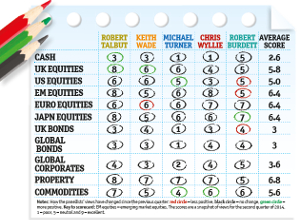

Asset allocation panellists bullish on US stocks

30th July 2014 12:14

by Jim Levi from interactive investor

Share on

The US stockmarket continues to defy gravity. The NASDAQ 100 index in particular - which includes such frighteningly successful technology companies as , and - has performed better than any major market in the past year, up 31.5% at the time of writing. Meanwhile, the S&P 500 keeps breaking into higher ground. How much longer can this go on?

This question, of course, has wider implications. As Chris Wyllie pointed out last time: "If US markets start to fall, the chances are all other equity markets will go down."

Find out why Rob Burdett still finds Europe's recovery "quite precarious" in: Support for European stocks wanes while Japan finds favour.

Mixed signals

On this issue we continue to get mixed signals from the panel. Back in May two members (Robert Talbut, chief investment officer at Royal London Asset Management, and Rob Burdett, co-head of multi-manager funds at Thames River Capital) had both moved up their US equities scores in anticipation of the market going still higher.

Talbut remains "pretty optimistic". He expects a decent growth performance for the economy in the second half of the year. "Against that background US equities, and equities generally, can continue to do well," he says.

"We don't want growth to be too strong, though, as that would lead to higher interest rates coming sooner." He keeps his score unchanged at six.

Others share Talbut's concern about US growth becoming too exuberant. Michael Turner, head of global strategy and asset allocation at Aberdeen Asset Management, points out: "Sensitivity to interest rate rises in the US economy is still very prevalent.

"Levels of household debt in relation to incomes remain way above levels they were 10 or 15 years ago. So the authorities have to be careful they don't kill off the recovery when rates do start to rise."

Wyllie has for some time remained underweight in the US. Now he says: "I am more confident about that view in the longer term than I am in the short term - which I suppose means that I would like to move my score on US equities up from three to four - but I probably should not."

US underestimated

Turner was in the same underweight camp as Wyllie, but he admits his call on the US "has not been the greatest on earth". He reckons it is easy for us in Britain to underestimate the "cult of the equity" among Americans.

"When interest rates are rock bottom and bond yields are negligible, we in the UK scramble around looking for that extra 1% on our cash, while in America they just go out and buy stocks," he says.

"I am going to raise my score from four to five - really only reflecting the fact that the market may still keep going up but not as much as other markets."

Of course, the negative noises about fancy valuations on US stocks will eventually prove justified. And to emphasise that point, Burdett - previously the most bullish on the US in the short term - has now turned cautious.

The five panellists

Chris Wyllie is the former chief investment officer at Iveagh Private Investment House. He is shortly expected to announce a new post at a leading discretionary fund management group.

Rob Burdett is co-head of multi-manager funds at Thames River Capital, with £1.5 billion under management. It is a largely autonomous business within the F&C group, managing funds of more than £100 billion.

Michael Turner is head of global strategy and asset allocation at Aberdeen Asset Management, with £330 billion under management.

Robert Talbut is chief investment officer at Royal London Asset Management, with £75 billion of assets under management.

Keith Wade is chief economist and strategist at Schroders, which has £268 billion of assets under management.

He has lowered his score from seven to five. Like Turner, he thinks the Wall Street party is not yet over, but sees more potential elsewhere.

Wade is staying overweight in the US at six. "We were never that concerned about US share valuations being stretched, but we had been concerned about earnings growth," he says. "Now some earnings growth has come through. US markets have not disappointed in the last three months."

Government bonds

The surprise of the year in financial markets has been the way government bond markets have performed. Yet to a man, our panellists have been underweight in both UK bonds and global bonds. Average scores remain at three in both categories.

"Bond yields have drifted down this year, so we all got it wrong at the beginning of the year," Chris Wyllie admits. "People have been worried at the prospect of deflation not just in Europe but in the US, prompted by the weak performance there because of the bad weather."

Rob Burdett did put his score for UK bonds up to five in May, but is now bringing it down to four because of the recent fall in bond yields.

"We forecast higher bond yields at the beginning of the year," says Keith Wade. "So what has happened has been one of the big surprises." Wade lists a number of reasons for the trend. First, the banks have been big buyers for structural reasons. "They have been told to hold more safe assets in their balance sheets under the new regulations," he explains.

"Another factor has been that low short-term interest rates actually make it expensive for investors to go short of bonds because of the cost of the transaction."

Wade also points out that a number of governments in emerging markets, notably India, have been buying bonds in the UK and the US for their wealth funds because of recent weaknesses in their currencies.

On the weak GDP numbers in the US in the first quarter, Wade argues it is "hard to ignore them completely, although people have tried to look beyond them".

But he insists that from an overall global asset allocation perspective there are "still better opportunities in equities, and I think in fact that yields will now creep up to 3%".