More funds outperform in rising markets - Consistent 50 Dec 14 update

8th December 2014 16:39

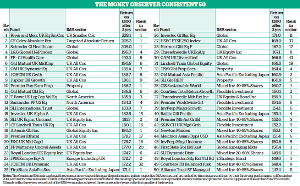

Money Observer's Consistent 50 has been almost entirely overhauled in the three months to 1 December as the strong gains that followed October's equity market sell-offs have propelled a number of funds to show consistently strong performance.

In this review all of the funds in our table have achieved "first tier" status, meaning they have all achieved three consective years in the top quartile of their respective Investment Management Association sectors.

This stands in stark contrast to last month when half of our table was populated by "second tier" funds, or those that had achieved two out of three years of top-quartile performance.

A total of 33 funds have been replaced this quarter, with only three funds featured in October's top 10 remaining there - , and .

Sector winners

takes the top spot, rising from 26th place in October as disappointing performance in 2011 slips out of its three-year record.

The latter has fallen from 18th to 25th place while new entrants include and Money Observer Rated Fund .

Mixed-asset funds also enjoyed a strong quarter with their cohort rising from five in October to seven this review. and were the strongest performers, delivering a 61% and 53% total return in the three years to 1 December while Premier's fund also boasts a 2.6% dividend yield - one of the highest in its sector.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks