recently, returning nearly 6% between 1 June 2013 and 1 June 2014 compared to 4.2% from its sector, IMA sterling strategic bond.

Managed by Ariel Bezalel since launch in 2008, the fund is also a consistent long-term performer, returning 86% over five years compared to 57% from the sector.

Bezalel attributes his success to the time spent meeting and researching the companies he invests in. "I look for companies with robust business models, competent management teams, and then I hold them for the medium to long term," he says.

Seasonal-transfers

However, the Premier League has not been without a few transfers this season. The sector to witness the most change is Asia Pacific ex Japan, which has seen a new champion in every quarterly review except this one.

However, this is perhaps unsurprising in a sector that has swung between losses of 7% and gains of 4% on a month-by-month basis since November.

The UK smaller companies sector welcomed a new incumbent in February, when Neil Hermon's was replaced by , while replaced in the global sector.

In May we said goodbye to in favour of Money Observer Rated Fund , managed by John Bennett.

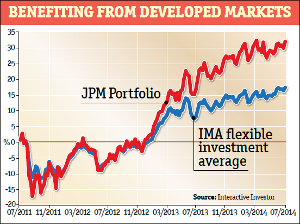

This quarterly review, we have seen two new entrants to the Premier League in the flexible investment and North America sectors, which had previously been untouched since November. In the former, replaces Money Observer Rated Fund , managed by Alex Grispos.

New fixtures

This is a technical call, as CF Ruffer Equity and General is still a strong performer, having returned a top-quartile 6.8% in the 12 months to 1 June compared to 3.8% from the IMA flexible investment sector.

However, Ruffer has now imposed a mandatory 1% initial charge on new investments into the fund, which unfortunately means exclusion from the Premier League.

The next qualifier in the sector is, in fact, another Ruffer fund, . However, as it is focused solely on one region, we felt it was not the best representative of the sector.

Hence JPMorgan Portfolio, managed by Joe Cummings, takes the crown this quarter, due in no small part to its impressive 8.4% return in the 12 months to 1 June.

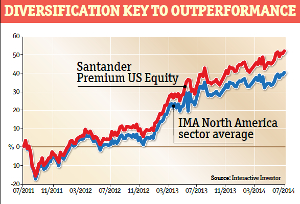

In the North America sector, has been replaced by , as the former's performance slipped to third quartile in the year to 1 June, with the fund returning 5.3% compared to 6.7% from the sector. That's good, but not good enough for the Premier League.

Whether these two new funds will last the course until our full review in November remains to be seen, however, given the Premier League's strong track record for consistency.

New entrant flexible investment

JPMorgan Portfolio

- Manager: Joe Cummings

- Fund size: £ 60.5 million

- OCF: 2.21%

- Return on £100 three years to 1 June: £131.80

What has driven performance?

"However, the balance of risks has shifted since the turn of the year; while 2013 was euphoric for developed equity investors, 2014 looks more muted."

New entrant North America

Santander Premium US Equity

- Manager: Toby Vaughan and Tom Carrick

- Fund Size: £135 million

- OCF: 1.04 per cent

- Return on £100 three years to 1 June: £153.90

What has driven performance?

Vaughn: "We see two key factors in our investment process: targeted stock selection and a carefully managed risk strategy to ensure controlled value generation on a consistent basis.

"Diversification, leading to very attractive risk-adjusted returns, and carefully researched stock selection across a number of industries were key to our performance last year."