Banking sector winners and losers in a UK economic recovery

28th August 2014 10:10

by Heather Connon from interactive investor

Share on

September 2014 sees the sixth anniversary of the collapse of Lehman Brothers, which precipitated the global banking crisis; yet judging by the headlines, the industry still looks some way from good health - or even good behaviour.

Hardly a week goes by without bad news emanating from the banking sector: from the break up of Portugal's Espirito Santo to of the US twice failing the Federal Reserve's stress test. From investigations into market manipulation by Barclays to record fines for France's BNP Paribas for breaching US sanctions on trade with countries such as Sudan and Cuba.

From the escalating cost of settlements for mis-selling Payment Protection Insurance in the UK to outrage over the scale of bankers' bonuses - the list of crimes and misdemeanours seems never-ending.

Is this a case of the darkest times coming before the dawn for the sector? Should contrarian investors buy now, before the good news starts to come through, or is recovery still too far off to justify a purchase?

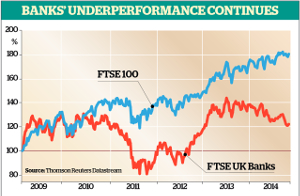

UK bank shares did, in fact, enjoy a strong bounce during 2012 and 2013, when all but tripled in value while and both added more than 50% - although, of course, all banks are still way below their pre-crisis peaks.

Dark times at Barclays

Worst hit has been Barclays, where the efforts of new chief executive Anthony Jenkins to instil a new, customer- and shareholder-friendly culture have been stymied by his apparent failure to do much to curb bankers' pay and bonuses, as well as further revelations about market manipulation, now spreading into areas such as foreign exchange, and an investigation into its private trading platform - the so-called "Dark Pool" - which could well lead to yet more heavy fines.

Some professional investors are enthusiastic about the prospects, despite the headlines. Among the most enthusiastic are Fidelity fund managers Alex Wright, who runs the , and manager of , James Griffin, both of whom have large holdings in , Lloyds and Barclays.

Wright's fund has more than a third of its assets in financials, while in Moneybuilder the proportion is a quarter.

Toby Gibb, investment director of UK equities at Fidelity, says Wright and Griffin are particularly enthusiastic about domestic banks such as Lloyds, encouraged by increasingly positive economic data such as GDP and unemployment.

House prices are rising strongly, which is proving positive for mortgage demand, while other forms of lending are recovering and banks' loss provisions are falling.

"One concern among investors had been that banks would not have the same return on equity as before the crisis as [tighter capital regulation means] they could not use the same leverage rates as before.

"That is true, but in some areas the competitive environment is more favourable, and that is helping offset the effect of lower leverage. Lloyds' mortgage market share is now higher than it was going into the financial crisis."

Domestic banking business is certainly far less competitive than it was before the crisis, when borrowers could take their pick from a host of US, Icelandic and other foreign banks - most of whom have now packed up and gone home, if they have survived at all.

Stabilisation

Matthew Beesley, head of global equities at Henderson Global Investors, also cites as a positive sign the fact that some banks voluntarily restricted mortgage lending in London on fears the market was getting overheated. "That would have been unheard of five or six years ago."

Based on Henderson's two-to-three-year time horizon, he likes a number of UK banks including Lloyds, as well as European banks such as KBC of Belgium, Italy's UniCredit and Greece's Alpha Bank.

"While they are all different, they all have common features - an element of stabilisation or normalisation of their business - and they all have a strong or dominant position in their core markets."

While he accepts that growth may be more pedestrian, Beesley adds that banks have used the crisis to cut costs and consolidate. "Those banks with a superior position in their domestic markets should be able to increase their margins." That should help to compensate for more sluggish growth.

It is not just retail banks that have been retrenching and refocusing: he points out that five or six years ago, every bank felt it had to be in all markets. "Banks are now more capital-constrained and there is increasing pressure on how they allocate capital."

For example, Barclays is scaling back its investment banking business as part of a retrenchment that is costing 19,000 jobs; Lloyds and RBS have been forced to sell parts of their operations; HSBC has been scaling back parts of its global empire.

New competitors are arriving: recently floated , for example, because regulators required its parent Lloyds to get rid of a parcel of branches.

Others - such as the new banks established by companies such as Virgin, and - are entering the market because well-regarded consumer brands think they can attract banking business from customers disillusioned by conventional banks.

Challengers emerge

More competition is on the way, as RBS gears up to sell its Williams & Glynn brand to meet EU requirements, and other challenger banks such as Metro are also likely to be considering flotation at some point.

So far, however, the impact of these newcomers has been limited, despite the government's stated aim of encouraging them. Gibb thinks these new entrants have some way to go before they have an impact on the incumbents. "TSB has a big cost base which it still has to grow into," he says.

Others are, however, less excited about banking prospects. Graham Spooner, investment research analyst at The Share Centre, says there is little enthusiasm for the sector among fund managers, with some owning no banks at all. He thinks that regulatory concerns, growing competition and market concerns will continue to weigh on the sector.

High-profile investors such as Invesco Perpetual's Mark Barnett and his predecessor Neil Woodford remain unenthusiastic. HSBC is the only bank in the portfolio of the new and financials account for a total of 17% of the portfolio, compared with a market weighting of 24%, while Barnett's financials weighting is even lower at 11%.

Those who are keen on banks have a choice of buying the shares directly, investing in specialised financials funds or choosing a generalist fund with a high weighting to financials. We consider each below.

State of the big five

Lloyds Banking Group

Lloyds Banking Group is the most geared of the five main banks to a rapidly recovering UK economy, has a dominant share in many of its businesses and is well on the way through the restructuring needed following the financial crisis.

It is also expected to resume dividend payments with its full-year results for 2014, making it interesting to income-seekers once again. This combination of UK growth and dividend prospects make Lloyds the favourite among banks for Jonathan Jackson, head of equities at Killik.

HSBC

HSBC is the most globally diversified of the banks and, for the moment, that is a negative with investors unenthusiastic about its emerging markets exposure.

But Jackson thinks that over the longer-term this should once again be positive for the bank and points out that its 5% yield is a good compensation for investors in the meantime.

Barclays

Barclays has had the lion's share of regulatory reprimands, fines and investigations and there could be further bad news to come from areas such as foreign exchange.

Chief executive Antony Jenkins is also trying to exit some of the less profitable areas of investment banking. These negatives outweigh the positives of its exposure to a recovering UK economy.

Standard Chartered

has also been troubled by fines and regulatory attention, which has added to the issue of its exposure to slowing emerging markets. Jackson thinks this will be a positive over the long term while the shares are attractively valued. Poor news flow may, however, dampen the shares in the short term.

Royal Bank of Scotland

The government still owns around two-thirds of Royal Bank of Scotland shares and, with restructuring still in full flow, an early sale looks unlikely. Until that looks closer, there is little incentive to buy the shares.

Specialist financial funds help to spread the risk

Specialist funds include , , , and .

These have the advantage that their exposure is spread among other financial companies such as insurers, stock exchanges and so on and they are also all international funds, so can buy into global banks as well as domestic ones.

All have been disappointing over one year but have fared better over five and 10 years. The best performers have been Henderson Global Financials and Jupiter Financial Opportunities, with 10-year returns of more than 150% and almost 140% respectively.

General funds with high bank weightings include Fidelity Special Situations and the , both managed by Alex Wright, which have more than 30% of their portfolios in financials. has 4% in RBS and also holds Barclays among the 28% of assets in financials.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.