Weak data has Europe looking pricey

15th October 2014 10:08

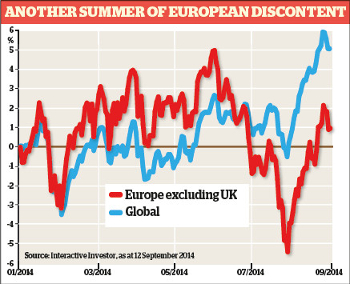

In the year to 31 August, the Investment Management Association (IMA) Europe excluding UK sector shed 0.7%, making it the third worst-performing sector in the IMA universe.

This stands in stark contrast to 2013, when European funds returned an average of 26.1% between January and December; the top performer, Money Observer Rated Fund , delivered an astonishing 42%.

However, Tom Becket, chief investment officer at Psigma, says this bull run on European equities has led to the region becoming overvalued.

"Over the past two years, the European equity index is up close to 45%, despite corporate earnings being down 10%," he explains.

Overvalued

Gross domestic product growth in the eurozone fell from 0.2% in the first quarter of the year to 0% in the second, while July consumer prices data indicates that European inflation is now running at just 0.3% - well below the European Central Bank's (ECB) target of 2%.

Despite this, some still hold out hope for Europe, particularly as Mario Draghi, governor of the ECB, has signalled his intention to boost the economy through an asset-backed security purchase programme later this year.

Moreover, according to Jon Ingram, co-manager of the , European companies are in good shape despite the gloomy economic backdrop.

Ingram points out that year-on-year earnings growth in Europe stood at 8.4% in the second quarter of the year, outpacing the US for the first time in five years, while 52% of companies beat expectations and a further 12% were on target.

He says: "With various factors weighing on sentiment, it has been easy to overlook the significantly positive news buried in the second-quarter earnings season, which is that the European corporate sector is in improving health."

The slight confidence boost provided by Draghi's ABS announcement, alongside a further cut to the ECB base interest rate from 0.15% to 0.05%, has boosted European investment funds, with a number already posting strong short-term gains.

These include Rated Fund , which in the month to 31 August returned more than 2% against a loss of nearly 5% over three months. This is a welcome turnaround for manager Mark Hargraves, whose focus on "quality growth" has left him underperforming the sector over one year.

Investment process

A steadier performer is fellow Rated Fund , managed by fund veteran John Bennett since 2010. The fund has returned 59.3% over the past three years, compared with the sector's 43%. Bennett attributes this to his stockpicking process.

He says: "At the heart of our investment process is the belief that stock prices are mean-reverting: competitive advantages are eroded over time, and underlying strong businesses that are badly managed can be rehabilitated."

He identified the pharmaceuticals industry as a prime candidate for mean reversion in 2010, as he thought the "worst-case scenarios were already priced in'. His analysis of the situation proved correct, and European pharmaceutical stocks have returned an average of nearly 75% over the past three years.

The fund is well diversified and invests in some well-known European firms, including Nestlé, Total and Telefonica. However, it has a value bias, making for some interesting holdings particularly in its largest sector weighting, consumer staples.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks