Lloyds excites bulls with profits beat

31st July 2014 12:01

In another sign that Britain's banking industry is on a firmer footing, announced better-than-expected first-half profits, a lower-than-forecast impairment charge and more bullish guidance on margins.

Underlying pre-tax profit, which strips out a whole host of hefty costs and other one-off items, surged by almost a third to £3.8 billion during the six months, about £200 million more than consensus forecasts. Exclude the sales of its 21% stake in late last year, and it was up 58%, driven by a 39 basis-point improvement in net interest margin to 2.4%.

Lloyds more than halved the impairment charge to £758 million; again, that's about £200 million better than the City expected, and cut costs by 2% to less than £4.7 billion. It now expects full-year costs of about £9 billion.

Add all the horrible charges back in - this includes a further £600 million provision for miss-selling of Payment Protection Insurance (PPI) and a £226 million to settle LIBOR manipulation and BBA repo rate issues - plus the £780 million made from the sale of government bonds in 2013, and statutory profit sank by £1.3 billion to £863 million. That was light.

Still, Investec Securities reckons the extra PPI provision "offers relief rather than alarm," and that Lloyds has £2.3 billion (22%) in hand. "We regard it as credible that the current provision will now prove adequate. If we are wrong, any incremental charge is now likely to be small," says the broker, which still reckons the shares are worth 85p a share.

Lloyds increased guidance for full-year net interest margin by 5 basis points to 2.45%, and now expects its asset quality ratio to be around 35 basis points. The run-off portfolio should drop below £20 billion by year-end, too, about £3 billion better than previous guidance.

The Capital Requirements Directive (CRD IV) Common Equity Tier 1 (CET1) ratio is up 40 basis points to 11.1% and, according to Investec could hit 13.6% by the end of 2016. "As such, we see a resumption of the dividend in February 2015 as 'nailed on'," it says, predicting a 4.5p dividend by 2016 - a prospective yield of 5.9%.

So, clearly there is much to cheer here, but it's not plain sailing. Loans to customers fell by 0.7% during the second quarter to £487 billion, and despite improved margin guidance, analysts at Espirito Santo warn that minimal underlying loan growth with likely limit any improvement in net interest income (from lending and borrowing).

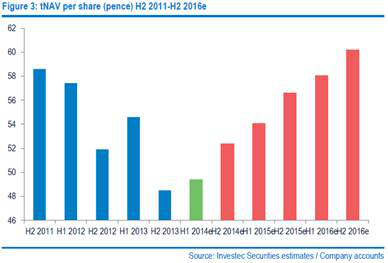

Higher-than-expected legacy charges caused a sequential dip in tangible net asset value (tNAV) per share to 49.4p, too. Bulls at Investec expect 60p in 2016, and a current share price of 74p puts Lloyds on between 1.4 and 1.5 times forecast tNAV for 2014. That is modest by historical standards - it's about half pre-credit crunch multiples for Lloyds - and business is improving.

Lloyds shares have also used the 72p level as a springboard for a number of modest rallies over the past 12 months. Of course, none has proved sustainable, but with further evidence of improvement on this scale and nearing a return to the dividend list, there's certainly more to justify optimism these days.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks