Asset allocation panellists cooling on UK equities

11th November 2014 10:35

by Jim Levi from interactive investor

Share on

Good news is sometimes bad news in financial markets, and vice versa. The UK is currently a fine example of this perversity: the economy is growing robustly at around 3.5% this year, and is positively booming in the South East.

Yet the stockmarket has on the whole reacted coolly. Indeed, following October's market jitters, the major indices for UK equities - the FTSE 100, the FTSE 250 and the FTSE All-Share index - are all in the red on a 12-month view. Meanwhile the FTSE Aim index is down more than 11%.

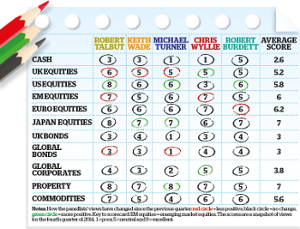

So how do our team of panellists react to this disconnect? Significantly, three of the panel members - Robert Talbut of Royal London, Keith Wade of Schroders and Michael Turner of Aberdeen - have lowered their scores for UK equities.

In the second part of this article, the panel outlines their bullish opinions on US equities and property: US bull market shows no sign of relenting.

Sterling weakness

Constitutional changes following the Scottish referendum result, together with a pending general election and, further out, a promised referendum on Europe, produce a quite lethal cocktail of uncertainty for UK investors.

Michael Turner has cut his score from 6 to 5, fearing there will now be "some hesitation over inward investment into the UK". He also points to the vulnerability of UK exports to weakness in the European economy.

Keith Wade - his score also down from 6 to 5 - says the UK market "was doing quite well when there was more speculation about takeovers". But the failure of the bid for and tougher rules by the US Congress on foreign takeovers has cooled all that.

Rob Burdett at Thames River Capital has left his UK score unaltered at 5. He is as yet not sure whether we are seeing "a buying opportunity or the beginning of a correction".

Chris Wyllie is more optimistic. Three months ago he was worried about the impact of the strength of sterling on earnings and exports of our medium-sized companies. He pointed out that UK equities tend to underperform when sterling is strong.

That strength has now evaporated and sterling has fallen from $1.7190 to $1.59 since mid-July. "Sterling's bull run has come to an end as financial markets begin to sense the embedded political risk in the UK," he says. "Perversely, I believe this is helpful to the stockmarket." So he is raising his score from 4 to 5.

Europe

If the signals appear confused on the UK, this has also been the case in Europe until very recently. In the eurozone, unlike the UK, there is plenty of bad news about the underlying economy.

Sanctions against Russia over Ukraine produced negative numbers for the German economy in the third quarter, while overall growth remains anaemic, with Italy in deep recession and France on the brink.

In September Mario Draghi, governor of the European Central Bank (ECB), massively disappointed financial markets in his efforts to stimulate growth.

And in October they finally cracked under the strain as sentiment about prospects for global growth turned gloomy as well. European equities had performed quite well until that point, with gains of around 10% in the broadly based Eurofirst 300 index.

Those gains have been rapidly wiped away. Nevertheless all our panellists remain overweight in this sector. Four of them score 6 while Chris Wyllie has a 7.

"The competition that interest rates and bond yields represent in Europe is now negligible," says Turner, "so investors continue to buy equities".

The eurozone is "in a mess", says Talbut. "The situation is probably going to get even worse before the European Central Bank is willing to embark on what the markets are crying out for - the kind of full-blown quantitative easing both the Americans and we in Britain adopted to get us out of the financial crisis. The Germans have not yet been softened up enough to accept that policy."

Optimistic

However, the anticipation of this eventual outcome - sometime next year - is keeping our panellists optimistic. They hope the growth stimulus the ECB eventually imposes will make European shares look cheap.

The five panellists

Chris Wyllie is chief investment analyst of Connor Broadley, a financial planning and investment management firm with £200 million under management.

Rob Burdett is co-head of multi-manager funds at Thames River Capital, with £1.5 billion under management. It is a largely autonomous business within the F&C group, managing funds of more than £100 billion.

Michael Turner is head of global strategy and asset allocation at Aberdeen Asset Management, with £177 billion under management.

Robert Talbut is chief investment officer at Royal London Asset Management, with more than £40 billion of assets.

Keith Wade is chief economist and strategist at Schroders, which has £203 billion of assets under management.

Wyllie thinks the key influence will be the movement of currencies. "There is a lot of cynicism about what Mario Draghi can really do," he says.

"The market seems to thInk all he can produce is either a lot of hot air or damp squibs, because he is not allowed to indulge in quantitative easing."

He sees Draghi as buying time, waiting for the dollar to rise further in expectation of higher interest rates in the US next year. He could then start to get stimulus for Europe via the weaker euro.

"It is important for Draghi to have success in talking down the euro," Wyllie insists. "That would be positive not just for European equities but for global equities too.

"We could probably get another year or two of the global bull market in equities if we could get European corporate earnings to improve on the back of a weak euro."

Burdett says: "The conundrum for Europe is that earnings and profit margins have still failed to recover. The market looks cheap if the situation is about to recover, but it looks expensive if it is structurally challenged forever."

Japan

Japan has emerged as the most favoured equities sector among the panellists, where the average score is now 7. Again, the "bad news means good news" paradox seems to apply.

Wade is raising his score for Japan equities from 5 to 7, even though he fears the recent rise in consumer taxes has slowed the economy and put a squeeze on real incomes.

"It may seem odd to sound pessimistic on the economy while raising my score," Wade says. "But you need that dose of pessimism to make the Bank of Japan introduce more liquidity into the system.

"Meanwhile, share valuations are very attractive - below the average for the last 10 years - and there are not many markets you can say that about."

Burdett has just returned from a visit to the country in bullish mood. He found widespread local support for the economic reform programme known as Abenomics, introduced by prime minister Shinzo Abe in 2012.

"Japan looks cheap on most measures - and there is not much cheapness elsewhere," he says. "The rest of the world may be bored with Abenomics, but we foresee a gradual snowball effect of the changes."

Michael Turner thinks Japanese equities will continue to benefit from the depreciation of the yen against the dollar. "The weaker the yen the more it will drive the stock market higher," he says.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.