Conservative investment trust tips: Global and regional

22nd September 2014 11:13

by Fiona Hamilton from interactive investor

Share on

A lack of market volatility and a weak dollar hindered our 2013/2014 tips, chosen to do well in either bearish or bullish markets. Nevertheless, we are sticking with our formula and many of the trusts that have rewarded investors in previous years.

As in previous years, we have picked two trusts for each of eight different sectors, plus two specialist selections. The adventurous choices are for those who believe stockmarkets in the region concerned will offer opportunities for strong gains over the next 12 months, but the conservative choices are for investors who want some market exposure but prefer a relatively conservative stance.

Below, Fiona Hamilton profiles our conservative selections for the year ahead from regions around the world and those that invest globally.

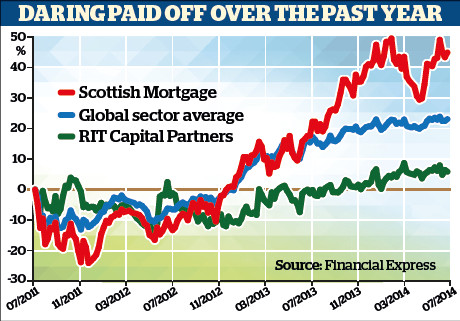

Global

is our new conservative choice. Its managers prioritise capital preservation but are not afraid of a sizeable exposure to equities.

Chairman Lord Rothschild says: "Since inception we have participated in 70% of the market upside but only 38% of market declines. This has resulted in our net asset value per share compounding at 11.7% a year - a meaningful outperformance of global equity markets."

Rothschild warns that the world recovery is fragile and equity valuations high, and it's easy to envisage the market suffering shocks this year. Despite this, nearly two-thirds of RIT's portfolio is in equities. Private equity accounts for a quarter. Gold, property and a growing exposure to absolute return and credit make up the balance. North America accounts for more than 40% of overall exposure.

RIT is unlikely to match in a purple patch and has been less rewarding over the past 10 years, but it should give a much less bumpy ride.

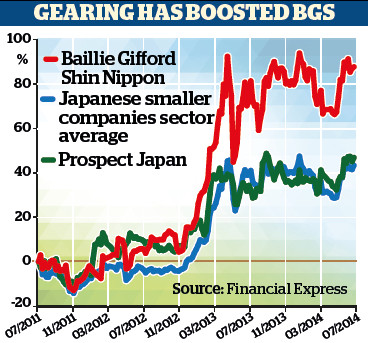

Japan

has the best five-year net asset value returns in the Japan sector after the two Baillie Gifford trusts, it has done well over one year and has low volatility. Its current wide discount looks excessive, so we have made it our new conservative choice.

Curtis Freeze heads Prospect Asset Management and has managed the trust since launch in 1994. The trust has a concentrated portfolio of smaller companies Freeze considers undervalued relative to their growth prospects, cash holdings and/or underlying assets.

Freeze is not convinced that Abenomics will live up to expectations, so he is happy to have raised a lot of cash by taking profits on the trust's holdings in Japanese real estate investment trusts.

Europe

The income shares of are our new conservative Europe selection.

The trust's net asset value total returns are above average over one, three and five years, they trade on a reasonable discount and offer an attractive yield, paid quarterly.

JETI's management approach contrasts sharply with that of HEFT. It has more than 200 holdings, so its exposure to stock-specific risk is low.

It has substantial overweights in financials, utilities and energy, and it is underweight in healthcare, information technology and materials.

Stephen Macklow-Smith, lead manager since launch in 2006, says holdings are selected by screening the Europe ex UK stockmarket for the highest yielders - which reduces the investment universe from about 1,400 companies to around 420 - then selecting those with good growth prospects and a well-protected dividend.

The trust's performance fee has been abolished, leaving it with a competitive annual management fee of 0.75%. An added attraction of the income shares is that they can be converted into the trust's growth shares semi-annually (and vice versa), free of capital gains tax.

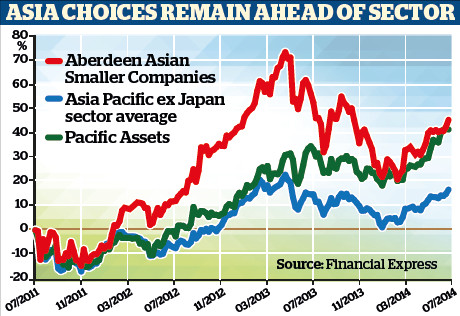

Asia

is another trust to hold its place, despite a tight discount to net asset value, because we think it is worth sticking with proven quality.

It has been managed since December 2010 by David Gait at First State Stewart, another well-established specialist in Asia and emerging markets.

The group is noted for its team approach and willingness to adopt a conservative stance when the outlook is uncertain. Its managers seek to minimise risk by focusing on companies with shareholder-friendly management, quality franchises with "defendable moats" and financial strengths such as "sensible balance sheets, sensible borrowing and sensible capital expenditure through the cycle".

Companies are bought for their five-year prospects and visited several times a year to check progress. Stakes are topped or tailed if they start to look too cheap or too pricey.

Gait takes First State's emphasis on well-run companies a step further by focusing on those facing up to Asia's environmental and resource constraints. This may involve the provision of sustainable goods and services for the billions at the bottom of the wealth pyramid, social infrastructure such as clean water and mass transport or cleaner energy supplies.

Under Gait's leadership the trust has built up a substantial weighting in India that has worked well so far this year. However, FSS is wary about the global macro-economic outlook, so the trust is ungeared and has 6% in cash.

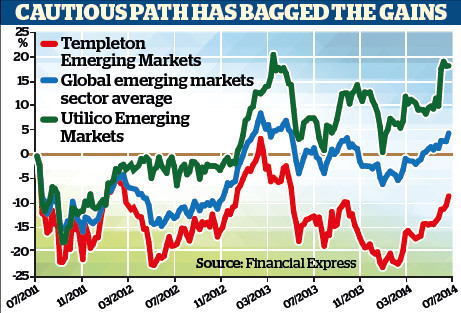

Emerging markets

has had a tough 12 months. Most emerging stockmarkets have only recently emerged from the doldrums, sterling strength against most emerging market currencies has significantly reduced the value of UEM's portfolio and a put option on the S&P 500 index has been costing the trust millions of pounds.

However, UEM once again performed well compared with most global emerging markets specialists. It offers a decent yield, adjustments to its fees should result in lower charges and its discount has widened to 9.1%.

The trust's managers prioritise capital preservation, and it remains our conservative choice.

UEM invests in companies involved in essential services, demand for which should increase as the global population continues to grow and living standards improve. Ports and airports, gas, and water, and waste management are currently its main sectoral exposures.

China including Hong Kong accounts for a third of assets. The trust's performance was enhanced by strong gains at China Gas Holdings, which has gas concessions in 208 cities, and China Everbright, a leading environmental protection and alternative energy supplier.

Malaysia and Brazil each account for around 16% of assets. The balance is mostly in the Philippines, Thailand, and Chile.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.