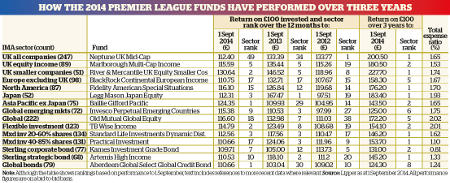

Consistently great UK equity funds - Premier League 2014 annual review

12th November 2014 10:03

UK All Companies sector: Neptune UK Mid Cap

Managed by: Mark Martin

One of only two funds to retain its place in our Premier League for more than a year is . Managed by the highly rated Mark Martin, the £268 million fund has been a consistent top performer since its launch in December 2008, delivering first-quartile returns every year but one.

As its title suggests, the fund invests predominately in UK mid-cap stocks listed within the FTSE 250 index; however, it also has the ability to invest in the 50 largest stocks in the FTSE Small Cap index.

On his investment process, Martin says: "We look to invest in companies that are undervalued, offer attractive risk-reward, and are aligned with Neptune's top-down, global sector view of the world. We believe this balanced approach allows the portfolio to perform across the business cycle, reducing volatility and maximising risk-adjusted returns in the long term."

The firm does not release details of the fund's top 10 holdings, but says that its largest weighting is in consumer products at 46% of the portfolio, followed by healthcare at 23% and industrials at 19%.

Recently, Martin says the fund benefited from one of its largest holdings, semiconductor company , being approached by Microchip Technology (MCHP) regarding a possible offer, which helped to boost CSR's share price by 27%.

This, he believes, confirms his view on "the ongoing potential for mergers and acquisitions within the fund".

In the face of a spate of sell-offs in mid and small-cap stocks this year, Martin continues to "focus closely on valuations, avoiding sectors where profit margins are at all-time highs and sentiment is consensually bullish".

He adds: "Though the short term is hard to predict, long-term valuations in select parts of the market continue to provide cause for optimism and we continue to see exciting opportunities to invest."

UK Smaller Companies sector : River & Mercantile UK Equity Smaller Companies

Managed by: Daniel Hanbury

Delivering the best three-year return of any of our Premier League funds is the £413 million .

The fund has demonstrated remarkable resilience given the torrid time faced by UK smaller companies this year, returning 2.5% in the nine months to 30 September compared to a loss of 2.4% from the IMA UK smaller companies sector.

Current manager Daniel Hanbury has been involved with the fund since its launch in 2006. However, in accordance with River & Mercantile's "collegiate" approach to managing its funds, he spent a period of four years as deputy manager before returning as lead manager last year.

Hanbury insists that this approach, along with River & Mercantile's "boutique atmosphere" is the secret to the smaller companies fund's success. "We are a small, focused, bureaucracy-free team. We are very aligned with our clients, we have significant investments in our own funds and we're partners in our own business, so we are very motivated to do well," he says.

According to Hanbury, the River & Mercantile team take a systematic approach to choosing investments, calling their investment approach "PVT", or Potential, Valuation and Timing.

This year, Hanbury says he has seen some of the best opportunities in initial public offerings, despite the "bad name" they seem to be gaining following some unsuccessful high-profile launches.

UK Equity Income sector: Marlborough Multi-Cap Income

Managed by: Siddarth Lall and Giles Hargreave

, managed by Siddarth Lall with help from Giles Hargreave, replaces in the Premier League. Having launched in July 2011, the fund came of age for inclusion in our league this summer, and with a three-year return 30% higher than the sector average it easily scored a place.

Since launch the fund's assets have swelled from just £17 million to a staggering £960 million, growth that Lall attributes largely to the fund's strong focus on delivering a consistent, sustainable income.

He achieves this through close scrutiny of company balance sheets, looking particularly at levels of debt or gearing - the mere presence of which is usually a deal-breaker for him thanks to the lessons of the financial crisis.

"Having lived through 2008, my preference is never to be in a situation again where we find companies are cutting dividends; I try to put myself in the position of an investor seeking income and think what they would want," he says.

Lall claims that diversification is also "key" to maintaining his income stream and managing risk, with 125 to 140 holdings "fairly typical". Currently he has 125 investments, the largest of which is FTSE 250 telecommunications firm at 2.4%.

Mid caps make up the majority of Lall's portfolio, but he is not afraid to move down the market cap scale and currently has over 20% of the portfolio in Alternative Investment Market and Fledgling index stocks, including his second-largest holding .

"The multi-cap focus means this is slightly different from the average UK equity income fund, and it's not meant to be aggressively positioned; it could be a complement to a large-cap UK equity income fund, with far more diversification," says the manager.

*To view our consistent Premier League stars, and for a snapshot of how they have performed over the past three years, click through using the links below.

Browse Money Observer's Nov 2014 Premier League review

Editor's Picks