Former top performers falter in Consistent 50

25th September 2014 12:23

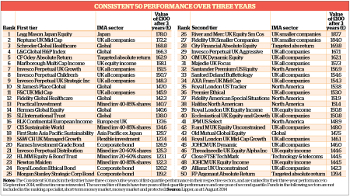

The Money Observer Consistent 50 underwent a significant overhaul in the three months to 1 August. Half the funds in the previous quarter's table lost their places to new contenders.

Among the losers was the previous number one, , which has been ousted by , following a stellar three months for the latter fund in which it returned more than 17%.

The Consistent 50 first tier lists open-ended funds that have achieved three consecutive years of top-quartile performance. They are ranked in their sector according to their total return over three years. The second tier of the table lists funds with two years of top-quartile performance and one year of second quartile.

The second tier has expanded from six funds - at our last review - to 25, reflecting challenging conditions in developed markets, particularly the UK market, where the FTSE All-Share index has risen by less than 1.5% over the past six months.

Biggest losers

The tough environment has also caused the number of funds from the UK all companies sector residing in the first tier to shrink from 12 to five.

Similarly, Premier's fell from sixth to 33rd place, while fell from third to 29th place.

However, strong 1.4% gain over the summer helped it retain second place. , and funds also flew the flag for the UK in the top tier.

Emerging markets lost ground. The number of funds from the global emerging markets and Asia Pacific ex Japan sectors making the grade shrank from seven to just one, despite a strong rally in the region over the past six months.

Biggest winners

Rising 12 places from 30th to 18th, was the sole survivor in the region, thanks to its 19% return over the past six months.

Global healthcare funds made strong gains. and climbed to third and fourth place in this quarter. made its Consistent 50 debut at number 12 as global healthcare stocks continued to outpace developed market equities.

Multi-asset funds halved in number to five but crept up the table in terms of returns. , which climbed from 22nd to 13th, was the most consistent fund this quarter.

went up 10 slots to 17th place, while and each rose 12 places to 21st and 22nd place respectively.

The number of North American funds in the table increased from zero to five in this review, reflecting the strength of US markets as the Federal Reserve Bank prepares to withdraw quantitative easing.

is the best of the bunch, with a return of £157 over three years, closely followed by , which returned £154, and , which grew by £152.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks