Solar power sector set to shine in Active Income Portfolio

8th December 2014 11:09

by Heather Connon from interactive investor

Share on

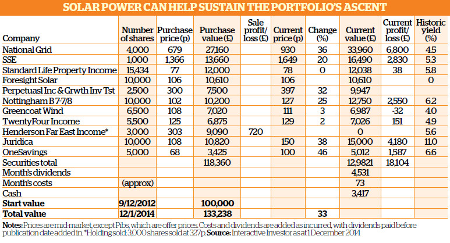

has been a decent enough performer for the active income portfolio, producing a share price return of almost 8%, even excluding the return from its generous 5.2% yield.

We have, however, now decided to take the profits from this investment. There are two main reasons for this.

First, economic uncertainty is growing across the world: China's growth is slowing, Japan is technically in a recession, Russia is suffering the impact of plunging oil prices and sanctions, due to its activities in Ukraine, and Europe is struggling to gain momentum.

To view the active income portfolio's holdings and trading chronology, click here.

Market correction

Slowing growth will have an impact both domestically and on exports across the Far East. In addition, investors are growing increasingly nervous about stock market levels, particularly in the US and the UK, and should there be a correction in these markets, there is likely to be a knock-on effect in other regions.

The second reason is that growth in the UK is expected to be respectable in 2015 - many commentators think it is one of the more attractive global stock markets - so we are happy to continue to increase our exposure to the country. We have chosen to reinvest the funds in one of the faster-growing areas of the market: solar energy.

Foresight Solar (FSFL) is a closed-ended vehicle, launched on the stockmarket in October 2013 and dedicated to building a portfolio of solar farms solely in the UK. A series of acquisitions since its launch - the latest two adding 74MW of capacity - mean it now has 185MW in total. As Money Observer went to press, Foresight was in detailed talks about a further acquisition which, if successfully concluded, would leave it owning four of the largest solar plants in the UK.

(click to enlarge)

In the depths of winter, with the sun a rare sight, UK solar power may not seem like an obvious opportunity. However, the industry is coming of age. A dramatic fall in the cost of solar panels, partly due to increased production in China, means the cost of equipment and installation has roughly halved over the past four years, making solar power generation viable even in less sunny countries such as the UK.

The government's commitment to increasing alternative energy use is also a positive - the Department of Energy and Climate Change has set a target of 10GW of solar capacity within the next five years, about twice that currently available - increasing the potential for growth in solar power generation.

Lower risk activity

Jamie Richards, head of Foresight, believes solar generation is a lower risk-activity than other forms of alternative energy, as solar panels have no moving parts to go wrong and need no maintenance - unlike wind turbines.

Moreover, the UK weather notwithstanding, the hours of sunlight that can be exploited are more predictable than wind resources. The company will only buy fully operational farms, so it does not take on construction risk.

It has secured agreement to fund acquisitions at least until the autumn. Its £200 million placing programme, open until September, has already used £60 million for recent acquisitions in Bournemouth and Oxfordshire. It has a £100 million debt facility with a consortium of banks.

Revenues from solar farms come from two sources: through the sale of power, typically through supply agreements that are frequently inflation linked, and through the sale of renewables obligation certificates and other "green" benefits, which are index-linked and guaranteed for 20 years from accreditation.

The predictability of these revenues means Foresight can target a 6p dividend in its first year of operation, increasing in line with inflation. That would give it a yield of about 6%. It paid 3p as an interim dividend in September, which underpins the full-year target. Richards points out that other solar companies have adopted similar targets, which suggests a 6% yield is realistic.

Foresight shares currently trade on a small premium to net asset value. However, the company's growth prospects and steady income make this acceptable. Some readers may feel the inclusion of a solar company in the portfolio makes it unduly energy-focused.

In demand

We have considered reducing our holdings in and , but both have performed strongly recently, and in a nervous stock market, their bountiful yields and predictable earnings are likely to remain in demand.

In its interim results, announced in November, National Grid pledged to increase its dividends to at least match the retail prices index for the foreseeable future, underpinning its generous yield and justifying its place in the income portfolio.

In its interims, SSE pointed to a number of challenges, including the distribution review, the investigation into the energy market by the Competition and Markets Authority, and the looming general election, during which power prices could be a campaign bone of contention. But it has reiterated its commitment to growing dividends to at least match inflation.

The dividend commitments are welcome, but we will keep the holdings under review and take profits as appropriate.

It was an active two months for dividends, with income being paid by most portfolio constituents. We banked a 14.71p a share interim payment from National Grid, to be paid on 7 January; a 60.70p final from SSE, omitted in the November update; a 1.16p payment from the recently acquired ; a 2.80p quarterly payment from (Pigit); a final 4.7p quarterly payment from Henderson Far East; a bumper 20p payment from Juridica, which accounted for almost half the total; a second interim of 1.5p from ; and half-yearly interest payments from both and the Nottingham Building Society (NOTB) permanent interest bearing shares (Pibs).

It was also a busy period for results and trading updates. An interim statement from Pigit revealed a total return of 2.5% in the six months to September, double that of the FTSE All-Share index.

It added: "Your board continues to recognise the importance of dividends to shareholders, particularly in the present low-interest environment, and is determined to maintain its policy of real dividend growth over the medium to longer term."

While Pigit's 3% yield is the lowest in the portfolio, it is still well above the rate of inflation and the rate readily available for cash. That, together with the commitment to grow the dividend and the spread of investments, means Pigit earns its place in the portfolio.

Company updates

also updated on its performance to September. It acquired four new facilities in August, bringing installed capacity to 271.5MW. It pointed out that there are still "£60 billion of further investment opportunities in the short to medium term", and its independence and lack of operating gearing leave it well placed for utilities looking for investment partners. It also asserted that it is "actively evaluating and performing due diligence on a number of interesting opportunities".

TwentyFour Income announced its interim results to September. It said its total return from launch was close to 30%. It issued new shares in October, at a 5% premium to net asset value, raising a further £22.6 million.

On the outlook, the trust said: "With fundamentals continuing to improve across the board, there is good reason to expect performance to continue to be driven by central bank policy and a demand/supply imbalance in the asset class, rather than any expression of greater specific risk to credit pushing spreads wider.

"Credit spreads should continue to tighten in European asset-backed securities in response to the start of the ABS purchase programme [announced by the European Central Bank to try to kick start lending] due to begin, although at current levels, they still look cheap compared with alternatives.

"While ABSPP will not be able to buy all asset classes and across all ratings, its ability to re-price the parts of the market that it will buy means that, as the 'ineligible' market starts to look cheap, ECB-eligible investors will likely sell product into the ECB and move into other assets, creating similar pricing pressure."

The OneSavings 6.591% subordinated bonds can be called in March 2016. They have gradually risen above their par value, and we will monitor them with a view to selling if there is a risk of capital loss as the call date approaches. We are reviewing the Pibs market for further opportunities for the portfolio in the months ahead.

Standard Life Investments Property Income Trust is expected to convert to a real estate investment trust at the start of 2015. Brokers Winterflood says that, although the trust trades at a premium to net asset value of about 6%, "it can be justified by the outlook for the sector and the fund's historic performance".