Companies to benefit from low oil prices

14th November 2014 17:09

by Lee Wild from interactive investor

Share on

Falling oil prices have been bad news for the oil majors and junior explorers alike. Shares prices have tumbled and, according to a new article written by Interactive Investor's Harriet Mann, the immediate future looks bleak. But concerns about a deflationary spiral look wide of the mark, and outside of the oil industry, the drop in energy costs has been welcomed. In fact, JPMorgan reckons it equates to a tax cut for most of the world.

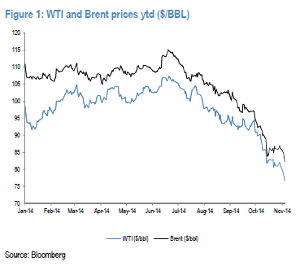

Both West Texas Intermediate (WTI) and Brent Crude are down 25-30% from their June highs, and JPMorgan's commodity analysts reckon the price could slump further. Watch out for lows of $72 for WTI and $75 for Brent during the first quarter of 2015, they say, and do not expect any rebound in the average price in either 2015 - expected to be $77 and $82, respectively - or 2016.

Many may see the falling oil price as a "risk-off" indicator, a signal that demand is weakening. We note that this time around, however, the key driver of lower oil prices appears to be the spike in supply in addition to a strengthening US dollar index. This contrasts with '01 and '08, when poor oil demand drove the downside. Historically, a sharp fall in oil price tended not to be a precursor to a slowdown in activity, on the contrary.

It's clear that cheap fuel is a tailwind for transport, airlines, automotive, retail, travel and leisure sectors, with disposable incomes likely to increase and transportation costs fall. JPM comes up with plenty of names it expects to do well from the slump. Its top dozen are:

- effective employment of fuel surcharges and active hedging activities mean net exposure of the sector to lower commodity prices is somewhat limited

- Lower fuel prices provide significant expense savings for all airlines

- From a longer-term view, lower oil prices could lead to higher demand for cars.

- Fuel costs represent approximately 10% of the Tour Operators' cost base and hence lower oil prices should have a positive impact on the sector

The rest are all European names - Electrolux, Inditex, Kuehne & Nagel International, Daimler, BMW, Lufthansa and DP World.

Other potential stock beneficiaries

JPM analysts also screened for the stocks, in oil sensitive sectors, which displayed the most negative correlation to oil prices. Of those, there are another dozen which JPM rates as 'overweight'. They are:

, , , Inditex, Zodiac Aerospace, , Bouygues, LVMH, Anheuser-Busch Inbev, Airbus, L'Oreal and ASML Holding.

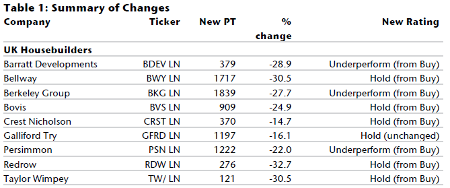

As you can see from the table below, other UK-listed companies which should do well out of cheap oil include , , , , , , , and . JPM's sector experts add and to the list.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.