14 tech stocks under the microscope

8th October 2014 15:14

by Lee Wild from interactive investor

Share on

UK technology plays have experienced a wild ride this year, and a 12% slump in the FTSE 350 Technology index since early September has given back all the previous month's gains. A series of profits warnings have spooked tech investors, and the coming weeks will be crucial as we get a clearer idea of just how second-half earnings are panning out.

"Anything that can be construed as a warning is likely to be severely punished and some stocks which have managed to hold onto premium valuations will need flawless delivery," explain the tech team at Barclays.

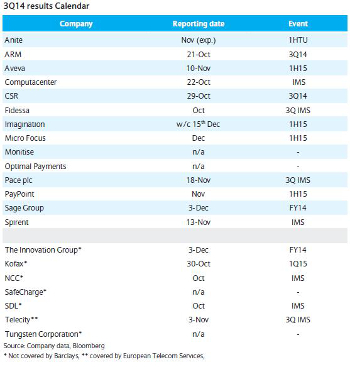

(click to enlarge)

Bearing that in mind, the broker has redone its sums and made changes to its forecasts and house view. Its observations are worth considering.

Software rarely so volatile: The wide valuation divergence between the two "quality" names in UK software, and , is an increasing challenge to justify on a longer term outlook. However, further near-term estimate risk to consensus at AVEVA and our anticipation of outstanding derivatives progress at Fidessa support our EqualWeight and Overweight ratings respectively. remains a key call in value tech; performance has been strong, but we see potential for further estimate progression. We retain Underweight on given management change and Cloud uncertainty.

Payments a focus, but diverging performance: Earlier in the year we initiated on and , expanding our payments coverage into the UK. Optimal has seen upgrades outpace share price gains, leaving the shares highly attractive. Meanwhile delivery at PayPoint has been broadly as anticipated, but insufficient to support the valuation, in our view, and we downgrade to Underweight. remains an Overweight call for us, although we accept that it will take time to rebuild credibility and convince the market on user growth acceleration.

Hardware focus on self-help and company specific growth: Our favoured name is , where we expect record second-half results to more than offset concerns over the CFO's departure. We are positive on , as we view second-half royalty consensus expectation as achievable and note improved FX from USD strength. Finally, we remain Underweight on , as we see little room for upside to the 10% unit growth target for full year 2015.

Test and Measurement, industry still tough: Yesterday's warning from confirmed that the tougher second-half comps simply represented too much of a step up. is a better positioned business in our view, however, the recent Xceed acquisition seems expensive and the market will be nervous post Spirent. We retain Equal Weights.

And we've carried out our own research on a number of the companies covered by Barclays, and spell out our thoughts here:

Chip designer ARM Holdings rallied 15% after we covered its half-year results late July, although they've eased again since amid rising costs and dwindling growth in royalty revenue. But ARM had a decent second-quarter and has a huge cash hoard. Trading at less than its historic average, the shares look good value.

A surprise profits warning last month wiped out a fifth of Aveva's market value, and despite some spirited director share-buying, the highly-rated engineering design software company continues to fall. The warning has blotted its copy book and as we said at the time "the prospect of this being more than just a one-off should be a concern."

Monitise has issued its fair share of profits warnings this year, and news that is to offload a 5.5% stake looked like another nail in the coffin. Monitise shares have lost almost two-thirds of their value since February, yet the loss-making mobile payments specialist retains a loyal army of followers.

As we've just reported, Spirent Communications has sunk to a five-year low following a third-quarter profits warning. Business has slowed in the key US and Chinese markets, and customer spending in areas at which the telecommunications testing firm has thrown a lot of money is being held up. But the shares have, at least, found technical support at 70p - it's where Spirent shares ended up after the massacre that was the dotcom crash in 2001. The relief then was only temporary. Assuming there is no further impact on earnings, this time the support should prove more solid and long-lasting.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.