Focus on three specialist investment trusts

17th November 2014 14:02

The investment trusts and closed-ended investment companies that compete head-on with similarly managed open-ended funds have less of an advantage now that fees in the two sectors have converged.

There are, however, a number of investment companies and trusts which use their closed-ended structure to do things that funds can't do, as illustrated by the three profiles below.

Bluefield Solar Income Fund (BSIF) invests in projects that are unquoted and too big to be practical holdings for an open-ended fund. It is our pick for income-seekers. invests in very small immature companies and can take a longer-term view because of its closed-ended structure.

It is liable to be volatile but it is our pick for long-term capital growth. divides its returns between three different share classes, to suit different types of investor.

Bluefield Solar Income fund

Bluefield Solar Income has forecast a dividend of 7p for the year to end June 2015, indicating a yield of 6.8% paid semi-annually at the current share price.

Two thirds of its revenue derives from government-backed renewable energy obligation certificates and feed-in tariffs, both of which are linked to the Retail Prices Index (RPI).

The rest derives from electricity prices, which the managers expect to rise broadly in line with inflation. On this basis, the dividend is predicted to rise in line with RPI, making it very attractive.

Launched in July 2013, the Guernsey-based fund has a portfolio of 12 large-scale solar energy projects on greenfield sites across southern England and Wales. All but one are operational.

It only invests in projects that have the requisite planning permission and grid connections in place, but will also commit at the pre-operational stage. This allows it to achieve better terms, oversee the quality of installation, and secure greater contractor liability for any problems.

Bluefield Solar is managed by Bluefield Partners, which has a good track record in the solar sector. To minimise risks, Bluefield works with a variety of contractors using equipment from a range of manufacturers, and has started to diversify into ground-based industrial and commercial solar energy by buying a portfolio of established plants.

Its projects all have 20- to 25-year contracts, and the outlook for solar is arguably better than for wind generation as it is less environmentally contentious and the output from irradiation is less variable.

Growth in Bluefield Solar's net asset value (NAV) per share is likely to be limited and plans to nearly double the company's issued capital over the next year or so - in order to fund further diversification - seem likely to limit any increase in the modest premium.

More importantly, dividends from the current portfolio will tail off in around 20 years, and the projects may have negligible residual value. So unless the managers keep adding to the portfolio on attractive terms, investors are effectively buying a 20-year index-linked annuity.

However, the NAV per share, like the yield, should be unaffected by short-term gyrations in the stock market, making the shares a high-yielding refuge from a potential bear market.

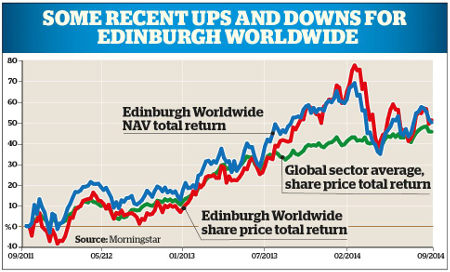

Edinburgh Worldwide IT

Over the long term, smaller company trusts have outperformed their mainstream counterparts in most regions. However they tend to be more vulnerable to market setbacks, and because they focus on a larger and less well-researched universe their results are very dependent on the manager's skills.

This has been evident in the Japanese smaller company sector, where Baillie Gifford Shin Nippon has pulled a long way ahead of its peers over the last five years.

Headed by Douglas Brodie, the team seeks to back future world leaders from a very early stage in their development. This has resulted in a strong bias towards technology and biotechnology-related companies.

In January Brodie took over as manager of Edinburgh Worldwide Investment Trust, with MacDougall as his deputy.

The new team was appointed because Edinburgh Worldwide had adjusted its growth-oriented global remit to focus on much smaller and less mature companies, thereby benefiting from more of their upside.

Its investments since the change are typically capitalised at between $500 million (£320 million) and $1.5 billion at the time of purchase. Because the fortunes of small companies can be unpredictable, the number of holdings in EWI's portfolio has more than doubled to around 90.

The trust now has a lot in common with the Baillie Gifford Global Discovery fund, which Brodie has managed since launch in 2011.

With 56% in healthcare and IT companies, plus holdings in a number of internet retailers, the fund has been exceptionally successful over the past three years, despite struggling in the first half of 2014.

The trust differs from the fund in that the managers can and do gear up, they can and have backed even smaller companies, they expect to invest up to 5% in unquoteds, and they can run their winners longer.

In addition, a fifth of assets remain invested in 10 companies acquired before the change of remit, including Tesla Motors, LinkedIn and China Financial Services.

Unfortunately for its shareholders, technology and biotechnology shares suffered a sharp correction in the spring, and smaller company shares drifted out of favour over the summer months.

However, Brodie says the spring sell-off made it possible to invest in promising companies on even more attractive terms.

JPMorgan Income & Capital

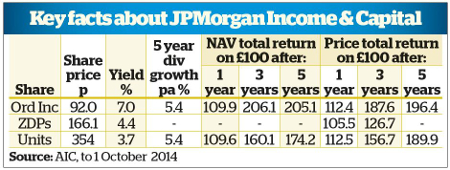

Dividing the returns on a portfolio between different classes of shares, as split capital trusts do, can provide appealing propositions for a variety of investors, as illustrated by JPMorgan Income & Capital (JPMI&C).

Launched in March 2008, JPMI&C's issued capital is split into zero dividend preference shares (ZDPs), highly geared ordinary shares, and units comprised of one ZDP and two ordinary shares.

It is conservatively managed, with no bank borrowings. Up to 10% can be invested in fixed-interest securities, to add stability or boost income, but the current portfolio is entirely invested in UK equities, with 78% in FTSE 100 constituents.

The units are effectively ordinary shares in a conventionally managed, ungeared UK equity growth & income trust.

Given the portfolio's lack of gearing, and its larger company emphasis, it is not surprising that five year returns on the units have been below average compared with ordinary shares in the sector. However they have been ahead of the FTSE All-Share index, and should hold up better than most if the UK stock market takes a turn for the worse.

In the meantime they offer a yield of 3.6%, paid quarterly and backed by revenue reserves equal to half a year's distributions. This should support dividend growth, which has averaged 5.4% a year over the last five years. The ZDPs aim for modest but reliable capital appreciation, from 100p at launch to 192p in February 2018, the wind-up date for the trust.

In return for giving up any income entitlement, they rank first for capital repayment when the trust is wound up, and their full redemption value should be met so long as the trust's assets do not fall by more than 12% a year over the next three and a quarter years.

The ZDPs should be relatively safe and reliable, but their progress has lagged the other share classes during the five-year bull market. Their price is more volatile than their NAV, as it is based on their gross redemption yield (GRY), which rises or falls in line with similarly dated bonds with similar risk profiles.

Their current GRY is 4%, which will be tax-free if any gains are covered by the holder's annual capital gains tax allowance. The ordinary shares are much riskier, but should be the most rewarding during rising markets.

They get all the income, and offer a 6.9% yield; however, they are nearly 100% geared by the ZDPs, and their NAV in February 2018 will be nil if total assets fall by an average of more than 12% a year.

Managers Sarah Emly and John Baker are reasonably confident about the outlook for large, higher-yielding UK-quoted equities.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks