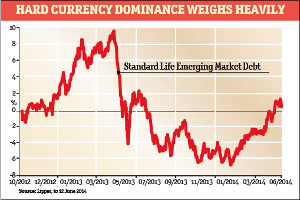

Fund profile: Standard Life Emerging Market Debt

16th July 2014 10:04

by Rebecca Jones from interactive investor

Share on

Money Observer Rated Fund is an interesting option for those looking for the superior yield available from emerging economy debt but wanting to play it relatively safe in hard currency.

Managed by Richard House, assisted by Nicholas Jaquier, the fund has 89% invested in US dollar bonds.

The remaining 11% is spread across debt denominated in the Mexican peso (the highest weighting, at 3%), Indian rupee, Kazakhstan tenge, Malaysian ringgit, Philippine peso and Brazilian real (at 0.2%).

Jaquier says this is largely due to the fund's underweight to the Brazilian real and overweight to the Mexican peso, a country and currency he favours for its government reforms and an upturn in sentiment.

Like most of its peers in the emerging market debt sector, the Standard Life fund has lost value over the past year: it is down 2.5% over the period and has a second-quartile ranking. Hard currency holding dominance has meant it's at the bottom of the income pile, yielding 3.4%.

In contrast, and local currency bond funds each yield more than 6%.