Shares to buy, hold and sell

11th July 2014 12:27

by Rebecca Jones from interactive investor

Share on

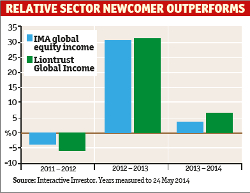

is the highest-yielding fund in the IMA global equity income sector at 4.6%, returning 30.2% over the past three years, compared with 28% for the sector.

Rebecca Jones asks co-manager Samantha Gleave which shares she is buying, holding and selling.

Buy - Banco Santander

The purchase of Spanish bank marks a new chapter for Liontrust's Global Income fund, which prior to its switch into the IMA global equity income sector last August had no exposure to banks and only 17% of its portfolio invested outside the UK.

Despite the previous exclusion of banks from the fund, Gleave claims that Santander fulfils the fund's two most important investment criteria: strong cash return on capital and an attractive free cash flow yield - a measure of how much "free cash" (after capital expenditures) a company is expected to earn per share.

Gleave says that Santander, like other banks in the region, is also showing some "tentative signs of improvement" in terms of strengthening its capital base and selling down bad loans.

"We bought Banco Santander because the dividend yield, currently over 8%, is attractive for the portfolio. The company is also engaged in quite a significant cost savings plan; it's targeting €1.5 billion (£1.2 billion) of savings by 2016 and half of that is to be achieved by the end of this year," she says.

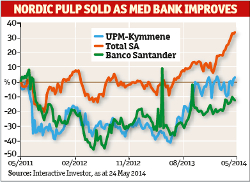

Hold - Total

Like Santander, French oil and gas company scores well on Gleave and Inglis-Jones's two main criteria, demonstrating a strong free cash flow yield of over 14% at the point of investment alongside a dividend yield of 6%.

As Gleave explains, Total has been unloved over the past few years due to its high level of capital expenditure, which has led to volatility in its share price and no real growth in the dividend. However, following assurances from the company that expenditure would peak in late 2013, Gleave and Inglis Jones bought in.

"When Total moved into the global sector last summer we were able to increase our weighting in the company, and it's probably been one of the best performers in the fund since then. Management has stepped up its strategy of selling non-core assets and as new projects go into production phase the cash flow will be boosted by production growth and by capex falling," she explains.

However, while Gleave is happy to hold the position and expects free cash flow to boost dividends, she has no immediate plans to buy any more stock, as the dividend yield has fallen back slightly to 5%.

Sell - UPM-Kymmene

Gleave and Inglis-Jones recently sold down their holding in Finnish pulp, paper and timber manufacturer UPM-Kymmene, one of the fund's more unusual stocks, after a period of strong performance.

"We bought UPM-Kymmene for the fund with a dividend yield of over 6% and really, it was a bit of a contrarian value purchase," says Gleave, explaining that although the company faced a difficult trading backdrop of falling paper prices, she was impressed by the management's determination to generate cash by cutting costs and selling non-core assets.

"We saw some progress on that in 2013, and the company delivered on its dividend and the shares performed very well; so our decision to sell was a case of us taking profits. The yield has now come back in to around 4.7%," says Gleave.

UPM-Kymmene's share price has continued to make steady gains, rising 178% from its five-year trough of €4.66 in mid-2009 to €12.97 in May this year; however, Gleave is confident in her decision to sell down her position. "We do have a very rigorous and disciplined approach to selling," she explains.