Outperforming the FTSE All-Share: Model Portfolio October 14 update

16th October 2014 12:11

by Helen Pridham from interactive investor

Share on

Global stockmarkets remained relatively strong over the summer, particularly in the US and Asia, despite the problems in Ukraine and Iraq. The FTSE World index rose 3.1% over the third quarter.

In UK markets, however, investors were rather pessimistic, because of concerns over the outcome of the Scottish referendum, worries about the consequences of an end to quantitative easing and unease over wider international problems. These factors held the market back. The FTSE All-Share index ended the quarter 1% down.

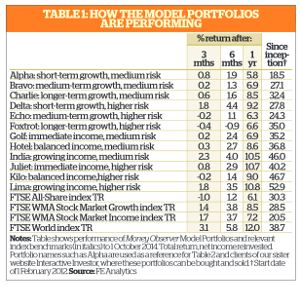

The performances of all our model portfolios over the period fell somewhere between these two indices. None of them managed to outperform the World index, but all of them beat the All-Share. Three fell slightly in value.

However, these were all higher-risk versions of our portfolios, so a tendency for them to fluctuate more than the others is to be unexpected.

Income performance

The performance of our six income portfolios varied more than usual over the third quarter, ranging from a gain of 2.3% to a 0.2% loss.

These two portfolios, which are heavily equity-oriented in order to maximise the scope for future income growth, have two holdings in common, one of which was this quarter's best-performing holding overall: , which gained 11.4% over the period.

This trust is not actually focused on income and has a yield of just 1.3%. However, it is included in these portfolios to help boost their growth potential. Capital withdrawals can be a tax-efficient way to supplement natural yields if you are reasonably confident of future growth.

was the other holding common to these portfolios. The holding returned 1.5% over the period. Despite fear that the performance of the Invesco fund would suffer following the departure of Neil Woodford, its current manager, Mark Barnett, in whom we have considerable faith, has managed to keep it on course.

The most disappointing income portfolio over the past quarter was the balanced income, higher-risk portfolio, which fell by 0.2%. Unfortunately, three of its seven holdings lost ground, one of which was our worst-performing income holding, Unicorn UK Income.

The fund suffered recently because of its focus on smaller and medium-sized companies. However, this fund and the portfolio as a whole is still showing a good return over one year and longer.

is another holding that slipped backwards. It appears in four income portfolios and has leaned towards the very largest companies in the market over the past few years, such as and . However, the shares of many of these companies have performed poorly.

Alastair Mundy, Temple Bar's manager, expects this situation to change, but he says that as a contrarian investor his recurring 'problem' is buying too early.

Growth story

The best-performing growth portfolios during the past quarter were the two short-term options, the higher-risk version of which achieved the best return, 1.8%.

When you are investing for the shorter term, it is important that your portfolio is not too volatile, as there is little time to make up for losses, so we are pleased these portfolios have managed to hold their ground recently.

They were not immune from weakness, however. Two holdings that both portfolios hold fell in value. One was the , which declined by 0.8% - although the fund actually held up slightly better than the index itself. fell back slightly too. This fund is also managed by Alastair Mundy, whose contrarian approach requires some patience before it pays off.

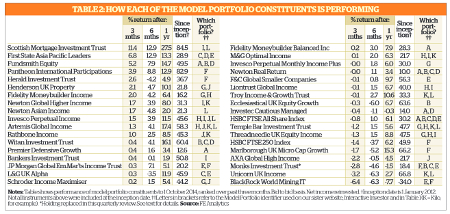

(click to enlarge)

Fortunately, the gains from the short-term portfolios' other holdings outweighed these losses. The higher-risk portfolio profited in particular from strong performance from and FUND:LSX6:Fundsmith Equity. Managers of both funds believe in investing in high-quality, resilient companies.

The two worst-performing growth portfolios were the higher-risk medium- and longer-term portfolios. Four of the seven holdings in each case lost value during the quarter. Both portfolios hold the and .

BlackRock World Mining was added to these portfolios at the beginning of this year. It is the type of specialist fund that will inevitably have its ups and downs. However, with Monks, which has been held in these portfolios since inception, we have decided it is time to sell.

Unfortunately, exposure to UK tracker and smaller-companies funds also dragged down the performance of the two lagging portfolios. Holdings in stronger funds helped offset the losses - the medium-term version holds First State Asia Pacific Leaders while the longer-term portfolio includes and .

However, the rises in these funds were insufficient to offset the falls.

Switch for the better

Monks investment trust has been replaced with and .

Monks has been one of our most disappointing holdings. It was included in four of the growth portfolios at inception and we were fairly confident that its performance would improve, as it is run by two highly respected managers at Baillie Gifford. However, its performance has remained lacklustre, so we have decided it is time to switch.

Existing investors may wish to hold on. Numis Securities has recently reiterated its support for the trust, and it is trading on a relatively large discount to net asset value of around 13%. Numis recently said: "We believe there remains potential for the discount to narrow significantly once NAV performance picks up."

We hope to see a more immediate boost by switching to Ardevora Global Equity and Caledonia. Ardevora Global Equity will go into the medium-risk medium- and long-term growth portfolios. Caledonia will be placed in the higher-risk medium- and long-term growth portfolios.

The Ardevora fund, managed by a team of four led by company founders Jeremy Lang and William Pattisson, is a 150/50 long/short fund. It can invest for the long term, but also sell stocks short to take advantage of falling values. The managers aim to pick stocks where they think the market has got it wrong.

Caledonia investment trust has seen its performance pick up recently following a tricky period after the arrival of Will Wyatt as manager four years ago. Under Wyatt the portfolio has been repositioned and the investment process refined.

It has a significant exposure to unquoted assets, which sets it apart from other global trusts and may make it appear too risky for some investors. However, we believe these investments, combined with the substantial discount of around 17%, makes it an attractive medium- to long-term investment.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.