How to handle Russia and the crisis in Ukraine

25th July 2014 17:27

by Lee Wild from interactive investor

Share on

Five months after the crisis erupted in Ukraine, the threat to regional stability and economic recovery is greater than ever. Yet, the very real possibility of further hard-hitting sanctions, and the chance of a proxy war fought by NATO and Moscow has failed to dent stockmarket optimism. Of course, that could all change very quickly, leaving investors with little time to react. They currently have two options - do nothing, or run for the hills. But which one should they choose?

President Putin's annexation of the Crimea caused little more than whimper in the west, but the downing of Malaysian Airlines Flight MH17 with a Moscow-made BUK missile is a game-changer which will require far more punitive measures. Politicians are voting on wider economic sanctions, and a Bloomberg survey suggests most economists reckon the Americans will impose tough measures on Russian industries. Even Germany, heavily dependent on Russian gas, is coming round to the idea.

It seems impossible that a weapons embargo would not form part of any action. Banks and energy companies would be hit, too. Many of Putin's cronies are already under travel bans and assets have been frozen. But sanctions already in place could wipe out economic growth in Russia almost completely this year. The International Monetary Fund (IMF) predicts GDP growth of just 0.2% in 2014, down from 1.3 previously, and only 1% next year.

"Risks of an oil price spike are higher due to recent developments in the Middle East while those related to Ukraine are still present," said the IMF.

But historically, sanctions have had questionable impact on the behaviour of rogue states, a fact Putin has been keen to press home. "They usually have a boomerang effect," he said recently in Brazil at a summit with fellow BRIC nations. Few disagree.

History lesson

While we can't predict the exact outcome of this conflict with any accuracy, a flick through the history books gives us a pretty good clue how financial markets could behave.

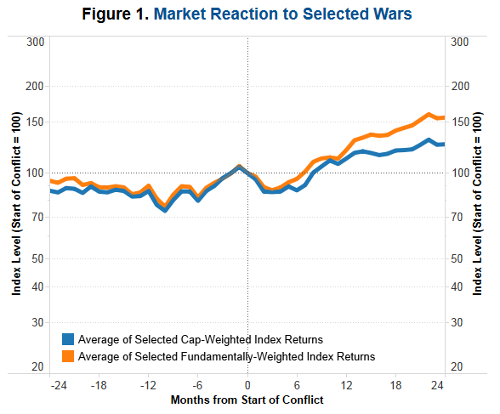

"When regionally contained wars break out, the negative impact is sharp but relatively short-lived," say Research Affiliates, an American team of analysts that has conducted an in-depth study of six carefully selected modern-day conflicts, with potentially dangerous stockmarkets.

They picked the US market response to the beginning of the Gulf War in 1990; NATO involvement in the Bosnian War in 1994; Indian market response to the Kargil War between India and Pakistan in 1999; Russian market response to the start of the Second Chechen War in 1999; the Cambodian–Thai border dispute in 2008; and the Russian market reaction to the Russo–Georgian war in 2008.

Source: Research Affiliates, LLC

In this chart, the cap-weighted indices represent pro-cyclical investing and fundamentally weighted strategies stand for countercyclical strategies.

"On average, the markets we studied rose in the six months of sabre-rattling that preceded the start of the military campaigns," say the report's authors, Philip Lawton, Noah Beck. "The markets fell sharply in the first two or three months after the beginning of the conflict."

They remained depressed for as long as six months after war began, but by month eight had fully recovered. "When prices recovered, the fundamentally weighted index smartly outpaced the cap-weighted index," said Lawton and Beck.

"After an average loss of 14% in the first three months of the conflict, procyclical and countercyclical investors alike may be powerfully inclined to pull money out of the country. But stocks sell at attractive prices in markets driven by fear.

"The subsequent outperformance of the fundamentally weighted index results from its systematically contrarian action in increasing exposure to stocks that have dropped in value. Fundamentally weighted strategies have the built-in discipline to buy low and sell high dispassionately."

"From a strictly financial perspective, withdrawing assets from Russia might not be the right move."

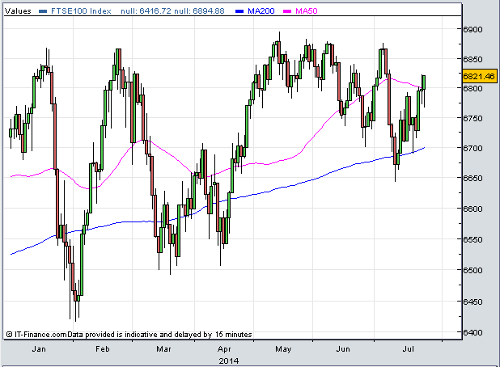

Moscow's reaction

Moscow's main financial index - Micex - fell 18% between mid-February and mid-March, but by June was back above 1,500. No other global stockmarket did better. Understandably, the escalation of events since the downing of flight MH17 has caused a pullback, but only to 1,400 despite the increasing threat of an escalation of hostilities, both military and financial.

"Most of these major geopolitical events do eventually pass even if concerns heighten so maybe the market is correct to be relatively sanguine," muses revered Deutsche Bank strategist Jim Reid. "In my mind the market is not assigning a high enough probability of this situation escalating to uncomfortable levels but the reality is the most likely outcome is that it doesn't."

And Mr Reid has more words of wisdom for the financial community:

"Therein lies the dilemma of investing. Do you position for the most likely outcome along with the crowd or do you stand more alone and position for the lower probability but higher impact outcome. Over a career you'll probably get higher overall returns with the latter strategy but you may have more uncomfortable moments explaining and surviving frequent small under-performance. Also trading liquidity is shallow enough at the moment, especially in assets like cash credit, that it doesn't necessary pay to try to capture short-term moves. So we're not changing our recommendations at the moment but it's fair to say we feel uneasy at developments over the past few days"

That level of concern is clear over at the German bank's asset management division. Asoka Wöhrmann, chief investment officer at Deutsche Asset Management, reckons it will take more to derail world stockmarkets, but admits that problems could be brewing.

"We expect equity markets to react to a series of events rather than to single events, but it's clearly getting worse and volumes are low in the summer," says Wöhrmann. "One of the biggest concerns is the impact on European earnings as a lot of companies are exposed to Russia."

Interactive Investor's own head of derivatives, Mike McCudden, is nervous. "With no sign of positive news flow from the Ukraine and Gaza we should expect to see some sharp moves lower in the days and weeks ahead," he says.

Luxury stores in London's West End are already feeling the pressure as big-spending Russian oligarchs suspended shopping trips to the capital. Russian tourists in Europe spent 13% less in June, according to tax refund firm Global Blue, and that was before the MH17 incident. This month will likely be much worse.

And among the listed companies, there are many with exposure to Russia. According to its annual results statement, can maker generated £242 million of sales in Russia last year, more than 6% of all revenue. Its shares have eased off recently, but it's well-diversified and it can wear some losses there if need be.

But few would be immune if the west ratcheted up sanctions against the Russian bear and the sirens sounded. Retailers, airlines, banks, oil companies like (its tie-up with Rosneft is clearly a risk), miners ( has a stake in aluminium business Rusal and a grain business in Ukraine), and exhibitions business which does work there.

And on the Continent, an expert at the German Chambers of Industry and Commerce (DIHK) told newspaper Rheinische Post that almost a quarter of German export companies is affected by sanctions imposed by the US and the European Union on Russia. True, they're likely more exposed than UK exporters, but not by much. In 2013, the UK shipped over £5.2 billion of goods to Russia, about 1.7% of exports.

If the worst happens, all bets are off. But both sides will be keen to resolve the problem in Ukraine before then. There may be some temporary pain for investors while we reach that point, but as Mr Reid says "it doesn't necessary pay to try to capture short-term moves."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.