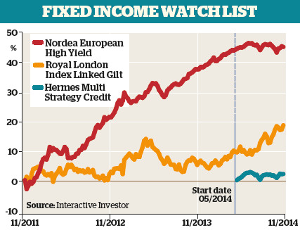

Three funds to help investors navigate choppy fixed-income waters

9th December 2014 09:22

In our quarterly multi-manager series we reveal the funds and trusts selected by a panel of leading multi-managers.

Rather than build their portfolios by investing in individual stocks or bonds, these managers invest largely or exclusively in investment funds, leaving them well placed to identity future winners.

Our panel was overwhelmingly bearish on the prospects for the fixed-income market, encouraging investors to avoid the asset class.

However, some of the did pick some funds from the sector when they feel comfortable investing there in the future. These are listed below.

Areas of positive interest for our panel this quarter were investment trusts, global equities and emerging markets.

John Ventre, portfolio manager, Old Mutual Spectrum fund range

"High yield endured a weaker third quarter but it is still not clear that spreads offer compelling value. The problem is that spread-widening tends to beget spread-widening," he says.

To re-enter the high-yield market, Ventre says he would be looking for lower valuations than are available currently; however, when that time comes he is eyeing the Nordea European High Yield fund, managed by Sandro Naef and Torben Skodeberg of Capital Four Management.

David Hambidge, head of multi-asset funds, Premier Asset Management

Like Ventre, Hambidge believes investors should avoid high-yield bonds at the moment, arguing that the asset class "no longer does what it says on the tin", i.e. produce a high yield.

However, one fund he thinks will be capable of navigating these choppy waters is the Hermes Multi-Strategy Credit fund.

Manager Fraser Lundie invests around two thirds of the fund in a combination of corporate bonds, loans and convertibles, with the other third used to defend against falling markets, which Hambidge believes will be particularly useful during the next two years.

Ian Aylward, head of multi-manager research at Aviva Investors

In common with a number of our managers, Aylward is bearish on fixed income, particularly UK government bonds, which he has had no exposure to this year.

He "struggles to see value" in current rock bottom gilt yields, particularly considering the risk posed by any interest rate rise. However, were he forced to invest in the asset class, he favours the .

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks