Readying for dividend cuts in Active Income Portfolio

15th October 2014 13:30

by Heather Connon from interactive investor

Share on

has done it already and and could well be next. "It", of course, is a dividend cut; concern about the level of income available from UK shares is growing as Europe stagnates, Asia and China slow down and Brazil loses its commodity-based lustre.

Government and blue-chip bonds, meanwhile, remain vulnerable to price falls as economic recovery in the UK and US accelerates, interest rates start to rise and the quantitative easing (QE) support mechanism is taken away. Income seekers need to keep an active watch on their portfolios.

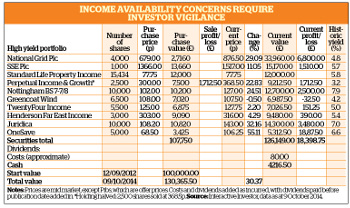

We are pretty happy with the look of our active income portfolio and will make only one addition and a partial disposal this month.

To view the active income portfolio's holdings and trading chronology, click here.

Market correction fears

(PIGIT) has been a good performer under manager Mark Barnett, who has now taken on the funds that were run by investment guru Neil Woodford. However, the yield is relatively low at 3.2% and, with fears of an impending market correction growing, its UK-focused portfolio could be at risk.

We are, therefore, halving our holding - although we will retain some exposure to this attractive fund - and will reinvest the proceeds in property, where the income available is high and, as the economy recovers, the outlook for capital growth improves.

The vehicle we have chosen is , a fund that invests directly in property, rather than property equities, and has a diversified portfolio of UK assets.

Firepower

Its strategy is to buy assets that it can improve through active management; recent acquisitions include industrial units in Livingston, central Scotland, and offices at the Farnborough Aerospace Centre.

Its yield is just under 6% and it aims to ensure that its dividend is covered by income - which not all its rivals achieve. In the first half of the year cover was 115%, giving some scope for growth. Its shares stand on a 12% premium to NAV, in line with the historic level and worth paying for its good income and growth prospects.

Following a placing in the summer, it has the firepower for new acquisitions. It intends to convert to a real estate investment trust and proposals will be announced in November. We have invested some of the cash in the portfolio together with the proceeds of a partial PIGIT sale, putting £12,000 into the trust.

, added to the portfolio last time, embarked on a placing and offer for subscription shortly after we went to press, raising £100 million to pay down its debt and for general corporate purposes.

The new shares were issued at a slight premium to the NAV and a small discount to the share price. Having just invested £7,020 in the company, we decided not to participate in the placing but are happy to hold.

Juridica's tasty yield

, which finances legal claims mainly in the litigious US, announced encouraging results, with gross settlements of more than $84 million (£52 million) in 2014 so far, of which $53.5 million in estimated net proceeds will be paid to the company on 31 December 2014.

That is 44% up on last year and it expects to pay a 20p dividend, which would represent a yield of around 14%. We are happy to wait for this payment.

There were no major announcements on other holdings in the portfolio. is paying its dividend at the end of October, which we will take as income in the next update. The two regulated utilities, and , remain a core part of the portfolio, both for their high income and for the resilience of that income.

Emerging markets have had a turbulent time in the past few months as the prospect of QE's easy money disappearing and the Chinese economy slowing has taken its toll on markets.

remains a good performer, however, and it offers a useful diversification from the UK-dominated portfolio. The two fixed-interest holdings - and - remain excellent sources of income, as well as having provided good capital gains.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.