Sector spotlight: UK equity income yield outpaces bonds

17th November 2014 11:02

At first glance the large and popular UK equity income sector and the much smaller UK equity & bond income have performed remarkably similarly over the past five years.

Their net asset value (NAV) returns have been 105.9 and 98.7% respectively, making them the third and fourth most rewarding sectors after biotechnology & healthcare and UK smaller companies. Share price total returns have been 111.6 and 100.9%.

Both sectors have pulled well ahead of the 71.3% gain from the FTSE All-Share index and shares in the sectors currently trade, on average, at close to NAV. However, there are two important differences between the two.

First, the UK equity & bond (E&B) sector's average five-year dividend growth record has been negative at -3.2% a year, with just two trusts managing even a modicum of growth.

Wide diversity of trusts

In contrast, only two trusts in the UK equity income (EI) sector failed to achieve five-year dividend growth and the average annual dividend increase was 2.8%.

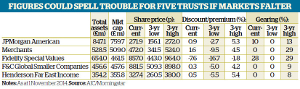

Second, as the table below (click to enlarge) shows, the average rise in NAV per share in the E&B sector has been much lower than EI's.

There is a wide diversity of trusts in both sectors. However, the main difference is that whereas all but one trust in the E&B sector have at least 10% invested in fixed-interest securities and a couple have over 80%, most trusts in the EI sector have negligible fixed-interest exposure.

This is a prime reason for the difference in their dividend records, as interest payments on most bonds do not rise over time. It also raises the question as to whether equities or bonds are likely to prove more rewarding over the next few years.

Both have had a strong five-year run which has left them looking fully valued. But how will they respond if economic growth falters or spurts ahead, and will higher-yielding equities prove as vulnerable as bonds to a sustained rise in interest rates?

Experts cautious on bonds

Invesco Perpetual's fixed interest gurus, Paul Read and Paul Causer, manage , which has 83% in fixed interest and one of the highest yields in the E&B sector.

The two Pauls have generally been adept at moving around the fixed-interest universe, and they believe there are still pockets of value in bank debt.

However, they have been wary of recent corporate bond issues, because these combine lower credit quality with relatively low coupons.

They see little potential for further gains on most existing high-yield bonds and they warn that stronger economic growth and the tapering of US quantitative easing will push up government bond yields, "creating a headwind for the wider market". As a sign of their caution, they have parked 8% of the trust's portfolio in cash.

also has a high fixed-interest exposure and its five-year total returns are almost identical to City Merchants'. It boasts an even higher yield, which has held up a bit better than City Merchants', but the trust's capital-only returns have been the worst in the sector.

Equities will do better than fixed income if we get genuine growth and wage inflation"Ian Francis

New City's manager Ian Francis fears fixed-interest securities will react badly to rising inflationary pressures and rising interest rates.

He expects high-yield bonds to hold up better than investment-grade bonds, but has nonetheless increased the trust's exposure to convertibles and equities to 24% as "a form of insurance".

"Equities will do better than fixed income if we get genuine growth and wage inflation," he comments.

Dividends

has the third-highest yield in the E&B sector and has started to grow its dividend again, having replenished the revenue reserves it used to maintain its quarterly payouts through the 2008 crisis. Its NAV total returns are the second-best in the E&B sector after .

This trust has a lower yield but has benefited from the exceptionally strong five-year rally in smaller companies - and the five-year growth in its NAV per share has been better than half the trusts in the UK equity income sector. On that basis it looks attractive for those wanting a higher income.

HHI's manager Alex Crooke invests predominantly in equities, because they have the potential to achieve dividend as well as capital growth, but in the past he has used gearing to invest up to 28% in fixed-interest securities to boost yield. However, caution on prospects for fixed interest has led to a cut in the trust's exposure to just 11%.

Prospects for dividend growth are good"Alex Crooke

Although HHI's chairman says "the fasten seat belt lights are on", Crooke is sufficiently positive to be geared into equities, which should work well if UK equities make further ground, but leaves the portfolio vulnerable to setbacks.

"Prospects for dividend growth are good," says Crooke, "and with momentum in economic activity, significant equity exposure relative to bonds remains preferable".

In the UK equity income sector, the only trusts to be as highly geared as HHI are , Merchants, and

Value & Income's gearing is fully offset by the trust's high-yielding UK property holdings, which should work well while the UK commercial property market remains in recovery mode. British & American is too small, too concentrated and much too highly geared to be suitable for most investors.

Yield boost

As far as the other two are concerned, their gearing is invested in equities, and - thanks to charging a proportion of interest payable on the gearing to revenue - it boosts their yield. But, as at HHI, it will increase their NAV's sensitivity to market changes.

Merchants offers one of the highest yields in the sector, but recent dividend growth has been minimal, and growth in NAV per share is among the lowest in the sector.

The only EI trust with worse growth in NAV per share is . It has a better dividend growth record and more robust revenue reserves. However, it is hard to square its premium rating with its poor NAV returns. Regular savers into the trust should review their options.

and have much the best five-year total returns in the EI sector, but investors must make do with the lowest yields, and in FIGT's case with low dividend growth.

Lowland's 5.1% a year dividend growth has been impressive, but not as good as the 6.6% achieved by Mark Barnett's . PIGIT's yield is a little below the sector average, but its NAV growth has been the third-best in the sector .

Barnett, head of UK equities at Invesco Perpetual, frequently stresses that he puts more emphasis on dividend growth than on immediate returns.

He is now also responsible for , which offers a higher yield than PIGIT but has achieved lower dividend growth. Both trusts have recently redeemed some of their expensive long-term gearing, which should reduce their vulnerability in a downturn.

Troy Income & Growth Trust

Investors who are fearful about the market outlook, but like the income growth potential of UK equities, should consider (TIG).

It has been managed since August 2009 by Francis Brooke of Troy Asset Management, which as a group has been sceptical about the recovery in the UK stock market.

As a result the trust has been ungeared since Brooke took charge. It has also had a relatively low exposure to medium to smaller companies, which has been a disadvantage for much of the past five years.

Despite this, its NAV returns have been better than the FTSE All-Share in each of the past five years. It has proved resilient in market setbacks and it has been among the strongest performers in the UK equity income sector year to date, as larger, more defensive companies have regained their appeal.

Having been slashed from an unsustainable 3p to 1.8p after Brooke took charge, TIG's dividend has risen annually, with expectations of at least 2.2p for the year to September 2014.

The board's zero discount policy means investors are protected from a significant derating if the market tumbles or if a hike in interest rates undermines the attractions of higher-yielding shares.

TIG's largest sector calls are in financials (such as real estate, non-life assurance and asset managers), consumer goods (including US tobacco companies, and Nestlé, because they offer a better yield and stronger dividend growth than UK equivalents), and utilities.

Brooke expects the latter to suffer when interest rates rise, but says they will do well in the long run as the UK has huge infrastructure requirements, and the government needs to persuade private capital to pay.

Brooke expects the rise in interest rates to be slow, but warns that once the cycle turns it could trigger a marked change in sentiment. "Over the next 18 months I expect the 10-year bond yield to be over 3%, which will not be good for holders of conventional bonds or for some parts of the equity market," he warns.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks