Trust Awards 2014: Japan

11th July 2014 09:11

by Fiona Hamilton from interactive investor

Share on

Winner: Baillie Gifford Shin Nippon

John MacDougall has been manager of for the past seven years. After a shaky start, he has performed impressively.

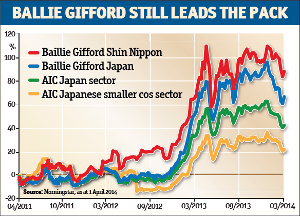

The trust's net asset value returns are the best of any Japanese trust over three years - and over five years - and way ahead of its benchmark index. It therefore retains this award.

MacDougall invests in small companies, with (sterling converted) market capitalisations typically of £350-£500 million. He reckons there are around 2,500 Japanese companies in this universe, but more than 2,000 of them are too stodgy or illiquid to be of interest.

MacDougall favours companies that should grow regardless of the fortunes of the Japanese economy, either by creating new markets (for example, the e-commerce companies he has a sizeable exposure to) or by stealing market share from inefficient incumbents. One of his main themes is "internet everywhere".

The service sector is another important focus. Holdings include the largest operator of care homes for the elderly in Japan and the leading operator of childcare facilities.

A third preoccupation is global leaders. Holdings consistent with this theme include Asics (ASCCF), which makes high-quality running shoes, and robotics company Nabtesco.

Some global investors appear to have lost confidence in the ability of the Japanese prime minister, Shinzo Abe, to galvanise the Japanese economy, but Baillie Gifford's Japan team believes his efforts are still on track. They liken the reforms he is undertaking to Margaret Thatcher's overhaul of the UK economy, and warn that they will take time to gain traction.

MacDougall sees encouraging signs. He says: "Inflation is up to around 2%, a sales tax increase has been pushed through to help deal with government debt, companies have been starting to increase their basic wages, and negotiations over free trade with the US appear to be progressing.

"Some people have got bored waiting for progress and sold out of Japan. But Abe has done well, given how hard it is to change things in Japan. I am particularly encouraged by his enthusiasm for the new economy and the entrepreneurs who have pioneered it."

| Managed by John MacDougall since April 2007 | ||

| Sector | Japanese smaller companies | |

| Three-year NAV total return | 72.8% | |

| Three-year share price total return | 88.9% | |

| Discount | -2.5% | |

| 12-month range | -9 to +9% | |

| Average for sector | -6.4% | |

| Ongoing charges | 1.24% | |

| Notes: Figures to 1 April 2014. | ||

| Website: shinnippon.co.uk | ||

He adds that one reason for this year's weakness in the Tokyo stock market has been downbeat company forecasts following the rise in sales tax.

However, Japanese companies tend to err on the side of caution, and he expects them to raise their forecasts later in the year. "Things got a bit hot in late 2013 and there was a bit of profit-taking, especially in internet-related sectors," he says. "That was a healthy correction."

He expects the recovery to be bolstered by Abe's moves to ensure Japan's massive government pension investment fund increases its exposure to equities, particularly Japanese shares.

Higly commended: Baillie Gifford Japan

Lead manager Sarah Whitley, the longstanding head of Baillie Gifford's Japanese team, is almost always optimistic about prospects for portfolio. As a result, the trust is generally among the most highly geared in its sector, which has boosted its performance in rising markets.

She is an astute stockpicker, which has further enhanced its results in good times and helped mitigate setbacks.

The trust invests mainly in small to medium Japanese companies, but it does not venture as far down the size spectrum as category winner Baillie Gifford Shin Nippon and can include larger companies if they offer the best value.

For this reason, its overseas exposure via multinationals and exporters is currently around 55%, whereas Shin Nippon's is only 35%. This leaves it more sensitive to global trade conditions and fluctuations in the yen's value.

Nearly half the portfolio is invested in companies Whitley classifies as "secular growth stocks". These includes Fuji Heavy Industries and Softbank Corp. A quarter is in "cyclical growth companies" such as Toyo Tyre & Rubber and Mazda.

Fifteen% is in "growth stalwarts" such as KDDI, which specialises in fixedline and mobile telecommunications, and Mitsubishi UFJ Lease & Finance Company. The balance is in special situations, such as Tokyo Tatemono, a real estate company.