Equities beating becalmed bonds in Tactical Asset Allocator

15th August 2014 09:14

by Ceri Jones from interactive investor

Share on

One asset class in the news in the past month has been emerging market bonds, as the market nervously awaited developments in the stand-off between the Argentine government and investors in its $95 billion (£56 billion) bond default.

The Supreme Court ordered the Argentine government to pay $1.5 billion to investors who have not settled, but it refused. It argued that if it did so, it would be obliged to pay the same to the larger group of investors who have already accepted a deal worth about 33% of their investment, and it promptly pushed the case to the International Court of Justice in the Hague.

These events are important, as the fund management world is split on whether bond yields from less-robust sovereign states such as Argentina and Venezuela justify the risk, having bounced back from rock-bottom valuations in the past year.

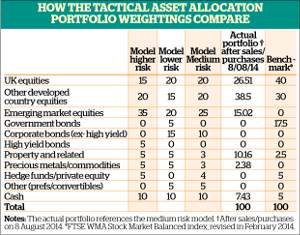

To view the Tactical Asset Allocator's holdings and trading chronology, click here.

Debt problems

However, the International Monetary Fund (IMF) is considering plans to make it easier for governments to force bondholders to accept restructuring terms. If the new proposal is adopted, the IMF would conditionally refuse funds to countries carrying unsustainable debt burdens unless creditors first agree to a "reprofiling" of debt.

Almost all emerging market countries have experienced recurrent debt problems. Argentina has defaulted eight times since 1826, the same number as Peru, Mexico and Turkey, but a greater number than Brazil, Chile, Ecuador, Venezuela and Costa Rica.

These bonds have also now largely rebounded from their all-time-low valuations of the past year and have little left to give. Investors should therefore look closely at their emerging market debt holdings, which could easily be buried in strategic bond and multi-asset funds as the investment world searches more widely for attractive returns.

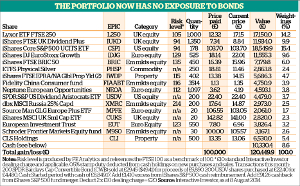

Our portfolio's sole remaining bond holding is the , the only passive fund servicing this market. The recovery in stockmarkets has led to a surge in the issuance of convertible bonds by European companies, which is at its highest level since 2008.

This is because convertibles allow investors to participate in the upside of equity markets - but with downside protection - and are less interest rate sensitive than fixed income, attractive qualities in this financial climate. However, the fund has been treading water and this, together with the current trend for convertible issues to be offered with declining coupons, has prompted our decision to sell the holding for a 19% gain.

Better value can be found in equities, where valuations, such as prices relative to earnings, are near historic averages. Encouragingly, recent data on China suggests its economy is growing at a rate of 8% a year - better than the 7.2% widely predicted.

In addition, China's policymakers have relaxed their commitment to reform and added stimulus through a policy instrument called pledged supplementary lending, where specific sectors of the economy enjoy low-cost credit for specific purposes.

Meanwhile, retail sales in China have proved resilient, considering Beijing's clampdown on largesse. The end of the severe winter in the US and improvement in global trade have also helped lift markets.

Too soon to celebrate

It is too early to put the bunting out, however. "Markets will celebrate this short-term palliative, despite the widespread acknowledgement that slower growth is a must if China is to meet its objective of reducing its over-reliance on cheap, loan-financed capital investment," says Alan Higgins, chief investment officer at Coutts UK.

"China's rate of economic growth should be of secondary importance to the strategy of stabilising indebtedness." While reform to stabilise debt remains a work in progress, our holding in the focused remains a sensible place to be.

Higgins says that over the past 50 years, when rates have been low for a long time, the first hike has generally been followed by an average 7% decline in US share prices.

Shares also tend to suffer a 15-20-week period of weakness in anticipation of a rate rise and take a year to recover as markets assess whether the stimulus removal was well timed.

However, Higgins says that, in recent years, the adjustment has been quicker, owing to faster dissemination of information. He adds that, as a result, US markets could fall by similar levels but recover more quickly than in the past.

Investors are certainly devouring high-dividend-paying US stocks as Treasury bond yields tumble, because of heightened demand for safe assets following the turmoil in Ukraine and the Federal Reserve's continued purchase of Treasuries while it pares back quantitative easing. The utility sector is up nearly 9% this year, for example, but stocks are still on valuations below the benchmark's average.

That's why we are buying an ETF linked to dividend payers this month, , that boasts an impeccable record of long-term dividend growth. Dividend growth has been the single largest contributor to nominal returns across key developed markets over the past 40 years. Research suggest the strategy produces attractive annual compound returns at lower risk.

Our US equity holding in the iShares S&P 500 ETF was merged on 4 August by the provider into the , using an exchange ratio of 0.281702082.

We have merged our three separate purchases into the CSP1 share class, which is denominated in sterling. iShares has been merging funds after its acquisition of the Credit Suisse business and says consolidation has helped improve spreads and liquidity.

Oil price bloodbath

Commodities have had a terrible time recently. The Bloomberg Commodity index dropped 5% in July, wiping out gains made since the start of the year. In the past month our portfolio sold out of oil, avoiding the bloodbath as Brent prices slid from mid-June highs of $115 a barrel to below $105.

The falls were prompted by optimism about an end to supply disruption in Iraq, the reopening of ports and oil fields in Libya, the strengthening of the US dollar, softer-than-expected demand in Europe and China, and the calming of sentiment from frothy levels. West Texas Intermediate prices dropped to below $98 a barrel.

However, now could be a good time to get back into oil, as the agreement between Libya's government and rebel forces forged in July is already fracturing.

Fighting between militias at Tripoli airport has interrupted operations at two large fields, and international oil majors have repatriated their staff from the country.

Meanwhile, deteriorating security in Iraq is affecting production in the country's north, and concern is growing about security in semi-autonomous Kurdistan.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.