Stockmarkets take a bath in Tactical Asset Allocator

17th October 2014 12:06

by Ceri Jones from interactive investor

Share on

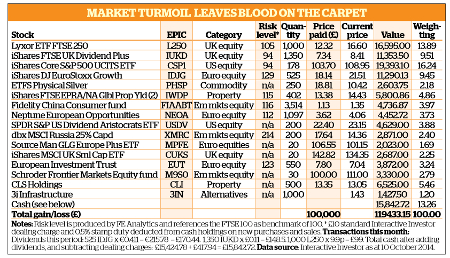

Our Tactical Asset Allocator portfolio was valued at close of play on Friday 9 October after a ferocious sell-off prompted by fresh fears of a global economic slowdown, rising tension in the Middle East and the spread of the Ebola virus outside west Africa. It wiped billions off UK airline, travel agent and hotel stocks.

The FTSE 100 slumped to 6340, its worst level for a year, housebuilding fell for the first month for 18 months, and the CBOE Volatility Index, known as the VIX, jumped to 18.76, some 70% above its lowest reading of the year back in July.

Investors fled from Europe, particularly US investors who saw the downgrade of Finland as the final straw and were alarmed at disappointing industrial production figures from Germany.

To view the tactical asset allocator's holdings and trading chronology, click here.

Faltering eurozone

Meanwhile Mario Draghi, president of the European Central Bank, has said on the record that he agrees the eurozone recovery is faltering, but has still not forged ahead with his bond-buying programme.

(click to enlarge)

In the US, Federal Open Market Committee meetings have taken a more dovish turn than expected, with the committee citing global weakness, particularly in the eurozone, and also warning that the dollar is too high, even though imports and exports account for only around 15% of US GDP.

However, that has not prevented investors from becoming nervous that US support is ending and interest rates are set to rise.

Chair Janet Yellen has said she wants to ensure a 'considerable period' between the end of quantitative easing and the start of rate rises.

Some hope the Fed will delay its tightening policy, and perhaps the dollar's strength will prove a deflationary impetus in coming months, weighing on CPI inflation and forcing a delay, but this spike in the dollar is as yet relatively small.

Other major concerns are slower economic growth in China and Japan, and geopolitical tensions, with air strikes on Isis, the crisis in the Ukraine, and the "Occupy Central" pro-democracy demonstrations in Hong Kong, which could impact Beijing's economic reforms.

Oil prices

Like every other asset class, oil has also been hit. The high for West Texas Intermediate (WTI) this year was $107 (£67) a barrel in June, but it has fallen to the $90 level recently. In fact this is a narrow range historically, but the sting is that a period of low volatility often precedes a spike in prices. Oil-producing nations also require higher prices to cover rising production costs.

Gold, seen as a safe haven, has added nearly 3% in a week, to $1,220 an ounce. Not so our silver holding, , which has singularly failed to prove its credentials as a diversifier when other assets fall, more or less declining for two straight years. However, industry consumes nearly 70 tonnes of silver every day and supply is dwindling, so its day may yet come.

The current volatility is most worrying because it has no rhyme or reason. Perversely, for example, the Federal Open Market Committee minutes, which noted the stagnancy in global growth, produced a rally of 274 points, though that was reversed the next day.

All this has made the chartists among us very excited, as they typically use short techniques as well as long ones. They say failed rallies and a strong sell-off as the market close approaches are sure signs that the bull market is finished.

Market recovery is possible

With all our holdings tumbling, it makes no sense to sell now - the market could quickly recover if a few of the geopolitical problems start to ease.

However, private investors might want to add on any further weakness. I will use some of our cash to get into infrastructure - which is what the best institutional investors are doing, as they race to exit hedge funds and other unconstrained funds that invest in public markets but cost the earth.

MacQuarie is a great name here, but its funds are not listed. Another option is the .

You could use a fund such as or , which invest in stocks in the sector, or go for a fund that invests in core economic infrastructure, typically concession-based assets with long-term government contracts, such as , , , or the baby of the piece, .

We will buy 3i Infrastructure, which invests in Anglian Water, the Norfolk and Norwich University Hospital, some Scottish schools and 3i India Infrastructure, even though its price has risen quite sharply recently.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.