Fund profile: Templeton Growth

17th September 2014 11:58

As the UK offshoot of the original US fund established by Sir John Marks Templeton in 1954, the has an enviable pedigree alongside an impressive track record.

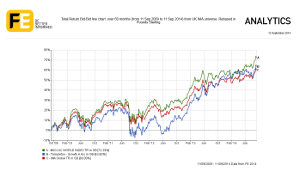

Established in 1988 by Sir John Templeton himself, the £200 million Templeton Growth Fund has returned 120% over the past 15 years alone, easily outpacing the IMA global sector, which has returned an average of 76% over the same period.

Since 2008 the fund has been managed by Franklin Templeton senior vice president Dylan Ball alongside director of research Heather Arnold and executive vice president Peter Moeschter, all of whom have stuck closely to Sir John's original investment template.

Contrarian conviction

"The fund has been around for decades, so we can look at the track record and see when and how the strategy has worked and what sort of markets it works in," says Ball. He quotes one of Sir John's most famous lines: "The most dangerous four words in investing are 'this time it's different'."

For Ball and his team this time period is five years at a minimum, which the manager claims allows them to buy into "essentially pessimistic scenarios" for the long term.

"We go in, look for stocks that can double by looking at what we think they can earn on a normalised basis while they are in the middle of a short-term crisis. Then we wait for the market to agree with our view of the world and we get our returns," he says.

As an example, Ball cites his purchase of global healthcare stocks in 2007, a time when the sector was deeply out of favour due to concerns over the expiry of drug patents and a fall in the amount of research and development (R&D) being undertaken.

"We bought these companies when they were trading at around 8 to 9 times price/earnings with a 5 to 6% yield. They had great balance sheets, but there was a question mark over whether their business models were going to persist," he says.

Ball thought the firms would restructure and expand into emerging and lower margin markets, which proved correct in years to come while an unexpected revival of R&D also helped to boost his portfolio, 18% of which is now in global healthcare stocks.

These include US pharmaceutical firm and European giant Roche, which are the fund's first and second-largest holdings at 2.7% and 2.2% of the portfolio respectively.

Financial gamble

Ball's largest wager, however, was on European financial stocks in 2012 when he bought into the then market pariahs in some cases for just 0.2 times their book value.

"That was perhaps a bit of a trading call, but we were fortunate on the timing. After the European crisis we looked at banks and insurers like and said, 'OK, you're not going back to 30% returns but we think you can earn about 12% and we think that's worth 1.5 times your book value - not 0.2 times'," says Ball.

However by Ball's own admission these contrarian plays, while paying off in the long term, can lead to short-term underperformance.

This is particularly the case when markets pull back aggressively as in 2008 when the fund lost 24.6%, and even in subsequent rallies as investors ignore the "bull market laggards" Ball and his team buy in to, as in 2009 and 2010 when the fund was a bottom-quartile performer.

"It works over the long-run, but it does go through periods of underperformance as we re-engage the portfolio, but then that can lead to a seven-year run of outperformance and we're about two years into this coming seven-year run so it's a very interesting time," says Ball.

The last two years have certainly been impressive, with the fund delivering top-quartile returns of 15% and 33% in 2012 and 2013 respectively, which if maintained for another five years will be more than "interesting".

This ebb and flow does, however, make for a bumpy ride and Templeton Growth carries one of the highest volatility ratings in the sector, not helped by a typically low growth fund yield of 0.66% as income often helps to smooth out any wrinkles.

Having said this, with over 100 holdings the fund is well diversified, which is important for mitigating risk. Ball says this is a cornerstone of the strategy, again quoting Sir John: "The only people that don't need to diversify are those people who are right 100% of the time."

New opportunities

Currently, Ball is of a mind to increase his holdings further as, he says, he is seeing more and more opportunities in small and mid-cap companies in both Europe and the US that have been "bashed by the market" due to concerns over the slowdown in Europe and the burgeoning recovery in the US.

"In Europe, where there is a generic slowdown in GDP we're seeing new ideas in industrials that are related to large government contracts, while in the US we are finding ideas exposed to an uncertain recovery in the residential housing market.

"Typically balance sheets are not so safe so you've really got to put your research hat on and try to work out whether these companies can fund themselves and whether they genuinely can double in value," explains Ball.

In emerging markets, Ball would like to add to his current 15% exposure, however the manager feels he may have missed the boat slightly following a stellar rally within the region that has seen it gain more than any other global market year to date.

"We raised our emerging market weighting at the right time then in true style the region raced out of the blocks again as it did in November 2008. No-one saw that China would bounce quite as phenomenally as it has, but we're patient. We're not going to chase markets, we're going to wait for the valuations to come to us," says Ball.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks