Share Sleuth's September Watchlist

17th September 2014 16:39

by Richard Beddard from interactive investor

Share on

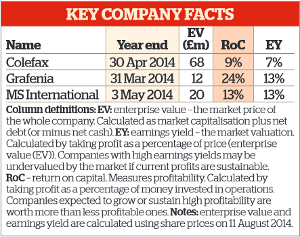

Each month Richard Beddard trawls through annual corporate results for his Watchlist and the Share Sleuth portfolio of companies that satisfy key valuation metrics such as earnings yield and return on capital - and profiles the most interesting candidates.

This month, revenue at wallpaper decorator Colefax's Product Division has increased by 6%, helped by an improving housing market in both the US and the UK. The firm's priorities in the coming year will be focused on the former, with a new showroom in Washington planned.

Another area of investment will be Italy, where they also plan brand new showrooms in Milan, despite its performance in Europe being patchy.

Meanwhile, Grafenia has been rejected by the portfolio, as its full-year results are difficult reading for shareholders, with its printing franchise losing franchisees fast. The company isn't all bad, but it is easy to imagine further gloomy scenarios.

Watch: Colefax

achieved a 30% increase in profit as revenues increased 11% in the year to April 2014. The company's cash position would have improved, had it not bought back shares worth £4.25 million in a tender offer.

Colefax principally designs and distributes luxury fabrics and wallpaper. At the Product Division, by far the largest of the company's two divisions, revenue increased 6%.

The rise was mainly due to improving housing markets in the US, which earns 53% of the division's revenue, and in the UK (20%). In Europe, where economic conditions are weaker, Colefax's performance was patchy.

Since the year-end, the company reports the upward trend has slowed to low single digits, although trading may improve because sales often lag house purchases. The fact that sales in the US are still 17% below pre-credit crunch levels suggests there could be further recovery potential.

The main reason for the improvement in 2014, though, was an exceptional performance from the relatively small decorating division, Sybil Colefax & John Fowler. Project delays meant much of the decorating income it might have earned in 2013 was booked in 2014.

Profits from decorating fluctuate from year to year, depending on the timing of contracts, which is evident in the results of earlier years and means the company is unlikely to benefit from such a large contribution in the year to April 2015.

Set against hesitant growth is Colefax's reputation as the leading exponent of the English Country House style cultivated over a period of stable management. It owns five established brands, Colefax and Fowler, Cowtan and Tout, Jane Churchill, Manuel Canovas and Larsen.

The company's investment priorities this year are focused on the US, where it's investing in a new Washington showroom. Other priorities include the Middle East and Russia, the most promising territories in the Rest of the World segment, which although small, grew 10% in 2014.

Colefax is also trying to revive its performance in Italy, where it's opening a new showroom in Milan. Plush showrooms don't come cheap though, and the company's otherwise debt-free balance sheet looks less impressive once the leases are capitalised.

The company's reputation may work against it sometimes too. Some brands have a more contemporary look but Colefax is most closely identified with heritage styles, which vie for popularity and fashionability with more modern and minimalist styles.

A share price of 340p values the enterprise at £68 million or about 14 times adjusted 2014 earnings. The earnings yield is about 7%.

Reject: Grafenia

full-year results are difficult reading for shareholders. Its printing franchise is losing franchisees, some to its own initiatives, as small business customers adopt cheap online print services. Revenues for the full year to March 2014 fell 6%, but revenues from Grafenia's Printing.com franchise network fell 32%, and overall adjusted profit fell 13%.

The numbers aren't entirely bad. If sustained, the company remains profitable enough to be a reasonable investment on an accounting and cash basis, and its bank balance was positive and stable at the year-end. It's easy to imagine further gloomy scenarios, though.

Grafenia has two main assets, a centralised printing hub in Manchester, and proprietary software that manages all aspects of print from template driven design to ordering. It packages these with marketing services into franchises that "bolt on" to existing print shops. Principally it derives revenue from print sales, but it also earns about 5% of its takings from franchise and software licence income.

