How to screen for bargains like Benjamin Graham

19th November 2014 14:27

by Edward Page Croft from Stockopedia

Share on

Last week we discussed some of the reasons why most investors underperform in the stockmarket and how rule-based investing can help counter losing behaviour. The first legend to recognise how to profit from these widespread behavioural flaws was Benjamin Graham - the "Father of Value Investing". In this article and the next we'll give some background on the great man and show you some of his techniques for finding so-called "bargain shares" in the market.

Who was Ben Graham?

Ben Graham was born in London in 1894, but moved almost immediately to the USA where he made his name and fortune as a professional investor and educator. Graham learnt about value investing the hard way, being nearly wiped out by the 1929 stockmarket crash. This early misfortune led to a complete reappraisal of his investment process.

Graham's eventual philosophy was to shun the highly favoured "glamour" stocks, and focus on unpopular shares that sold below their "intrinsic value". By doing this he believed he could minimise his risk, and maximise his profits by buying shares with a "margin of safety".

Graham's class

Graham's legacy though was sealed in class at Columbia Business School where he taught his valuation principles for 28 years. Amongst his students were some of the greatest investors of all time including the billionaire Sage of Omaha himself - Warren Buffett. Fifty years later, in 1984, Buffett returned to Columbia to give a speech in which he expressed utter bemusement that the professional investment community continued to overlook the astonishing success of Graham's value investing principles.

In his speech, and the follow up article based on it titled The Super-Investors of Graham and Doddsville, Buffett documented the track records of nine famous investor disciples of Graham and Dodd. Each generated annual compound returns of between 18% and 29% over periods lasting between 14 to 30 years. Results like these, Buffett illustrated, could not possibly be down to chance and he implored investors to learn from Graham - whose own investment partnership with Jerome Newman delivered an average 17% annualised return to investors.

So how did Graham do it?

Ben Graham was a hardcore security analyst who liked to dig deep into financial statements, make adjustments for corporate accounting shenanigans and try to get to a genuine sense of "intrinsic value".

Throughout his life he focused on comparing the net worth of a company against its current stockmarket value. If he could buy stocks trading on the stockmarket at valuations below this net worth he'd be quite possibly in the money.

The stockmarket crash of 1929 made him very paranoid so to find bargain stocks he pushed this theory further. He reasoned that if a company can go bust he wanted to be 100% sure he'd get more from a firesale liquidation of the assets than he spent buying the shares.

To do this he conjured up a pair of valuation metrics that have become known as Ben Graham's bargain ratios. The first is called the Price to Net Current Asset Value or P/NCAV for short, and the second, for the truly paranoid, is called the Price to Net Net Working Capital or the P/NNWC for short.

We won't go into detail here, but we can think of these as similar to the familiar Price to Book ratio, but putting an extremely conservative valuation of assets on the denominator. Any stock trading at a P/NCAV or P/NNWC of less than 1 would be classified as a "bargain". Graham preferred buying stocks at ratios of 0.66 or less.

The performance of bargain strategies

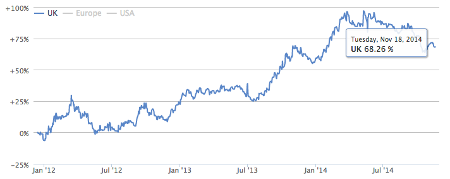

It's simple to create a stock screen to filter the market for these "Ben Graham Bargains" with a reasonable database. Independent studies by the investment house Tweedy Browne showed results over multi year periods of up to 29% annualised amongst these deep bargains. We've been tracking the Ben Graham NCAV strategy at Stockopedia.com in the UK market for the last three years and the strategy has returned over 19% annualised as shown in the chart below.

Performance of the UK Benjamin Graham NCAV Screen: January 2012 - November 2014

As we discussed last week - eventually the "weighing machine" of the market brings groups of undervalued stocks back to fair value. This is the "value effect" at work which profits from the fact that cheap stocks often get systematically oversold and become too cheap.

The problem with bargains

Of course, over the years many investors have learnt from Graham, and now there are much leaner pickings amongst "bargain shares". While the strategy remains profitable in theory, in practice there are serious liquidity issues in the shares that qualify for the list. Often they suffer from exceptionally wide spreads (the distance between the buy and sell price can make buying them uneconomic), or the stocks can be "nano-cap" (with very low market values making buying lines of stock hard).

These lists though are always worth reviewing to find out of favour securities. Some of the more notorious and notable stocks that are currently qualifying for this strategy at Stockopedia are listed in the table below. They include highly unpopular (questionable?) Chinese AIM shares like Camkids, as well as current press whipping boy , troubled solar wafer company and a host of energy stocks like and .

These are the kinds of stocks widows and orphans definitely should stay away from and never should be bought without serious due diligence or without checking the cost of trading. Ben Graham's approach was to seek safety in numbers - buying broadly diversified baskets of bargain shares (25 to 30) reasoning that while some might go bust, on average they couldn't all possibly be worth as little as they were valued at.

Name | Mkt Cap £m | P/NCAV | % Price Chg 1y | Stock Rank™ | Sector |

Asian Citrus Holdings | 115.6 | 0.55 | -58.9 | 34 | Consumer Defensives |

Camkids | 30.8 | 0.40 | -58.3 | 66 | Consumer Cyclicals |

Chariot Oil and Gas | 26.8 | 0.95 | -41.4 | 29 | Energy |

China Chaintek United Co | 36.7 | 0.72 | -72.5 | 73 | Industrials |

Minoan | 25.8 | 0.82 | +84.4 | 46 | Consumer Cyclicals |

PV Crystalox Solar | 24.8 | 0.79 | -16.2 | 87 | Energy |

Quindell | 235.6 | 0.68 | -77.5 | 41 | Technology |

Sterling Energy | 45.7 | 0.91 | -51.3 | 29 | Energy |

Skil Ports and Logistics | 20.5 | 0.47 | -40.0 | 9 | Industrials |

Tethys Petroleum | 55.5 | 0.59 | -50.7 | 24 | Energy |

Next week we'll look at how Ben Graham's philosophy evolved over his life away from pure deep value shares to focus more on finding the higher "quality" shares in the value basket. The strategy we'll look at has become known as his "last will" - stay tuned.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ed Page Croft of Stockopedia.com, the rules-based stockmarket investing website. You can click here to read Richard Beddard’s review of Stockopedia.com and learn more about the site.

● Interactive Investor readers can enjoy a 2 week free trial and £50 discount to Stockopedia using the coupon code iii014 - click here.

● To learn more about Ben Graham and his deep value investing strategies, you can download the free Stockopedia book, How to Make Money in Value Stocks.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

About the author

About the author

Edward Page Croft is the CEO and founder of Stockopedia.com. His background is in wealth management and engineering, having worked as a private client broker at Goldman Sachs before founding Stockopedia.

He graduated from Oxford University with first class honours and is a Zend Certified PHP Engineer. Edward writes regularly for This is Money, Business Insider and the London Stock Exchange's Private Investor Magazine. He is the author of several ebooks including "How to Make Money in Value Stocks".