Which countries should investors look to for dividend payouts?

25th July 2014 09:00

by Rebecca Jones from interactive investor

Share on

Global companies are increasingly paying high dividends, as factors such as favourable tax regimes, increasing pressure from domestic and foreign shareholders and rapid sector privatisation take effect, even in regions where dividend income was previously almost unheard of.

In many of the so-called Anglo-Saxon markets - particularly the UK and Australia - companies have a longstanding history of paying consistent and increasing dividends to shareholders. UK firms currently pay an average of 52% of their earnings to shareholders, and Australian firms pay more than 70%.

The picture is slightly different in the US, where companies prefer to reward shareholders through price-boosting share buybacks - a practice that shows no sign of abating. The value of buybacks hit $448 billion (£266 billion) among S&P 500 firms in 2013, the highest level since 2008.

.jpg) US income opportunities

US income opportunities

However, as Dan Roberts, manager of and funds, observes, this doesn't mean there are no income opportunities in the US.

He says: "At the end of October 2013, the 15-year average dividend yield in the US market stood at 1.8%, which is down on 3.4% in the UK and 2.6% globally. However, around 50% of dividend 'aristocrats' globally can be found in the US market. Companies such as Kimberly-Clark have an excellent track record of returning cash to shareholders."

European companies have historically been poor dividend payers, with the average firm returning just below 50% of its earnings to shareholders since 2004, although this has improved significantly over the past five years as companies have tried to entice investors with higher dividends.

Looking further afield, Japanese companies have tended to be unattractive for income investors, as they have been inclined to hoard cash rather than pay dividends.

In many emerging markets, particularly in China and South America, dividends were unheard of until quite recently, not least because firms in these regions have tended to be state-owned in the past.

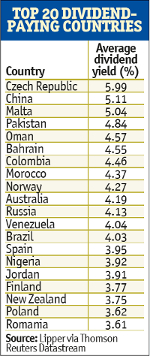

However, the global income picture is changing. According to data obtained from Thomson Reuters' Datastream service, regions that have historically been off the dividend map are now some of the highest-yielding on the globe.

These include China, which is currently paying the second-highest average dividend globally, at 5.1%, and a number of previously non- or low-yielding South American countries such as Columbia, Venezuela and Brazil.

The top 20 is also littered with South Asian, Middle Eastern and African frontier markets, including markets in Pakistan, Bahrain, Oman and Morocco, all of which yield more than 4%. Eastern Europe is also prominent.

Much of this can be explained by the economic changes that have taken place in many of these countries over the past 20 to 30 years. Changes in China typify the trend. The country switched from having a closed communist economy to an open semi-capitalist one where vast privatisations were undertaken and floods of foreign investment allowed in.

He says: "Ten years ago, it was not unusual for Asian companies to take significant leverage on their balance sheets to fuel growth. In recent years, firms have placed more emphasis on dividend payments, as returns on equity have expanded and the need for capital expenditure has fallen."

However, according to Matthew Beesley, head of global equities at Henderson, in some cases headline yields can be misleading, particularly in small markets where one or two companies can skew the average.

He claims that this is almost certainly the case in the highest-yielding region, the Czech Republic. There the 6% average yield is almost entirely due to utilities company Cez's 7% yield, as the company accounts for 22% of the Czech market.

Of course, many of these regions will also be yielding more due to their risky or stagnant economies; arguably, risk accounts for much of the yield in regions such as Russia and Nigeria, where political and economic uncertainty is rife and underlying share prices are depressed.

However, high yields can also reflect a strong dividend-paying culture as seen, for example, in much of the Middle East. James Davidson, manager of , observes that sometimes a large yield "can be a genuine undiscovered opportunity".

Accessing global dividends

If you would like to access a high-yielding foreign market, a global equity income fund offers diversified access to different markets and opportunities for both income and capital growth.

For those wanting to merely dip their toe abroad, may be suitable. Over the past 12 months, managers James Inglis-Jones and Samantha Gleave have significantly increased their global exposure - although 58% of the fund remains invested in the UK.

The fund's second-largest weighting is in Europe, at 23%. The remainder is allocated to the US, Asia Pacific and South Africa. The fund yields an impressive 4.5% - the highest in its sector.

, a Money Observer Rated Fund, is a particularly good option for those interested in Europe, as 46% of the portfolio is allocated there. In part, this reflects manager Jacob de Tusch-Lec's tendency to evaluate dividends based on a region's government bond yield - known as the risk-free rate - and only invest when equities are better value.

Trading stocks internationally

If you want direct access to foreign stocks, Alastair George, investment strategist at Edison, recommends starting with those that have a dual-London listing, such as or , which are large components of the Australian market.

However, de Tusch-Lec is quite sceptical about emerging markets. He claims company valuations are not yet "humiliated enough" to compensate investors for the risk they are taking in these markets.

If you want more exposure to the US, Fidelity Global Dividend and JPMorgan Global Equity Income have the bulk of their portfolios invested there. Meanwhile, within , run by Stuart Rhodes, Australia is overweight against the benchmark average.

For the more adventurous investor, an emerging market income fund such as , which has more than 50% invested in Asia and is currently yielding 4.7%, or on a yield of 4.2%, could be attractive. The former was the best-performing holding in our model growth portfolios over the last quarter.

A few dividend-paying funds and investment trusts invest in a single country - , managed by the highly experienced Hideo Shiozumi, being one example.

Alternatively, a global exchange traded fund - essentially a listed index tracker - is a cheap way to gain exposure to foreign markets and indices, with annual charges averaging around 0.30%.

Income-oriented ETFs available to UK investors include the , which invests in more than 1,000 different stocks worldwide, and the , which invests in the 30 highest dividend-paying stocks in the Asia Pacific region. Both yield more than 4%.

Global or regional funds, which are usually diversified and run by experienced managers, do reduce the risks associated with less mature economies. However, as Beesley observes, moving outside the UK will almost always carry extra risk, if only in terms of currency.