Fund profile: Pan European Property

17th July 2014 09:28

by Faith Glasgow from interactive investor

Share on

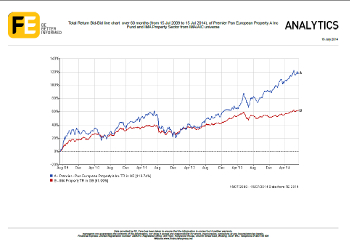

Whether you look at its performance in absolute terms or relative to the IMA property sector, the , managed by Alex Ross, has had an outstanding five years. Over both one and three years to 11 July it has returned more than triple the sector average, and it's up 126% over five years against the sector's 48% gain, with net income reinvested. The fund currently sports a net yield of 2.3%.

What has been driving this outperformance, and how likely is it to continue?

Ross's fund invests in the shares of property companies rather than directly in bricks and mortar, so it is influenced by the fortunes of the stockmarket as well as the property market. "Investing in quoted property companies makes the fund more volatile because the shares are repriced every day, unlike real estate; but the payoff is that there is potential for substantially higher returns," says Ross.

That's because institutional investors such as insurers and pension funds have become keen to shift their asset allocation away from government bonds that fail to keep up with inflation, in favour of their (currently very small) asset allocation towards real estate, which much pays a much better yield and offers inflation protection. Property companies have therefore been able to issue five to 10 year corporate bonds at fixed rates of just 1-2.5%, using the cash they raise to invest in prime properties on long leases yielding around 6%, which as Ross observes is "very earnings-enhancing".

European insurers are faced with government bond yields even lower than those in the UK, so they are particularly hungry to increase their property exposure. He gives the example of insurer Allianz, which last year announced the doubling of its real estate allocation from 7 to 15% - amounting to around €15 billion (£8.76 billion) of investment.

Specialist property

Institutional investors are mostly only interested in long, secure leases of 10-15 years on prime properties - but says Ross, "in the UK the average lease length these days is 5.75 years, so long leases are very rare, and very hot." He therefore prefers to look outside the overheated London prime market, focusing instead on specialist property companies operating in the provincial property market, where capital values are finally rising for the first time in seven years as a result of the changing investment dynamics.

These smaller outfits - for example , , - provide hands-on active management, aiming to turn secondary assets into highly desirable prime properties. That's achieved through, for example, changing their planning use, improving the quality of the tenants or negotiating lease extensions. "We have a third of the fund in these property companies," he says.

The changing nature of demand is one aspect of the strength of the current commercial property market, but the supply side is important too. "Unlike past bubbles, the 2007-09 crash was not dogged by over-development because credit was pulled by the banks so early on - so we've had seven years with no development finance, and very little development as a consequence," explains Ross.

"In central London vacant Grade A office space now stands at less than 4%, so we're seeing rental growth; moreover, 5% of stock has been converted to residential over the past five years because it commands a higher value. So we're facing an extraordinary lack of supply, plus a squeeze in demand," he adds. That's all the stronger as firms start to put into action the office moves they have put off in the past few uncertain years. As a consequence Ross anticipates a 10% rise in rental levels this year.

Schemes are once again starting to be built in London, but Ross believes the current imbalance will last several years. "By 2018 we could see it becoming more of a tenant market - at the moment it's absolutely a landlord market."

Nor are these dynamics confined to London: Paris, Berlin, Munich Oslo, Helsinki, Stockholm and Geneva are experiencing similar markets, he says.

The Pan European fund currently holds around 35% in regional UK specialists that are focusing on transforming secondary assets into prime holdings. It has a further 15% in property companies operating in fringe central London such as St Catherine's Dock and the Tech City corridor between Kings Cross and Old Street, where Ross expects to see the strongest rental growth on the back of the supply/demand imbalance.

The other half of the fund is spread across companies involved in similar situations in northern Europe, primarily Germany and France, with 5% in Scandinavia and a similar amount in Switzerland.

But Ross emphasises that he is very disciplined in his approach to owning these companies, selling without compunction when shares hit their price target and buying back on market dips such as the recent mid cap sell-off. "The beauty of market volatility is that it provides those opportunities," he says.