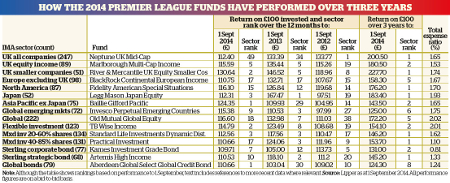

Consistently great global funds - Premier League 2014 annual review

12th November 2014 11:13

by Rebecca Jones from interactive investor

Share on

Global Emerging Markets sector: Invesco Perpetual Emerging Countries

Managed By: Dean Newman

Knocking out of the Premier League is , managed by Dean Newman, the firm's head of emerging market equities. The fund was launched in 1987, but Newman has managed the £180 million portfolio since 2007.

Under his tenure it has delivered mixed returns, with the three years to 31 August one of its strongest periods of performance for more than 10 years.

Like Asia Pacific Premier League star , Invesco Perpetual Emerging Countries' largest regional exposure is to South Korea at over 16% of the portfolio, with its biggest individual holding also in Samsung Electronics at 4.2%.

Newman says that overall he is particularly bullish on Asia, as "the economic background is generally sound with a very wide universe of interesting investment opportunities".

He also likes Latin America, particularly Brazil and Mexico - countries he says contributed significantly to performance this year, as hopes of policy change in Brazil and a stronger economy in Mexico led to equity rallies.

Newman believes emerging markets are now enjoying far "brighter prospects"compared to even just a year ago, thanks to many countries reducing their current account deficits and implementing political and structural reforms. "Many emerging market countries are embarking on a series of reforms to make their economies more competitive," he says.

On a sector level Newman says he favours media and pharmaceuticals.

Global sector: Old Mutaul Global Equity

Managed By: Ian Heslop, Amadeo Alentorn and Mike Servent

Holding onto its spot in our Premier League from the last quarterly review is . Investors have enjoyed nearly five years of stellar performance having delivered top-quartile returns every year since the beginning of 2010.

The £134 million fund has been managed by Ian Heslop, Amadeo Alentorn and Mike Servent since 2004, and the team has worked hard to turn both the portfolio and its performance around. Currently, the fund is most exposed to the US, with 57% of the portfolio invested in the region.

The top 10 holdings include a number of well-known US names including , the fund's single-largest investment at 2.3% of the portfolio, alongside fellow US tech giants and .

Technology is the fund's second-biggest sector weighting at 17% of the portfolio, while financial stocks occupy the largest proportion at 19%.

In this space the team's investments include and Japanese financial services firm , as they tend to steer away from mainstream banks.

In Europe, where the managers have 20% of their portfolio invested, holdings include pharmaceutical giants Roche and alongside energy behemoth , while only around 7% of the portfolio is invested in the UK.

Heslop insists that returns are ultimately delivered through individual stock selection combined with a strong understanding of how prices are influenced.

*To view our consistent Premier League stars, and for a snapshot of how they have performed over the past three years, click through using the links below.

Browse Money Observer's Nov 2014 Premier League review