In recent years, Grafenia has attempted to counteract the shrinking franchise network by developing its in-house software into a platform than can run the operations of any printer, marketing company or graphic designer, providing them with a print ordering and management system and a web store. Optionally, customers can source print from Grafenia.

In 2014, its first year of sales, the software solution W3P earned Grafenia £610,000 in printing revenue and licensing fees, but at the cost of 72 franchisees who became software customers instead. Other software solutions are, as yet, small scale, and the company is introducing a new stripped-down service targeting graphic designers.

In comparison to overall revenues of more than £19 million and capital investment running at over £1 million a year, principally related to the new software services, these initiatives have yet to prove their worth.

One investment that may have done so was the acquisition of a Dutch online printer in 2010. The businesses acquired by Grafenia earned revenues of more than £7 million in 2014 and comprised most of Grafenia's online revenue, which in total grew 8% and for the first time surpassed the franchise network. Online print is very competitive though, which may imply that despite growth, profit and cash flow principally still come from the diminishing number of franchises.

Over the past few years Grafenia has developed many new services, an experimental approach that may be the only way to cope with the rapidly changing industry. But it's difficult to evaluate these small projects.

Unsurprisingly perhaps, the current share price of 22p values the enterprise at £12 million, or eight times adjusted 2014 earnings. The earnings yield is an enticing 13%. Set against that very attractive market valuation is the palpable risk that in the bewildering new mix of brands and services, Grafenia has yet to find the seed of future long-term profitability.

Add: MS International

Revenue at fell 14% in the year ending May 2014, resulting in a 30% fall in adjusted profit. As recently as 2013, MSI's defence division earned more than half of its revenues, but in 2014 it brought in just 41%. The remainder is roughly split between the Forgings division and Petrol Station Superstructures.

The defence division manufactures the SEAHAWK naval gun system, navigation tables and compression chambers for navies, and containerised shelters and vehicle bodies for land-based armed forces.

Military orders may have picked up. The group order book rose 64% year-on-year and while the defence order book stretches out to 2020, the other two divisions operate on lead times of weeks.

MSI says the defence order book provides 'a good base load of business', which it hopes to improve through international sales and when the procurement phase of the Royal Navy's current shipbuilding programme starts.

Having substantially reduced the defence division's costs, the company is positioning itself for recovery by broadening its product range, although it sees little prospect of improvement in 2015.

For the other two divisions the immediate outlook is brighter. Forgings, which manufactures steel forgings for a wide range of industrial applications and fork lift arms, may be experiencing an incipient recovery.

Revenue fell 2% in 2014, but profit improved. Meanwhile, Petrol Station Superstructures - already the most profitable division - grew revenue 12% in 2014.

Profit grew too, as the company has benefited from road building in Eastern Europe and a trend to redevelop traditional filling stations into more sophisticated retailers. MSI manufactures and installs the canopies, shops and car washes.

Investors may be overreacting to contraction in the defence division and overlooking both the likelihood of recovery in the long term and the qualities of the other two divisions. The share price of 188p values the enterprise at just £18 million, or about seven times adjusted 2014 earnings. The earnings yield is 14%.

Although the timing of recovery is unknowable, it seems implausible that it won't happen. MSI has a long and profitable history. In 2014, it earned a return on capital of 13%, significantly below levels of recent years but still high enough. Cash returns were higher.

Its strategy is straightforward. In the pursuit of acceptable levels of profitability it is devoted to investing in product development, efficient production and "relentless, constant improvement in everything we do". Since MSI operates in niche markets, a policy of specialisation and excellence ought to result in a strong reputation.

Admittedly, its markets are cyclical, but these results show that the cycle in defence spending is not in synchrony with the business cycle, so diversification may help the company avoid the extremes of either. Its financial strength should enable it to invest during times of weakness and capitalise on recovery.

If you believe the time to invest in strong companies is when the short-term outlook is uncertain and weaker profitability is corroding traders' resolve and depressing the share price, now could be a good opportunity.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.